Vodafone 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

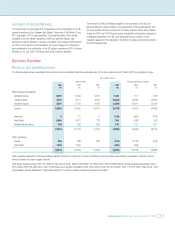

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 11

to withdraw from the Swedish market and the 3G joint venture described above.

As a result, Vodafone Sweden may have to invest more in the network in order to

achieve the national coverage required under the terms of its licence. Full

commercial launch of 3G services is expected on 1 January 2004, at which time

the licence terms require population coverage of 99.98%.

France

At 31 March 2003, the Group’s effective ownership interest in SFR was

approximately 43.9%, comprising a direct holding of 20% and an indirect

holding through the Group’s interest in Cegetel.

SFR has the second largest customer base of the three mobile carriers in the

French market, with an estimated market share of 35%. During the 2003

financial year, SFR expanded its customer base by 7% to 13,324,000 registered

customers at 31 March 2003. During the 2002 financial year SFR opened its

GPRS network for service.

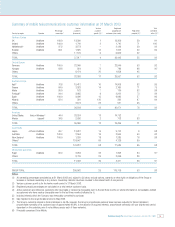

Central Europe

The Group’s interests in Central Europe comprise subsidiary undertakings in

Germany and Hungary and associated undertakings in Poland and Switzerland.

Below is a summary of the Group’s business activities in its mobile

telecommunications markets in Central Europe.

Germany

Following the buy-out of the remaining minority shareholders in Vodafone Holding

GmbH on 21 August 2002, the Group has an effective 100% interest in

Vodafone D2 GmbH (“Vodafone Germany”).

Customer growth in the German cellular market was over 5% in the year to

31 December 2002, compared with over 16% growth in the previous calendar

year. Germany is the largest mobile market in Europe based on customer

numbers and is one of the Group’s leading European networks in terms of

messaging and data revenues, which represented 16.4% of total monthly service

revenues for the 2003 financial year.

At 31 March 2003, Vodafone Germany had 22,940,000 registered customers,

representing growth of over 7% in the year. This growth was principally

attributable to contract customers, which increased 15% and now represent

47% of the closing customer base, up from 43% at 31 March 2002. The

continued removal of inactive prepaid customers from the total customer base

also resulted in active customers representing 92% of the total registered

customer base at 31 March 2003, compared with 91% at 31 March 2002.

During the year, Vodafone Germany continued to make significant investments in

its network which, at 31 March 2003, consisted of 148 MSCs in service and

over 19,000 base stations, giving declared population coverage of over 99%.

Germany participated in the Group’s Vodafone live! launch and became the first

network operator in Germany to launch a combined camera phone and online

portal. By the end of March 2003, 405,000 Vodafone live! handsets had been

activated. In April 2002, Vodafone Germany became the first German operator to

launch MMS services. Initially available to contract customers only, in November

2002 the service was made available for prepaid customers.

Following the acquisition of a twenty year 3G licence in Germany, the 3G network

infrastructure rollout is proceeding according to plan and in accordance with the

licence obligation to provide at least 25% population coverage by the end of

2003. During the 2003 financial year, Vodafone Germany successfully completed

voice and data calls on its pilot 3G networks.

Hungary

The Group currently has an effective 83.8% interest in Vodafone Hungary, the

smallest operator in Hungary.

At 31 March 2003, Vodafone Hungary’s registered venture customers amounted

to 954,000, representing growth of over 71% in the year and increasing its

market share from 10.5% at 31 March 2002 to 13.4% at 31 March 2003.

During the 2003 financial year, Vodafone Hungary has also improved its network

coverage, despite the cancellation of the National Roaming Agreement by a

competitor during December 2002. In an accelerated infrastructure roll-out

programme, Vodafone Hungary has constructed a further 297 sites during the

year, taking the total at 31 March 2003 to 1,461 sites.

Vodafone Hungary launched GPRS services on 15 July 2002, MMS services on

9 December 2002 and Vodafone live! on 3 February 2003.

Switzerland

The Group has a 25% interest in Swisscom Mobile S.A. (“Swisscom Mobile”), the

largest mobile telecommunications company in Switzerland, with an estimated

market share of 65%. At 31 March 2003, Swisscom Mobile had 3,635,000

customers compared with 3,428,000 customers at 31 March 2002.

Poland

The Group has a 19.6% interest in Polkomtel S.A. (“Polkomtel”), the second

largest operator in Poland with an estimated market share of 33% and a

customer base of 4,839,000 at 31 March 2003.

Southern Europe

The Group’s interests in Southern Europe comprise subsidiary undertakings in

Italy, Albania, Greece, Malta, Portugal and Spain, and an associated undertaking

in Romania. At 31 March 2003, the Group’s subsidiaries in Greece and Portugal

were also listed on public stock exchanges. However, Vodafone Portugal’s shares

were de-listed from the Euronext Lisbon exchange on 22 May 2003.

Below is a summary of the Group’s business activities in its major mobile

telecommunications markets in Southern Europe.

Italy

In November 2002, Vodafone Omnitel S.p.A. and certain other group companies

were merged into a single entity, Vodafone Omnitel N.V. (“Vodafone Italy”). The

Group has an effective ownership interest of 76.8% in Vodafone Italy, the second

largest of three operators in Italy. On 7 October 2002, Vodafone Italy purchased

certain assets from the former operator, “Blu”, which exited the market through a

break up.

The Italian market is characterised by a high level of prepaid product and one of

the highest penetration rates (nearly 97%) in any country in the world. Vodafone

Italy’s registered customer base grew by 10% in the year and was 19,412,000 at

31 March 2003, of which 92% was on prepaid tariffs. At 31 March 2003,

Vodafone Italy had a market share of approximately 35.6%, in terms of registered

customers and 95% of the registered customer base was active.

At 31 March 2003, Vodafone Italy’s network consisted of 123 MSCs and 9,353

base stations, giving population coverage of 99%. During the 2002 financial year

Vodafone Italy launched its GPRS service in both the corporate and consumer

markets. The services were initially provided free of charge, with services

charged from June 2001 for corporate customers and February 2002 for other

consumers.