Vodafone 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

86

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

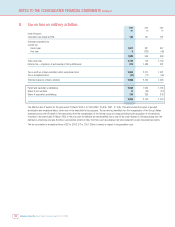

8. Tax on loss on ordinary activities

2003 2002 2001

£m £m £m

United Kingdom

Corporation tax charge at 30% 195 187 191

Overseas corporation tax

Current tax:

Current year 1,971 857 957

Prior year 9(322) (48)

1,980 535 909

Total current tax 2,175 722 1,100

Deferred tax – origination of and reversal of timing differences 818 1,489 381

Tax on profit on ordinary activities, before exceptional items 2,993 2,211 1,481

Tax on exceptional items (37) (71) (55)

Total tax charge on ordinary activities 2,956 2,140 1,426

Parent and subsidiary undertakings 2,624 1,925 1,195

Share of joint ventures 17 (23) (12)

Share of associated undertakings 315 238 243

2,956 2,140 1,426

The effective rate of taxation for the year ended 31 March 2003 is (47.6)% (2002: (15.8)%, 2001: (17.6)%). This rate includes the impact of goodwill

amortisation and exceptional items, which may not be deductible for tax purposes. The tax rate has benefited from the reorganisation of the Group’s Italian

operations and a one-off benefit in Germany arising from the reorganisation of the German group of companies following the acquisition of the remaining

minorities in the year ended 31 March 2003. In the prior year, the effective tax rate benefited from a one-off tax credit received in Germany arising from the

distribution of earnings and also the Visco Law incentive scheme in Italy. The Visco Law has subseque ntly been replaced by a less favourable tax regime.

The tax recoverable on exceptional items of £37m (2002: £71m, 2001: £55m) is mainly in respect of reorganisation costs.