Vodafone 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

128

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

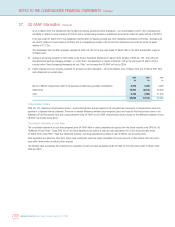

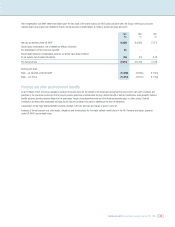

and results under US GAAP is to decrease US GAAP net income and other comprehensive income by £38m and £Nil, respectively. For the year ended 31

March 2003 US GAAP net income and other comprehensive income increased by £7m and £1m, respectively.

(k) Proposed dividends

Under UK GAAP, final dividends are included in the financial statements when recommended by the Board to the shareholders in respect of the results for a

financial year. Under US GAAP, dividends are included in the financial statements when declared by the Board.

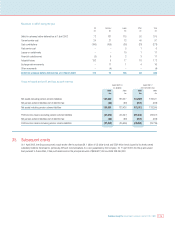

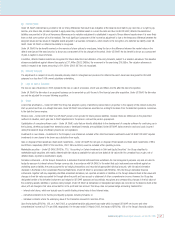

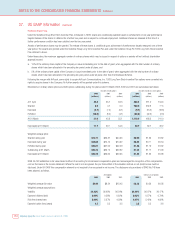

(l) Loss per ordinary share

Loss per ordinary share information is calculated based on:

2003 2003 2002 2001

$m £m £m £m

Net loss in accordance with US GAAP:

before change in accounting principle (14,298) (9,055) (16,705) (7,071)

after change in accounting principle (14,298) (9,055) (16,688) (7,071)

Number Number Number Number

Weighted average number of ordinary shares in issue (millions) 68,155 68,155 67,961 61,439

Cents per Pence per Pence per Pence per

Basic and diluted loss per ordinary share: share share share share

before change in accounting principle (20.98)¢ (13.29)p (24.58)p (11.51)p

after change in accounting principle (20.98)¢ (13.29)p (24.56)p (11.51)p

The Group has not included 382 million shares (2002: 246 million; 2001: 41 million) in the computation of diluted earnings per share as their inclusion would

be antidilutive.

Future developments in US GAAP

SFAS No. 145, “Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and Technical Corrections”

In April 2002, the FASB issued SFAS No. 145. SFAS No. 145 rescinds SFAS No. 4, “Reporting Gains and Losses from Extinguishment of Debt”, and an

amendment of that Statement, SFAS No. 64, “Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements”, and SFAS No. 44, “Accounting for

Intangible Assets of Motor Carriers”. This Statement amends SFAS No. 13, “Accounting for Leases”, to eliminate an inconsistency between the required

accounting for sale and leaseback transactions and the required accounting for certain lease modifications that have economic effects that are similar to sale-

leaseback transactions. The Statement also amends other existing authoritative pronouncements to make various technical corrections, clarify meanings, or

describe their applicability under changed conditions. SFAS No. 145 has not impacted the Group’s reported financial position and results under US GAAP.

SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities”

In June 2002, the FASB issued SFAS No. 146. SFAS No. 146 is effective for exit or disposal activities initiated after 31 December 2002 and requires that a

liability for a cost associated with an exit or disposal activity be recognised when the liability is incurred. This Statement nullifies EITF No. 94-3, “Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a Restructuring)”, under which a

liability for an exit cost as defined in EITF No. 94-3 was recognised at the date of an entity’s commitment to an exit plan. This Statement also establishes that fair

value is the objective for initial measurement of the liability. SFAS No. 146 has not impacted the Group’s reported financial position and results under US GAAP.

SFAS No. 148, “Accounting for Stock-Based Compensation –Transition and Disclosure –an amendment of FASB Statement No. 123”

In December 2002 the FASB issued SFAS No. 148. SFAS No. 148 allows alternative methods of transition for a voluntary change to accounting for stock-based

employee compensation under the fair value method prescribed by SFAS No. 123, “Accounting for Stock-Based Compensation”. This Statement also amends the

disclosure requirements of SFAS No. 123 to require prominent disclosures in both annual and interim financial statements about the method of accounting for

stock-based employee compensation and the effect of the method used on reported results. The Group accounts for stock-based compensation under APB No. 25

and applies the disclosure requirements of SFAS No. 148. SFAS No. 148 has not impacted the Group’s reported financial position and results under US GAAP.

SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging Activities”

In April 2003, the FASB issued SFAS No. 149. SFAS No. 149 will be effective for contracts entered into or modified after 30 June 2003 and for hedging

relationships designated after 30 June 2003. The Statement requires contracts with comparable characteristics to be accounted for similarly and clarifies

under what circumstances a contract with an initial net investment meets the characteristic of a derivative as discussed in SFAS No. 133. It also clarifies when

special reporting in the statement of cash flows is required if a derivative contains a financing component. The effect of SFAS No. 149 on the Group’s reported

financial position and results under US GAAP is not expected to be material.

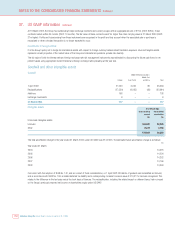

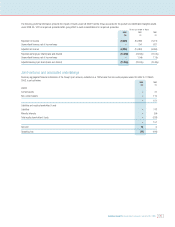

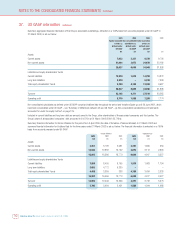

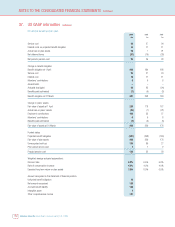

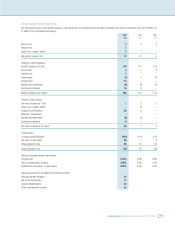

37. US GAAP information continued