Xerox 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

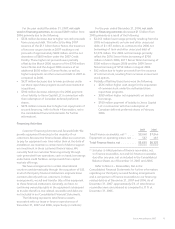

years due to the full amortization of certain intangible

assets from previous acquisitions.

Legal matters: In 2006 legal matters expenses

consisted of the following:

• $68 million for probable losses on Brazilian labor-

related contingencies – see Note 16 – Contingencies in

the Consolidated Financial Statements for additional

details.

• $33 million associated with probable losses from

various legal matters partially offset by $12 million of

proceeds from the Palm litigation matter. The $11

million remaining proceeds from the Palm litigation is

associated with a license and recorded in sales as

licensing revenue.

In 2005, legal matters expenses consisted of the

following:

• $102 million, including $13 million for interest

expense, related to the MPI arbitration panel ruling.

• $13 million related to all other legal matters, primarily

reflecting charges for probable losses on cases that

had not yet been resolved.

Refer to Note 16 – Contingencies in the Consolidated

Financial Statements for additional information regarding

litigation against the Company.

Loss on extinguishment of debt: 2006 loss of $15

million includes the $13 million write-off of unamortized

deferred debt issuance costs associated with the

termination of a previous credit facility and a $2 million

loss associated with the repayment of the mortgage in

connection with the sale of our Corporate headquarters in

Stamford, Connecticut.

All other expenses, net: In 2006 all other expenses,

net decreased due to the absence of the following 2005

items:

• $15 million for property damage and impaired

receivables losses sustained from Hurricane Katrina.

• $26 million charge related to the European Union

Waste Directive.

Income Taxes

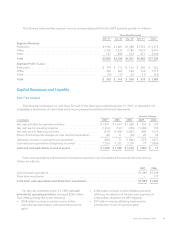

Year Ended December 31,

(in millions) 2007 2006 2005

Pre-tax income ................................................................... $1,438 $ 808 $830

Income tax expenses (benefits) ................................................... 400 (288) (5)

Effective tax rate ................................................................. 27.8% (35.6)% (0.6)%

The 2007 effective tax rate of 27.8% was lower than

the U.S. statutory rate primarily reflecting tax benefits

from the geographical mix of income and the related

effective tax rates in those jurisdictions and the utilization

of foreign tax credits as well as the resolution of other tax

matters. These benefits were partially offset by changes in

tax law.

The 2006 effective tax rate of (35.6%) was lower

than the U.S. statutory rate primarily due to:

• Tax benefits of $518 million from the resolution of tax

issues associated with the 1999-2003 IRS audits and

other domestic and foreign tax audits.

• Tax benefits of $19 million as a result of tax law

changes and tax treaty changes.

• $11 million from the reversal of a valuation allowance

on deferred tax assets associated with foreign net

operating loss carryforwards.

• The geographical mix of income and related effective

tax rates in those jurisdictions.

• These benefits were partially offset by losses in certain

jurisdictions where we are not providing tax benefits

and continue to maintain deferred tax valuation

allowances.

The 2005 effective tax rate of (0.6)% was lower than

the U.S. statutory tax rate primarily due to:

• Tax benefits of $253 million, associated with the

finalization of the 1996-1998 IRS audit.

• Tax benefits of $42 million primarily from the

realization of foreign tax credits offset by the

geographical mix of income and the related tax rates

in those jurisdictions.

• Tax benefits of $31 million from the reversal of a

valuation allowance on deferred tax assets associated

with foreign net operating loss carryforwards. This

reversal followed a re-evaluation of their future

realization resulting from a refinancing of a foreign

operation.

66