Vodafone 2003 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

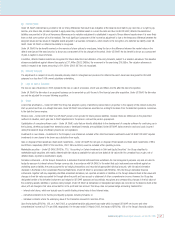

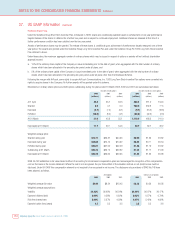

At 31 March 2003, the Group had outstanding foreign exchange contracts and currency swaps with an aggregate amount of £73m (2002: £28m). These

contracts mature within 69 months (2002: 13 months). The fair value of these contracts was £1m higher than their carrying value at 31 March 2003 (2002:

£1m higher). Profits and losses arising from these instruments are recognised in the profit and loss account when the associated sale or purchase is

recognised or when a hedged transaction is no longer expected to occur.

Investments in foreign entities

It is the Group’s policy not to hedge its international assets with respect to foreign currency balance sheet translation exposure, since net tangible assets

represent a small proportion of the market value of the Group and international operations provide risk diversity.

The fair value of both the interest rate and foreign exchange rate risk management instruments was estimated by discounting the future cash flows to net

present values using appropriate market interest and foreign exchange rates prevailing at the year end.

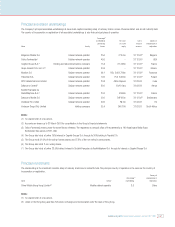

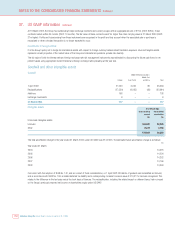

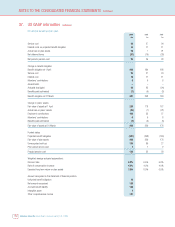

Goodwill and other intangible assets

Goodwill Mobile telecommunications

Middle East

Europe Asia Pacific and Africa Total

1 April 2002 27,550 6,025 89 33,664

Reclassifications (27,550) (6,025) (89) (33,664)

Additions 108 ––108

Exchange movements 9 ––9

31 March 2003 117 ––117

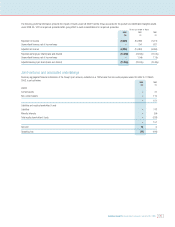

Intangible assets At 31 March 2003

Gross carrying Accumulated

amount amortisation

£m £m

Finite-lived intangible assets:

Licences 169,592 32,335

Other 8,474 3,754

178,066 36,089

The total amortisation charge for the year ended 31 March 2003, under US GAAP, was £14,619m. The estimated future amortisation charge is as follows:

£m

Year ended 31 March:

2004 14,318

2005 14,224

2006 14,262

2007 14,166

2008 14,363

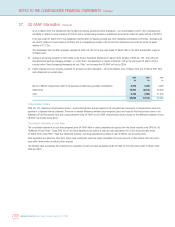

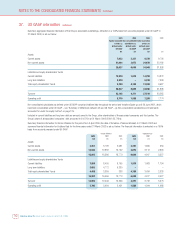

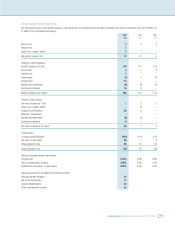

Concurrent with the adoption of SFAS No. 142, and as a result of these considerations, on 1 April 2002 £33,664m of goodwill was reclassified as licences;

and in accordance with SFAS No. 109, a related deferred tax liability and a corresponding increase to licence value of £19,077m has been recognised. This

relates to the difference in the tax basis versus the book basis of licences. The reclassification, including the related impact on deferred taxes, had no impact

on the Group’s previously reported net income or shareholders equity under US GAAP.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

130

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

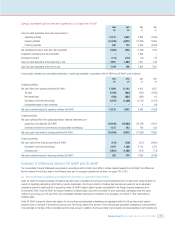

37. US GAAP information continued