Vodafone 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

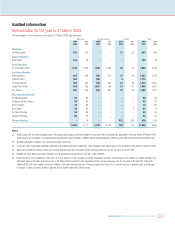

and the US. Options will have a ten-year term and vesting will be after three

years with the opportunity to measure performance again after years four and

five from a fixed base year. To the extent that the performance condition has not

been satisfied at the end of the five-year performance period, the options will

lapse. The following graph illustrates the basis on which share options vest:

Illustration

Based on the analysis of externally provided market data on the total

remuneration levels of chief executives of major European companies, the Chief

Executive received in 2002 performance shares with a face value of one and

three quarters-times salary and options with a face value of seven-times salary.

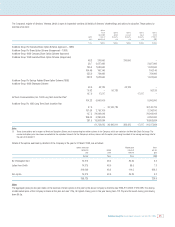

The graph below illustrates the approximate pre-tax long term incentive gains to

the Chief Executive that would be achieved based on various Company growth,

EPS and TSR performance scenarios:

For example, if the Company’s share price increases by over 60% from

120 pence to approximately 193 pence, the Company’s value increases by

£50 billion, and there is 50% vesting of long term incentives, the Chief Executive

would have a pre-tax gain of just under £4 million, representing less than

0.008% of the total increase in shareholder value.

The awards of performance shares and share options were made to executive

directors following the 2002 AGM on 31 July 2002.

It is intended that awards of performance shares and share options will be

granted to executive directors on a similar basis in 2003.

Awards are delivered in the form of ordinary shares of the Company. All awards

are made under plans that incorporate dilution limits that are set out in the

Guidelines for Share Incentive Schemes published by the Association of British

Insurers. The current estimated dilution from subsisting awards, including

executive and all-employee share awards, is approximately 2.0% of the

Company’s share capital at 31 March 2003.

Share ownership guidelines

Executive directors participating in these long term incentive plans must comply

with the Company’s share ownership guidelines. These guidelines, which were

first introduced in 2000, require the Chief Executive to have a shareholding in

the Company of four times base salary and other executive directors to have a

shareholding of three times base salary.

It is intended that these ownership levels will be attained within five years from

the director first becoming subject to the guidelines and be achieved through the

retention of shares awarded under long term incentive plans.

Pensions

Sir Christopher Gent, Julian Horn-Smith, Ken Hydon and Peter Bamford, being

UK-based directors, are contributing members of the Vodafone Group Pension

Scheme, which is a scheme approved by the Inland Revenue.

Peter Bamford, whose benefits under the Scheme are restricted by Inland

Revenue earnings limits, also participates in the defined contribution Vodafone

Group Funded Unapproved Retirement Benefits Scheme to enable pension

benefits to be provided on his basic salary above the Inland Revenue earnings

cap. Thomas Geitner participates in the Essener Verband Retirement Scheme.

Vittorio Colao will receive retirement benefits in accordance with Italian National

Collective Agreements. A contribution is made to a defined contribution plan for

dirigenti in Vodafone Italy which includes the supplementary dirigenti contribution

required under the national collective agreements. No other pension benefits are

provided. Further details of the pension benefits earned by the directors in the

year to 31 March 2003 can be found on page 62. Liabilities in respect of the

pension schemes in which the executive directors participate are funded to the

extent described in note 34 to the Consolidated Financial Statements,

“Pensions”.

Other remuneration matters

All-employee share incentive schemes

GEM Options

In July 2002, share options were granted to all employees of subsidiary

companies in all countries in which the Company operates, other than Japan

and Sweden. A key objective of the grant was to promote the Vodafone vision,

values and brand across the enlarged Group and to reinforce membership of

the Group’s worldwide employee community. Executive directors did not receive

GEM options. Vittorio Colao received GEM options in 2001 prior to his

appointment to the Board.

Sharesave Options

The Vodafone Group 1998 Sharesave Scheme is an Inland Revenue approved

scheme open to all UK permanent employees.

The maximum that can be saved each month is £250 and savings plus interest

may be used to acquire shares by exercising the related option. The options have

been granted at up to a 20% discount to market value. UK based executive

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 59

100%

80%

60%

40%

20%

0%

0% 5% 10% 15% 20%

Share Option Vesting Schedule

% of options vesting

Annualised EPS Growth in excess of RPI

10.48

+£25 bn

+£50 bn

+£75bn

100% Vesting (80th percentile

TSR ranking & UK RPI+15%

EPS growth per annum)

75% Vesting (73rd percentile

TSR ranking & UK RPI+11.7%

EPS growth per annum)

50% Vesting (64th percentile

TSR ranking & UK RPI+8.3%

EPS growth per annum)

25% Vesting (median TSR

ranking & UK RPI+5% EPS

growth per annum)

12

10

8

6

4

2

0

Chief Executive Pre-Tax Gain (£’millions)

Growth in value of Company from grant date