Vodafone 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

60

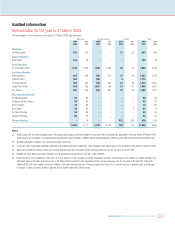

BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION Continued

directors are eligible to participate in the scheme and details of their participation

are given in the table on page 65.

Share Incentive Plan

The Vodafone Share Incentive Plan (“SIP”) is an Inland Revenue approved plan

open to all UK permanent employees. Eligible employees may contribute up to

£125 each month and the trustee of the plan uses the money to buy shares on

their behalf. An equivalent number of shares is purchased with contributions

from the employing company. UK based executive directors are eligible to

participate in the SIP and details of their share interests under these plans are

given in the table on page 66.

Non-executive directors’ remuneration

The remuneration of non-executive directors is established by the whole Board,

but the non-executive directors do not participate in the decision on their own

remuneration. Basic fee levels were last increased in 2000. From 1 July 2002,

an additional fee of £10,000 p.a. became payable for the responsibility of

chairing a principal Board Committee, i.e. the Audit, Remuneration or

Nominations Committee. Details of each non-executive director’s remuneration

are included in the table on the following page.

Non-executive directors are not eligible to receive awards under any of the

Company’s share schemes or other employee benefit schemes, nor does the

Company make any contribution to their pension arrangements.

Certain non-executive directors held share options relating to their service with

AirTouch. No options have been granted to non-executive directors in their

capacity as non-executive directors of the Company.

Service contracts and appointments of directors

The Remuneration Committee has determined that, after an initial term that may

be of up to two years’ duration, executive directors’ contracts should thereafter

have rolling terms and be terminable on no more than one year’s notice. No

payments should normally be payable on termination other than the salary due

for the notice period and such entitlements under incentive plans and benefits

that are consistent with the terms of such plans.

Details of the contract terms of the executive directors follow:

Current

contract start date Unexpired term Notice period

Sir Christopher Gent 1 January 1997 Indefinite One year

(retires 31

December 2003)

Peter Bamford 1 April 1998 Indefinite One year

Vittorio Colao 22 July 1996 Indefinite Up to one year

Thomas Geitner 1 June 2001 To 31 May 2005 One year from

and then indefinite June 2004

Julian Horn-Smith 4 June 1996 Indefinite One year

Ken Hydon 1 January 1997 Indefinite One year

At the time of his appointment to the Board, Thomas Geitner was employed

under a fixed term five-year service contract with Mannesmann AG (now

Vodafone Holding GmbH) which was the normal contract arrangement for

Mannesmann AG board members. Mr Geitner agreed, without recompense, to

accept new terms such that from June 2004 his contract will be indefinite and

terminable on one year’s notice.

There are no specific provisions for termination payments under the terms of any

of the executive directors’ service contracts.

In accordance with the National Collective Labour Agreement for “dirigenti”for

industrial companies in Italy, Vittorio Colao is entitled to receive an end of service

indemnity.

The appointment of the Chairman is subject to the terms of an agreement

between the Company and Lord MacLaurin with an initial three-year term that

began on 23 May 2000. In March 2003, the Chairman accepted the invitation of

the Nominations Committee and the Board to continue in office. His appointment

therefore continues on the terms of the original agreement, but may now be

terminated by either party on one year’s notice. The Chairman is entitled to the

provision of a car or car allowance.

In respect of non-executive directors, the policy is for the appointments to be for

three year terms. Fees cease to be payable immediately upon termination of any

appointments for any reason and no compensation is payable in respect of such

termination.

Non-executive directors, other than the Chairman, but including the Deputy

Chairman, Paul Hazen, are engaged on letters of appointment that set out their

duties and responsibilities and confirm their remuneration in line with the policy

described above.

John Buchanan was appointed to the Board as a non-executive director with

effect from 1 April 2003 and he holds office on the same terms as other non-

executive directors.

Appointment of new Chief Executive and

retirement of current Chief Executive

On 18 December 2002, the Company announced the appointment of Arun Sarin

as the new Chief Executive from after the 2003 Annual General Meeting on

30 July 2003. He commenced employment as Chief Executive Designate on 1

April 2003.

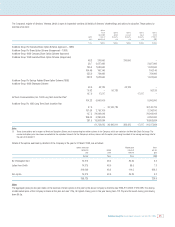

Arun Sarin will receive a basic salary of £1.1 million and the incentives and

benefits that will form the remainder of his remuneration package will be

consistent with the existing executive director remuneration policy described

previously and comparable in quantum to that received by Sir Christopher Gent

for the year ended 31 March 2003.

Arun Sarin has entered into a service contract that can be terminated by the

Company at the end of an initial term of two years or at any time thereafter on

one year’s notice. He is required to give the Company one year’s notice

if he wishes to terminate the contract. There are no specific provisions for

termination payments under the terms of the service contract.

Sir Christopher Gent will formally step down as Chief Executive at the end of

the 2003 AGM on 30 July 2003 and, to enable an orderly transition, will retire

from the Company on 31 December 2003. Sir Christopher will not receive a

severance payment and his entitlements under the various incentive and

retirement plans in which he participates will be determined by

the standard rules applicable to retirement under each of these plans. All awards

under the new remuneration policy and global market-related options granted

under the previous policy provide for awards to be pro-rated for time and

performance. Sir Christopher will not receive a salary increase, performance

shares or share option awards in 2003.