Vodafone 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

88

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

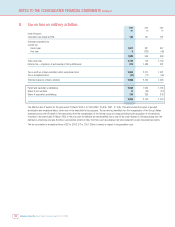

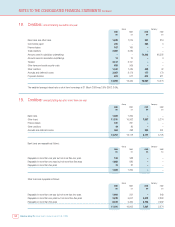

9. Equity dividends

2003 2002 2001

Pence Pence Pence

per per per

2003 ordinary 2002 ordinary 2001 ordinary

£m share £m share £m share

Interim dividend paid 542 0.7946 492 0.7224 423 0.6880

Proposed final dividend 612 0.8983 511 0.7497 464 0.7140

Additional final dividend payable in respect of

the year ended 31 March 2001 ––22 –––

1,154 1.6929 1,025 1.4721 887 1.4020

10. Loss per share

2003 2002 2001

Weighted average number of shares (millions) in issue during the year and used to calculate basic and

diluted loss per share 68,155 67,961 61,439

£m £m £m

Loss for basic and diluted loss per share (9,819) (16,155) (9,885)

Pence per Pence per Pence per

share share share

Basic and diluted loss per share (14.41) (23.77) (16.09)

Basic loss per share is stated inclusive of the following items: £m £m £m

Goodwill amortisation 14,056 13,470 11,873

Exceptional operating items 576 5,408 320

Exceptional non-operating items 5860 (80)

Tax on exceptional items (37) (71) (55)

Share of exceptional items attributable to minority interests (139) (14) –

Pence per Pence per Pence per

share share share

Goodwill amortisation 20.62 19.82 19.32

Exceptional operating items 0.85 7.96 0.53

Exceptional non-operating items 0.01 1.26 (0.13)

Tax on exceptional items (0.06) (0.10) (0.09)

Share of exceptional items attributable to minority interests (0.20) (0.02) –

Basic loss per share represents the net loss attributable to ordinary shareholders, being the loss on ordinary activities after taxation and minority interests.

Diluted loss per share is the same as basic loss per share as it is considered that there are no dilutive potential ordinary shares.