Vodafone 2003 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155

|

|

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

112

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

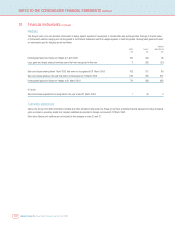

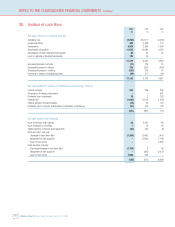

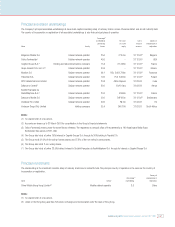

30. Analysis of cash flows

2003 2002 2001

£m £m £m

Net cash inflow from operating activities

Operating loss (5,295) (10,377) (6,439)

Exceptional items 496 4,486 176

Depreciation 3,979 2,880 1,593

Amortisation of goodwill 11,875 10,962 9,585

Amortisation of other intangible fixed assets 53 34 24

Loss on disposal of tangible fixed assets 109 46 –

11,217 8,031 4,939

(Increase)/decrease in stocks (17) 125 15

Decrease/(increase) in debtors 198 (242) (350)

(Decrease)/increase in creditors (233) 215 67

Payments in respect of exceptional items (23) (27) (84)

11,142 8,102 4,587

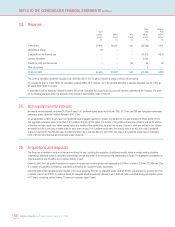

Net cash outflow for returns on investments and servicing of finance

Interest received 543 259 296

Termination of hedging instruments –– 901

Dividends from investments 15 2 102

Interest paid (1,004) (1,104) (1,254)

Interest element of finance leases (14) (9) (11)

Dividends paid to minority shareholders in subsidiary undertakings (91) (84) (81)

(551) (936) (47)

Net cash outflow from financing

Issue of ordinary share capital 28 3,581 65

Issue of shares to minorities 112 44

Capital element of finance lease payments (97) (46) (9)

Debt due within one year:

Decrease in short term debt (1,366) (2,486) (407)

Repayment of debt acquired –(1,256) (7,181)

Issue of new bonds –– 2,823

Debt due after one year:

(Decrease)/increase in long term debt (1,700) 646

Repayment of debt acquired –(991) (2,072)

Issue of new bonds 2,998 505 –

(136) (675) (6,691)