Vodafone 2003 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 139

ADDITIONAL INFORMATION FOR SHAREHOLDERS

Related Party Transactions

During the year ended 31 March 2003, and as of 23 May 2003, neither any

director nor any other executive officer, nor any associate of any director or any

other executive officer, was indebted to the Company, except for Dr Michael Boskin

who, at the start of the year held a $100,000 unsecured promissory note facility

entered into with AirTouch for the purposes of financing the purchase of AirTouch

common stock pursuant to the 1993 Long Term Incentive Plan, bearing interest at a

market rate. On 8 January 2003, Dr Boskin repaid the loan and accumulated

interest in full.

Since 1 April 2002, the Company has not been, and is not now, a party to any

other material transactions, or proposed transactions, in which any member of

the key management personnel (including directors, any other executive officer,

senior manager, any spouse or relative of any of the foregoing, or any relative of

such spouse), had or was to have a direct or indirect material interest.

Transactions with joint ventures and associated undertakings of the Group are

regularly entered into by the Company and its subsidiaries. Information regarding

the value of transactions and loans with joint ventures and associated

undertakings is provided in the Notes to the Consolidated Financial Statements in

this Annual Report.

Share Price History

Upon flotation of the Company on 11 October 1988 the ordinary shares were

valued at 170p each. On 16 September 1991, when the Company was finally

demerged, for UK taxpayers the base cost of Racal Electronics Plc shares was

apportioned between the Company and Racal Electronics Plc for capital gains tax

purposes in the ratio of 80.036% and 19.964% respectively. Opening share

prices on 16 September 1991 were 332p for each Vodafone share and 223p for

each Racal share.

On 21 July 1994, the Company effected a bonus issue of two new shares for

every one then held and on 30 September 1999 it effected a bonus issue of four

new shares for every one held at that date. The flotation and demerger share

prices, therefore, may be restated as 11.333p and 22.133p, respectively.

The share price at 31 March 2003 was 113.00p (31 March 2002: 129.75p).

The share price on 23 May 2003 was 125.50p.

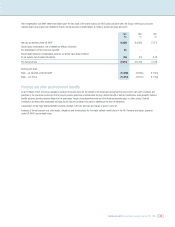

The following tables set out, for the periods indicated, (i) the reported high and low

middle market quotations of ordinary shares on the London Stock Exchange, (ii) the

reported high and low sales prices of ordinary shares on the Frankfurt Stock

Exchange, and (iii) the reported high and low sales prices of ADSs on the NYSE.

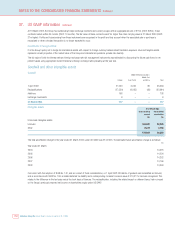

Five year data on an annual basis

London Stock Frankfurt

Exchange Stock Exchange* NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

1998/1999 2.45 1.11 ––39.52 19.15

1999/2000 3.99 2.13 ––63.06 34.11

2000/2001 3.56 1.82 5.82 2.87 56.63 26.01

2001/2002 2.29 1.24 3.70 2.00 33.26 17.88

2002/2003 1.31 0.81 2.15 1.26 20.30 12.76

* The Company’s ordinary shares have been traded on the Frankfurt Stock

Exchange since 3 April 2000 and therefore information has not been provided

for certain prior periods.

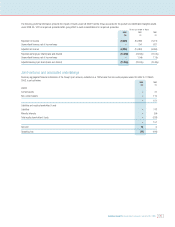

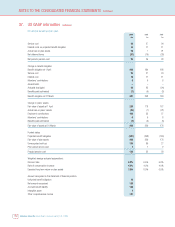

Two year data on a quarterly basis

London Stock Frankfurt

Exchange Stock Exchange NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

2001/2002

First Quarter 2.29 1.46 3.70 2.43 33.26 20.56

Second Quarter 1.68 1.24 2.80 2.00 23.50 18.25

Third Quarter 1.93 1.47 3.13 2.38 27.58 21.80

Fourth Quarter 1.84 1.26 3.02 2.09 26.69 17.88

2002/2003

First Quarter 1.31 0.87 2.15 1.34 18.80 13.13

Second Quarter 1.10 0.81 1.73 1.26 16.87 12.76

Third Quarter 1.27 0.84 2.00 1.36 20.19 13.35

Fourth Quarter 1.26 1.01 1.90 1.50 20.30 16.80

2003/2004

First Quarter* 1.27 1.16 1.86 1.67 20.94 18.53

* covering period up to 23 May 2003.

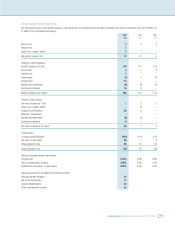

Six month data on a monthly basis

London Stock Frankfurt

Exchange Stock Exchange NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

November 2002 1.27 0.99 2.00 1.56 20.19 15.45

December 2002 1.24 1.10 1.94 1.68 19.43 17.60

January 2003 1.26 1.07 1.90 1.65 20.30 18.11

February 2003 1.18 1.09 1.74 1.65 18.90 17.80

March 2003 1.22 1.01 1.83 1.50 19.45 16.80

April 2003 1.27 1.16 1.86 1.67 20.51 18.53

May 2003* 1.26 1.18 1.78 1.68 20.94 19.14

* High and low share prices for May 2003 only reported until 23 May 2003.

The current authorised share capital comprises 78,000,000,000 ordinary shares

of $0.10 each and 50,000 7% cumulative fixed rate shares of £1.00 each.

Markets

Ordinary shares of Vodafone Group Plc are traded on the London Stock

Exchange, the Frankfurt Stock Exchange and, in the form of American Depositary

Shares (“ADSs”), on the New York Stock Exchange.

ADSs, each representing ten ordinary shares, are traded on the New York Stock

Exchange under the symbol ‘VOD’. The ADSs are evidenced by American

Depositary Receipts (“ADRs”) issued by The Bank of New York, as Depositary

under a Deposit Agreement, dated as of 12 October 1988 as amended and

restated as of 26 December 1989, as further amended as restated as of 16

September 1991 and as further amended and restated as of 30 June 1999,

among the Company, the Depositary and the holders from time to time of ADRs

issued thereunder.

ADS holders are not members of the Company but may instruct The Bank of

New York on the exercise of voting rights relative to the number of ordinary

shares represented by their ADRs. See “Memorandum and Articles of Association

and Applicable English Law – Rights attaching to the Company’s shares – Voting

rights”below.