Vodafone 2003 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 133

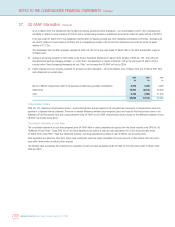

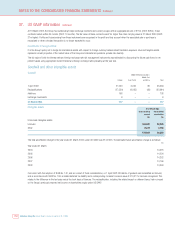

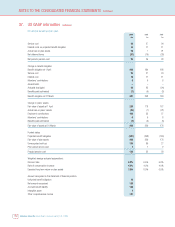

Fixed asset investments

Under US GAAP, SFAS No. 115, “Accounting for Certain Investments in Debt and Equity Securities”, requires certain disclosures to be made of the Group’s

fixed asset investments, all of which are equity securities and classified as available for sale.

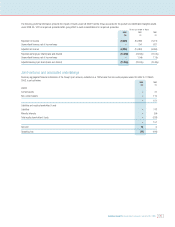

UK GAAP net

book value(1) Unrealised gains Unrealised losses Fair value

£m £m £m £m

At 31 March 2003 1,127 7 (144) 990

At 31 March 2002 1,325 286 (10) 1,601

Note:

(1) Determined using the weighted average cost basis.

During the period, the Group realised proceeds of £575m (2002: £319m; 2001: £513m), realising gross gains on sale of £258m and gross losses on sale of

£3m (2002: £9m; 2001: £6m).

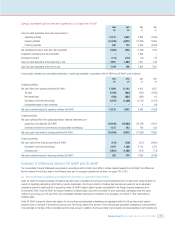

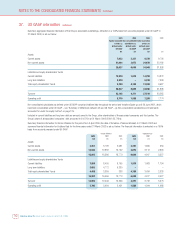

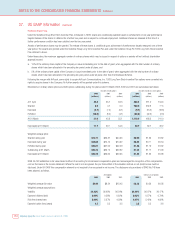

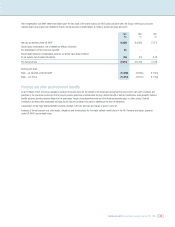

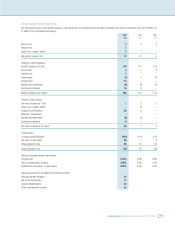

Stock based compensation

For the purposes of US GAAP reporting, the Group accounts for stock based compensation in accordance with APB 25. The Group also adopts the disclosure

only provisions of SFAS No. 148.

The Company currently uses a number of share plans to grant options and share awards to its directors and employees.

Share Option Plans

Sharesave Scheme

The Vodafone Group 1998 Sharesave Scheme (“the Sharesave Scheme”) enables UK staff to acquire shares in the Company through monthly savings of up

to £250 over a three or five year period, at the end of which they also receive a tax free bonus. The savings and bonus may then be used to purchase shares

at the option price, which is set at the beginning of the savings contract and usually at a discount of 20% to the then prevailing market price of the

Company’s shares. Invitations to participate in this scheme are normally made annually.

Discretionary share option plans

The Company has two discretionary share option plans, the Vodafone Group 1998 Company Share Option Scheme (which is UK Inland Revenue approved)

and the Vodafone Group 1998 Executive Share Option Scheme (which is unapproved). Options under the discretionary schemes are subject to performance

conditions. Options are normally exercisable between three and ten years from the date of grant.

Long Term Stock Incentive Plan

The Vodafone Group Plc 1999 Long Term Stock Incentive Plan is a discretionary plan under which both share option grants and share awards may be made.

For some grants to US employees, the options have phased vesting over a four year period and are exercisable in respect of American Depositary Shares

(“ADSs”). For all other grants, options are normally exercisable between three and ten years from the date of grant, subject to the satisfaction of

predetermined performance conditions and are exercisable in respect of ordinary shares listed on the UK stock exchange, or ADSs for US employees.

Share option plans belonging to subsidiaries

Share option schemes are also operated by certain of the Group’s subsidiary and associated undertakings, under which options are only issued to Executives

and key personnel.

Share Plans

Share Incentive Plan

The Share Incentive Plan enables UK staff to acquire shares in the Company through monthly purchases of up to £125 per month or 5% of salary, whichever

is lower. For each share purchased by the employee, the Company provides a free matching share.