Xerox 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Sustaining engineering costs of $148 million were $13

lower than 2006 due primarily to lower spending

related to environmental compliance activities and

maturing product platforms in the Production

segment.

• R,D&E as a percentage of revenue declined

0.5-percentage points as we leveraged our current

R,D&E investments to support GIS operations.

2006 R,D&E of $922 million decreased $21 million

from 2005 reflecting lower environmental compliance

spending.

• R&D of $761 million increased $6 million from 2005

reflecting higher expenditures in the Production and

Office segments primarily related to expected 2007

product launches.

• Sustaining engineering costs of $161 million

decreased $27 million from 2005, reflecting lower

spending related to environmental compliance

activities and maturing product platforms.

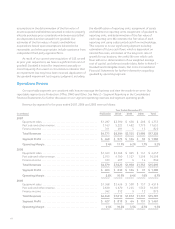

Selling, Administrative and General Expenses (“SAG”)

Year Ended

December 31, Amount

Change

2007 2006 2005 2007 2006

Total SAG

expenses . . . $4,312 $4,008 $4,110 $304 $(102)

SAG as a % of

revenue .... 25.0% 25.2% 26.2% (0.2)pts (1.0)pts

2007 SAG expenses of $4,312 million were higher

than 2006, including a $141 million negative impact from

currency. The SAG expense increase was the result of the

following:

• $93 million increase in selling expenses primarily

reflecting the negative impact from currency and the

inclusion of GIS. This increase was partially offset by

lower costs reflecting the benefits from the 2006

restructuring programs intended to realign our sales

infrastructure.

• $164 million increase in general and administrative

(“G&A”) expenses primarily from the inclusion of GIS,

unfavorable currency and information technology

investments.

• $47 million increase in bad debt expense primarily as a

result of an increase in reserves for several customers

in Europe as well as a 2006 reduction in expense due

to adjustments to the reserves to reflect improvement

in write-offs and aging.

2006 SAG expenses of $4,008 million decreased from

2005 as a result of the following:

• $58 million reduction in selling expenses, including

lower marketing spending and headcount reductions.

• $59 million reduction in G&A expenses as a result of

continued expense management initiatives, including

benefits from restructuring.

• The above reductions were partially offset by a $15

million increase in bad debt expense.

Bad debt expense included in SAG was $134 million,

$87 million and $72 million in 2007, 2006 and 2005,

respectively. Both 2005 and, to a lesser extent, 2006

reflect the benefits associated with recoveries and

adjustments to the reserves as the result of improvements

in write-offs and aging. This favorable trend in write-offs,

receivables aging and collections continues to be reflected

in our current year bad debt expense. Bad debt expense as

a percent of total revenue was 0.8%, 0.5% and 0.5% for

2007, 2006 and 2005, respectively. At December 31,

2007, bad debt reserves, as a percentage of receivables,

were comparable to year end 2006.

Restructuring and Asset Impairment Charges

For the three years ended December 31, 2007, 2006

and 2005 we recorded restructuring and asset impairment

(credits)/charges of $(6) million, $385 million and $366

million, respectively. Restructuring activity was minimal in

2007 and the related credit of $6 million primarily reflects

changes in estimates for prior years’ severance costs.

2006 net charges of $318 million related to headcount

reductions of approximately 3,400 employees in North

America and Europe. Lease termination and asset

impairment net charges of $67 million primarily reflected

the relocation of certain manufacturing operations and

the exit from certain leased and owned facilities. 2005 net

charges of $350 million related to the elimination of

3,900 employees worldwide and the remaining $16

million of net charges related to asset impairments and

lease cancellations. The remaining restructuring reserve

balance as of December 31, 2007, for all programs was

$109 million. Refer to Note 9-Restructuring and Asset

Impairment Charges in the Consolidated Financial

Statements for further information regarding our

restructuring programs.

64