Vodafone 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 97

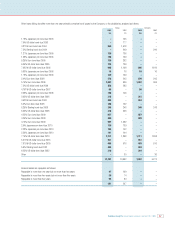

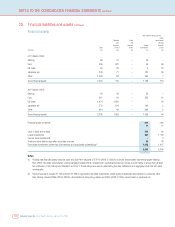

Other loans falling due after more than one year primarily comprise bond issues by the Company, or its subsidiaries, analysed as follows:

Group Company

2003 2002 2003 2002

£m £m £m £m

1.78% Japanese yen bond due 2003 –135 ––

7.0% US dollar bond due 2003 –177 ––

4.875% Euro bond due 2004 859 1,518 ––

7.5% Sterling bond due 2004 –249 –249

1.27% Japanese yen bond due 2005 139 136 ––

1.93% Japanese yen bond due 2005 140 139 ––

5.25% Euro bond due 2005 139 282 ––

6.35% US dollar bond due 2005 125 139 ––

7.625% US dollar bond due 2005 995 1,166 995 1,166

0.83% Japanese yen bond due 2006 16 16 16 16

1.78% Japanese yen bond due 2006 139 139 ––

5.4% Euro bond due 2006 276 245 276 245

5.75% Euro bond due 2006 1,032 906 1,032 906

7.5% US dollar bond due 2006 258 285 ––

4.161% US dollar bond due 2007 95 –95 –

2.58% Japanese yen bond due 2008 140 146 ––

3.95% US dollar bond due 2008 315 –315 –

4.625% Euro bond due 2008 344 –344 –

5.5% Euro bond due 2008 146 132 ––

6.25% Sterling bond due 2008 248 248 248 248

6.65% US dollar bond due 2008 316 353 ––

4.25% Euro bond due 2009 957 –957 –

4.25% Euro bond due 2009 349 –349 –

4.75% Euro bond due 2009 567 1,682 ––

2.0% Japanese yen bond due 2010 139 139 ––

2.28% Japanese yen bond due 2010 136 142 ––

2.50% Japanese yen bond due 2010 141 144 ––

7.75% US dollar bond due 2010 1,711 1,898 1,711 1,898

5.375% US dollar bond due 2015 251 –251 –

7.875% US dollar bond due 2030 465 516 465 516

5.9% Sterling bond due 2032 443 –443 –

6.25% US dollar bond due 2032 310 –310 –

Other –30 –30

11,191 10,962 7,807 5,274

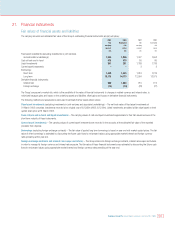

Finance leases are repayable as follows:

Repayable in more than one year but not more than two years 47 109 ––

Repayable in more than two years but not more than five years 39 74 ––

Repayable in more than five years 95 84 ––

181 267 ––