Vodafone 2003 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155

|

|

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 137

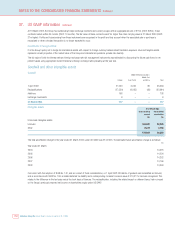

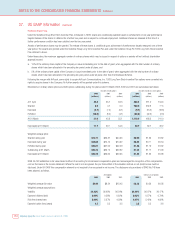

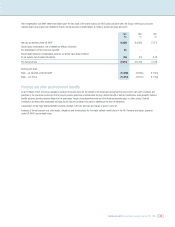

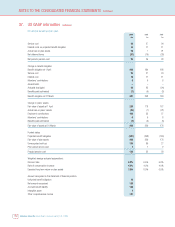

German defined benefit pension plan

The net periodic pension cost, benefit obligations, plan assets and funded status under US GAAP, translated at the year-end exchange rate of 11.4486:£1, at

31 March 2003 comprised the following:

2003 2002 2001

£m £m £m

Service cost 322

Interest cost 777

Actual loss on plans’ assets 21 –

Net periodic pension cost 12 10 9

Change in benefit obligation

Benefit obligation at 1 April 119 114 126

Service cost 322

Interest cost 777

Amendments (3) 5 (12)

Actuarial loss 13 ––

Benefits paid (estimated) (9) (8) (9)

Exchange movements 15 (1) –

Benefit obligation at 31 March 145 119 114

Change in plans’ assets

Fair value of assets at 1 April 122

Actual loss on plans’ assets –(1) –

Employer’s contributions 88 8 –

Members’ contributions –––

Benefits paid (estimated) (9) (8) –

Exchange movements 6––

Fair value of assets at 31 March 86 12

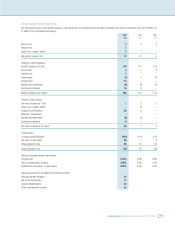

Funded status

Projected benefit obligation (145) (119) (114)

Fair value of plan assets 86 12

Unrecognised net loss 46 31 26

Accrued pension cost (13) (87) (86)

Weighted-average actuarial assumptions:

Discount rate 5.25% 6.0% 6.5%

Rate of compensation increase 2.00% 2.5% 2.5%

Expected long term return on plan assets 5.25% 6.0% 6.5%

Amount recognised in the statement of financial position:

Unfunded benefit obligation 55

Net amount recognised 13

Accrued benefit liability 42

Other comprehensive income 42