Vodafone 2003 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 135

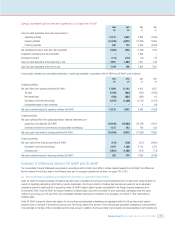

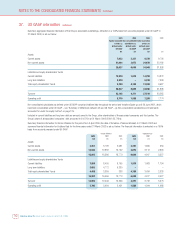

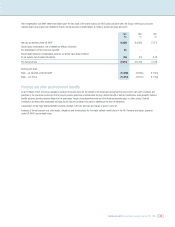

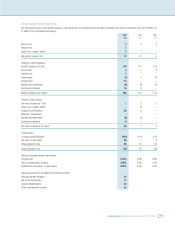

Had compensation cost been determined based upon the fair value of the share options and ADS options at grant date, the Group’s net loss and loss per

ordinary share would have been restated to the pro forma amounts indicated below (in millions, except per share amounts):

2003 2002 2001

£m £m £m

Net loss as reported under US GAAP (9,055) (16,688) (7,071)

Stock based compensation, net of related tax effects, included in

the determination of net income as reported 48 ––

Stock based employee compensation expense, under fair value based method

for all awards, net of related tax effects (65) (81) (148)

Pro forma net loss (9,072) (16,769) (7,219)

Earnings per share

Basic – as reported under US GAAP (13.29)p (24.56)p (11.51)p

Basic – pro forma (13.31)p (24.67)p (11.75)p

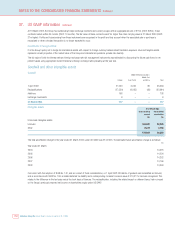

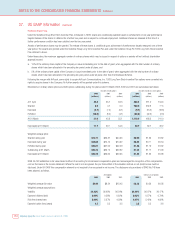

Pensions and other post retirement benefits

As at 31 March 2003, the Group operated a number of pension plans for the benefit of its employees throughout the world, which vary with conditions and

practices in the countries concerned. All the Group’s pension plans are provided either through defined benefit or defined contribution arrangements. Defined

benefit schemes provide pensions based on the employees’ length of pensionable service and their final pensionable salary or other criteria. Defined

contribution schemes offer employees individual funds that are converted into pension benefits at the time of retirement.

A description of the major defined benefit schemes provided in the UK, Germany and Japan is given in note 34.

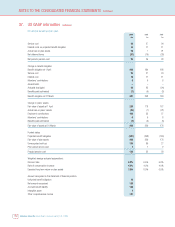

Analyses of the net pension cost, plan assets, obligations and funded status for the major defined benefit plans in the UK, Germany and Japan, prepared

under US GAAP, are provided below.