Vodafone 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

106

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

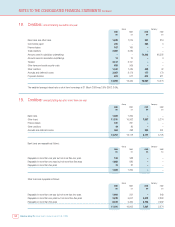

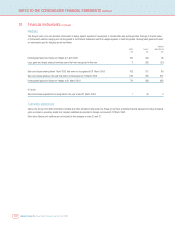

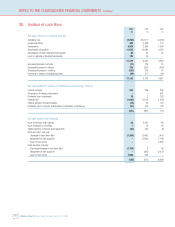

24. Reserves

Group Company

Share Profit Profit

premium Merger Other and loss and loss

account reserve reserve account account

£m £m £m £m £m

1 April 2002 52,044 98,927 935 (25,606) 3,351

Allotments of shares 29 ––––

(Loss)/profit for the financial year –––(10,973) 4,876

Currency translation –––9,039 –

Transfer to profit and loss account ––(92) 92 92

Other movements –––1 –

31 March 2003 52,073 98,927 843 (27,447) 8,319

The currency translation movement includes a loss of £826m (2002: £517m gain) in respect of foreign currency net borrowings.

For acquisitions prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals, was £1,190m at

31 March 2003 (2002: £1,190m).

In accordance with the exemption allowed by section 230 of the Companies Act, no profit and loss account has been presented by the Company. The profit

for the financial year dealt within the accounts of the Company was £6,030m (2002: £1,987m).

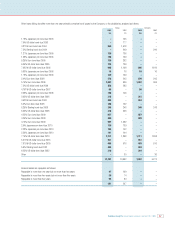

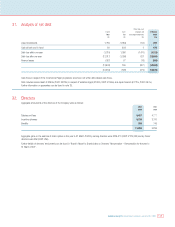

25. Non-equity minority interests

Non-equity minority interests comprise £1,015m of class D & E preferred shares issued by AirTouch (2002: £1,124m) and £Nil non-cumulative redeemable

preference shares issued by Vodafone Australia (2002: £4m).

An annual dividend of $51.43 per class D & E preferred share is payable quarterly in arrears. The dividend for the year amounted to £55m (2002: £61m).

The aggregate redemption value of the class D & E preferred shares is $1.65 billion. The holders of the preferred shares are entitled to vote on the election

of directors and upon each other matter coming before any meeting of the stockholders on which the holders of common stock are entitled to vote. Holders

are entitled to vote on the basis of twelve votes for each share of class D or E preferred stock held. The maturity date of the 825,000 class D preferred

shares is 6 April 2020. The 825,000 class E preferred shares have a maturity date of 1 April 2020. The class D & E preferred shares have a redemption

price of $1,000 per share plus all accrued and unpaid dividends.

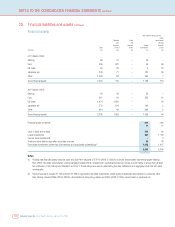

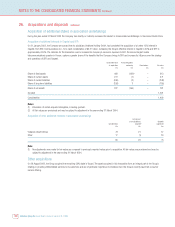

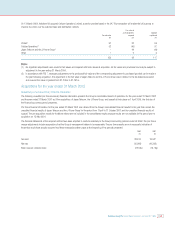

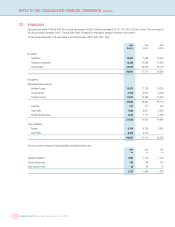

26. Acquisitions and disposals

The Group has undertaken a number of transactions during the year, including the acquisition of additional minority stakes in certain existing subsidiary

undertakings, additional stakes in associated undertakings and the acquisition of the remaining 50% shareholding in Vizzavi. The aggregate consideration for

these acquisitions was £5,496m and comprised entirely of cash.

Under UK GAAP, the total goodwill capitalised in respect of transactions has been provisionally assessed as £4,586m, of which £3,284m, £1,296m and £6m

is in respect of subsidiary undertakings, associated undertakings and customer bases, respectively.

Under US GAAP, these transactions have resulted in the Group assigning £4,679m to intangible assets, of which £108m was assigned to goodwill, £4,270m

to cellular licences and £301m to customer bases. All intangible assets acquired are deemed to be of finite life, with a weighted average amortisation period

of 12 years, comprising cellular licences 16 years and customer bases 5 years.