Xerox 2007 Annual Report Download - page 58

Download and view the complete annual report

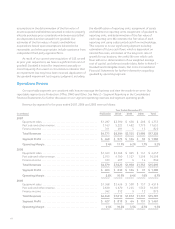

Please find page 58 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• $68 million (pre-tax and after-tax) for litigation

matters related to probable losses on Brazilian labor-

related contingencies.

• $46 million tax benefit resulting from the resolution of

certain tax matters associated with foreign tax audits.

• $13 million ($9 million after-tax) charge from the

write-off of the unamortized deferred debt issuance

costs as a result of the termination of a previous credit

facility.

• $385 million ($257 million after-tax) restructuring and

asset impairment charges.

2005 Net income of $978 million, or $0.94 per

diluted share, included the following:

• $343 million after-tax benefit related to the

finalization of the 1996-1998 IRS audit.

• $115 million ($84 million after-tax) charge for

litigation matters relating to the MPI arbitration panel

decision and probable losses for other legal matters.

• $93 million ($58 million after-tax) gain related to the

sale of our total equity interest in Integic Corporation

(“Integic”).

• $366 million ($247 million after-tax) restructuring and

asset impairment charges.

Application of Critical Accounting Policies

In preparing our Consolidated Financial Statements

and accounting for the underlying transactions and

balances, we apply various accounting policies. Senior

management has discussed the development and

selection of the critical accounting policies, estimates and

related disclosures, included herein, with the Audit

Committee of the Board of Directors. We consider the

policies discussed below as critical to understanding our

Consolidated Financial Statements, as their application

places the most significant demands on management’s

judgment, since financial reporting results rely on

estimates of the effects of matters that are inherently

uncertain. In instances where different estimates could

have reasonably been used, we disclosed the impact of

these different estimates on our operations. In certain

instances like revenue recognition for leases, the

accounting rules are prescriptive; therefore, it would not

have been possible to reasonably use different estimates.

Changes in assumptions and estimates are reflected in the

period in which they occur. The impact of such changes

could be material to our results of operations and financial

condition in any quarterly or annual period.

Specific risks associated with these critical accounting

policies are discussed throughout the MD&A, where such

policies affect our reported and expected financial results.

For a detailed discussion of the application of these and

other accounting policies, refer to Note 1-Summary of

Significant Accounting Policies, in the Consolidated

Financial Statements.

Revenue Recognition for Leases: Our accounting for

leases involves specific determinations under applicable

lease accounting standards, which often involve complex

and prescriptive provisions. These provisions affect the

timing of revenue recognition for our equipment. If a

lease qualifies as a sales-type capital lease, equipment

revenue is recognized upon delivery or installation of the

equipment as sale revenue as opposed to ratably over the

lease term. The critical elements that we consider with

respect to our lease accounting are the determination of

the economic life and the fair value of equipment,

including the residual value. For purposes of determining

the economic life, we consider the most objective measure

to be the original contract term, since most equipment is

returned by lessees at or near the end of the contracted

term. The economic life of most of our products is five

years since this represents the most frequent contractual

lease term for our principal products and only a small

percentage of our leases are for original terms longer than

five years. There is no significant after-market for our used

equipment. We believe five years is representative of the

period during which the equipment is expected to be

economically usable, with normal service, for the purpose

for which it is intended.

Revenue Recognition Under Bundled Arrangements:

We sell the majority of our products and services under

bundled lease arrangements, which typically include

equipment, service, supplies and financing components for

which the customer pays a single negotiated monthly

fixed price for all elements over the contractual lease term.

Typically these arrangements include an incremental,

variable component for page volumes in excess of

contractual page volume minimums, which are often

expressed in terms of price per page. Revenues under

these arrangements are allocated, considering the relative

fair values of the lease and non-lease deliverables included

in the bundled arrangement, based upon the estimated

relative fair values of each element. Lease deliverables

include maintenance and executory costs, equipment and

financing, while non-lease deliverables generally consist of

56