Xerox 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

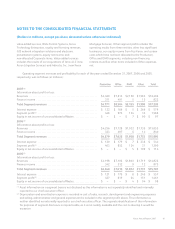

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

the intangibles acquired as part of the acquisition was $16

for 2007. The primary elements that generated goodwill

are the value of the acquired assembled workforce,

specialized processes and procedures and operating

synergies, none of which qualify as a separate intangible

asset.

The fair values of assets acquired and liabilities

assumed at the acquisition date as reflected in the

financial statements are as follows:

As of

May 9,

2007

Weighted-

Average

Useful

Life

Current assets (includes cash

of$2) .......................... $ 291

Other long-term assets ............. 41

Goodwill .......................... 1,323 n/a

Intangible assets:

Customer relationships ........ 189 12years

Tradenames .................. 174 20years

Total assets acquired .............. 2,018

Current liabilities .................. (162)

Long-term liabilities ................ (325)

Net assets acquired ................ $1,531

The unaudited pro forma results presented below

include the effects of the GIS acquisition as if it had been

consummated as of January 1, 2006. The pro-forma

results include the amortization associated with the

estimated value of acquired intangible assets and interest

expense associated with debt used to fund the acquisition.

However, pro forma results do not include any anticipated

synergies or other expected benefits of the acquisition.

Accordingly, the unaudited pro forma financial

information below is not necessarily indicative of either

future results of operations or results that might have

been achieved had the acquisition been consummated as

of January 1, 2006.

Year Ended

December 31,

2007 2006

Revenue .......................... $17,619 $16,992

Net income ....................... 1,139 1,222

Basic earnings per share ........... 1.22 1.26

Diluted earnings per share ......... 1.20 1.23

Advectis, Inc: In October 2007, we acquired Advectis,

Inc. (“Advectis”), a privately-owned provider of a

web-based solution to electronically manage the process

needed to underwrite, audit, collaborate, deliver and

archive mortgage loan documents for $30 in cash. The

purchase agreement requires us to pay the sellers an

additional $11 if certain performance conditions are

achieved over the next three years. The operating results

of Advectis are not material to our financial statements,

and are included within our Other segment from the date

of acquisition. The purchase price is expected to be

primarily allocated to intangible assets and goodwill and

will be based on management’s estimates which have not

yet been finalized.

GIS Acquisitions: In the latter half of 2007, GIS

acquired four businesses that provide office-imaging

solutions and related services for $39 in cash. The

operating results of these entities are not material to our

financial statements, and are included within our Office

segment from the date of acquisition as part of GIS. The

purchase prices are expected to be primarily allocated to

intangible assets and goodwill and will be based on

management’s estimates which have not yet been

finalized.

De Lage Landen Joint Venture: In July 2007, we

purchased De Lage Landen’s (“DLL”) 51% ownership

interest in our lease financing joint venture in the

Netherlands. Refer to Note 4 – Receivables, Net for more

information regarding this purchase.

XMPie, Inc: In November 2006, we acquired the stock

of XMPie, Inc. (“XMPie”), a provider of variable

information software, for $54 in cash, including

transaction costs. XMPie’s software enables printers and

marketers to create and print personalized and customized

marketing materials to help improve response rates. We

had an existing relationship with XMPie, as its largest

reseller, and its software is primarily sold together with our

Production systems including the iGen3.

The operating results of XMPie are not material to

our financial statements, and are included within our

Production segment from the date of acquisition. The

purchase price was allocated to Goodwill $48, Intangible

assets, net $9 and Deferred tax liabilities $(3). The

primary element that generated the Goodwill is the value

Xerox Annual Report 2007 93