Xerox 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

any grace period), (iii) cross-defaults and acceleration to

certain of our other obligations and (iv) a change of

control of Xerox.

Senior Notes Offerings

In May 2007, we issued $1,100 of Senior Notes due

2012 (the “2012 Senior Notes”) at 99.613 percent of par,

resulting in net proceeds of $1,088. The 2012 Senior

Notes accrue interest at the rate of 5.50% per annum,

payable semiannually, and as a result of the discount,

have a weighted average effective interest rate of 5.59%.

In conjunction with the issuance of the 2012 Senior Notes,

debt issuance costs of $7 were deferred. The 2012 Senior

Notes are subordinated to our secured indebtedness and

rank equally with our other existing senior unsecured

indebtedness.

Zero Coupon Bonds

In July and August 2007, we issued $300 and $100,

respectively, of zero coupon bonds in private placement

transactions. The bonds mature in 2022 and the final

amounts due at maturity are $706 and $233, respectively.

The bonds are putable annually at the option of the bond

holder after two years.

Other Debt Activity

Bank Credit Facilities: In July 2007, our subsidiary in

the Netherlands entered into an unsecured €120 million

(U.S. $161) bank loan due July 1, 2008. The proceeds were

used to repay secured borrowings to DLL in connection

with our purchase of DLL’s interest in our lease financing

joint venture (Refer to Note 4-Receivables, Net for further

information). As of December 31, 2007, approximately

€120 million (U.S. $177) was outstanding under this loan.

In October 2007, we entered into a €330 million (U.S.

$466) bridge facility due March 31, 2008, in order to repay

maturing secured debt in France with Merrill Lynch. As of

December 31, 2007, approximately €55 million (U.S. $81)

was outstanding under this facility.

Guarantees: At December 31, 2007, we have

guaranteed $37 of indebtedness of our foreign

subsidiaries. This debt is included in our Consolidated

Balance Sheet as of such date. In addition, as of

December 31, 2007, $55 of letters of credit have been

issued in connection with insurance guarantees.

Interest: Interest paid on our short-term debt,

long-term debt and liabilities to subsidiary trusts issuing

preferred securities amounted to $552, $512 and $555

for the years ended December 31, 2007, 2006 and

2005, respectively.

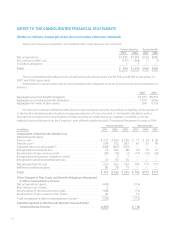

Interest expense and interest income for the three

years ended December 31, 2007 was as follows (in

millions):

2007 2006 2005

Interest expense(1) ............. $579 $544 $ 557

Interest income(2) .............. 877 909 1,013

(1) Includes Equipment financing interest expense, as well

as, non-financing interest expense included in Other

expenses, net in the Consolidated Statements of

Income.

(2) Includes Finance income, as well as, other interest

income that is included in Other expenses, net in the

Consolidated Statements of Income.

Equipment financing interest is determined based on

an estimated cost of funds, applied against the estimated

level of debt required to support our net finance

receivables. The estimated cost of funds is based on a

blended rate for term and duration comparable to

available borrowing rates for a BBB rated company, which

are reviewed at the end of each period. The estimated

level of debt is based on an assumed 7 to 1 leverage ratio

of debt/equity as compared to our average finance

receivable balance during the applicable period.

106