Xerox 2007 Annual Report Download - page 87

Download and view the complete annual report

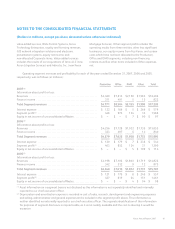

Please find page 87 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

price was equal to the market price at the date of grant. If

we had elected to recognize compensation expense using

a FAS 123(R) methodology our 2005 net income and

earnings per share would have been reduced by $88 and

$0.09 per diluted share, respectively.

Refer to Note 17 – Shareholders’ Equity – “Stock-

Based Compensation” for additional disclosures regarding

our stock compensation programs.

Other Accounting Changes: In March 2005, the

FASB issued Interpretation No. 47, “Accounting for

Conditional Asset Retirement Obligations – an

interpretation of FASB Statement No. 143” (“FIN 47”). FIN

47 requires an entity to recognize a liability for the fair

value of a conditional asset retirement obligation if the

fair value can be reasonably estimated. A conditional

asset retirement obligation is a legal obligation to perform

an asset retirement activity in which the timing or method

of settlement are conditional upon a future event that

may or may not be within control of the entity. The

adoption of FIN 47 in 2005 resulted in an after-tax charge

of $8 ($12 pre-tax) and was recorded as a cumulative

effect of change in accounting principle. This charge

represented conditional asset retirement obligations

associated with leased facilities where we are required to

remove certain leasehold improvements and restore the

facility to its original condition at lease termination.

In June 2006, the FASB ratified the consensus

reached on EITF Issue No. 06-2, “Accounting for

Sabbatical Leave and Other Similar Benefits Pursuant to

FASB Statement No. 43” (“EITF 06-2”). EITF 06-2 clarifies

recognition guidance on the accrual of employees’ rights

to compensated absences under a sabbatical or other

similar benefit arrangement. We recorded a $7 after-tax

charge to Retained earnings in 2007 reflecting our share

of the cumulative effect recorded by Fuji Xerox upon

adoption of EITF 06-2. With the exception of this charge,

the adoption of EITF 06-2 did not impact the Company as

we do not have a similar benefit arrangement.

Summary of Accounting Policies:

Revenue Recognition: We generate revenue through

the sale and rental of equipment, service and supplies and

income associated with the financing of our equipment

sales. Revenue is recognized when earned. More

specifically, revenue related to sales of our products and

services is recognized as follows:

Equipment: Revenues from the sale of equipment,

including those from sales-type leases, are recognized at

the time of sale or at the inception of the lease, as

appropriate. For equipment sales that require us to install

the product at the customer location, revenue is

recognized when the equipment has been delivered to and

installed at the customer location. Sales of customer

installable products are recognized upon shipment or

receipt by the customer according to the customer’s

shipping terms. Revenues from equipment under other

leases and similar arrangements are accounted for by the

operating lease method and are recognized as earned

over the lease term, which is generally on a straight-line

basis.

Service: Service revenues are derived primarily from

maintenance contracts on our equipment sold to

customers and are recognized over the term of the

contracts. A substantial portion of our products are sold

with full service maintenance agreements for which the

customer typically pays a base service fee plus a variable

amount based on usage. As a consequence, other than the

product warranty obligations associated with certain of

our low end products in the Office segment, we do not

have any significant product warranty obligations,

including any obligations under customer satisfaction

programs.

Revenues associated with outsourcing services as well

as professional and value-added services are generally

recognized as such services are performed. In those service

arrangements where final acceptance of a system or

solution by the customer is required, revenue is deferred

until all acceptance criteria have been met. Costs

associated with service arrangements are generally

recognized as incurred. Initial direct costs of an

arrangement are capitalized and amortized over the

contractual service period. Long-lived assets used in the

fulfillment of the arrangements are capitalized and

depreciated over the shorter of their useful life or the term

of the contract. Losses on service arrangements are

recognized in the period that the contractual loss becomes

probable and estimable.

Xerox Annual Report 2007 85