Vodafone 2003 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

118

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

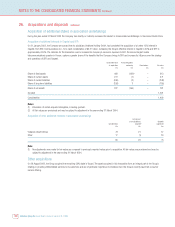

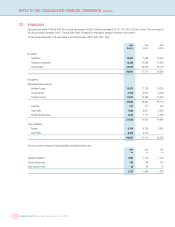

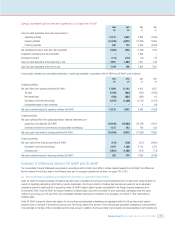

History of amounts that would have been recognised in the statement of total recognised gains and losses under FRS 17

2003

£m %

UK Difference between the expected and actual return on assets(1) (95) (36)

Experience gains and losses arising on scheme liabilities(2) ––

Actuarial loss(2) (132) (34)

Germany Difference between the expected and actual return on assets(1) (1) (1)

Experience gains and losses arising on scheme liabilities(2) 74

Actuarial loss(2) (5) (3)

Japan Difference between the expected and actual return on assets(1) ––

Experience gains and losses arising on scheme liabilities(2) (1) (1)

Actuarial loss(2) (17) (13)

Other Difference between the expected and actual return on assets(1) (14) (37)

Experience gains and losses arising on scheme liabilities(2) 11

Actuarial loss(2) (18) (14)

(1) Percentage stated is expressed as a percentage of scheme assets at 31 March.

(2) Percentage stated is expressed as a percentage of scheme liabilities at 31 March.

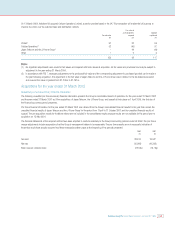

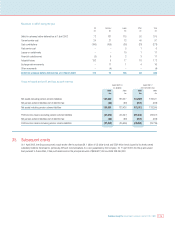

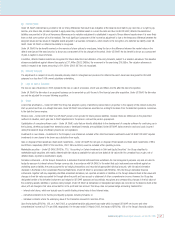

Fair value of the assets and liabilities of the schemes

UK Germany Japan Other Total

2003 2002 2003 2002 2003 2002 2003 2002 2003 2002

£m £m £m £m £m £m £m £m £m £m

Bonds 56 23 ––––712 63 35

Equities 208 206 ––––27 26 235 232

Other assets ––107 81145112 14

Total fair value of

scheme assets 264 229 107 81138 43 410 281

Present value of

scheme liabilities (383) (301) (180) (139) (127) (116) (126) (95) (816) (651)

FRS 17 deficits (119) (72) (73) (131) (126) (115) (88) (52) (406) (370)

Related deferred tax

assets 36 22 30 52 53 48 30 20 149 142

Net FRS 17 deficits (83) (50) (43) (79) (73) (67) (58) (32) (257) (228)

The funded status of each of the above principal defined benefit schemes is reported at the beginning of this note. The deficits reported under FRS 17 reflect

the different assumptions for valuing assets and liabilities compared with SSAP 24 and include the immediate impact of the fair value of assets at 31 March

2003. FRS 17 does not have any impact on the basis of funding these schemes.

The funding policy for the UK scheme is reviewed on a systematic basis in consultation with the independent scheme actuary in order to ensure that the

funding contributions from sponsoring employers are appropriate to meet the liabilities of the scheme over the long term. In respect of the UK pension

arrangements, the shortfall in assets represents approximately 31% (2002: 25%) of the pension liabilities as derived using assumptions adopted for the

purposes of FRS 17. The performance of investment markets around the world over the last three years has been a major contributor to this shortfall.

The assets of the German scheme include £95m in respect of the main scheme and £12m in respect of the deferred compensation scheme.

The deficit in respect of other schemes at 31 March 2003 primarily relates to internally funded schemes in Italy, Sweden and the United States and the

externally funded scheme in Ireland.

34. Pensions continued