Vodafone 2003 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 125

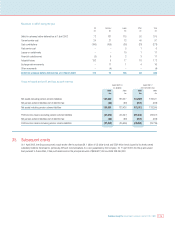

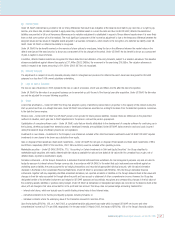

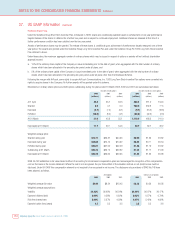

Summary consolidated cash flow information as presented in accordance with US GAAP

2003 2003 2002 2001

$m £m £m £m

Cash and cash equivalents were (used in)/provided by:

Operating activities 13,172 8,342 2,885 (1,853)

Investing activities (15,018) (9,511) (11,999) 11,995

Financing activities 282 178 2,089 (2,699)

Net (decrease)/increase in cash and cash equivalents (1,564) (991) (7,025) 7,443

Acquisitions (excluding cash and overdrafts) ––1,309 –

Exchange movement (177) (112) (76) 29

Cash and cash equivalents at the beginning of year 2,951 1,869 7,661 189

Cash and cash equivalents at the end of year 1,210 766 1,869 7,661

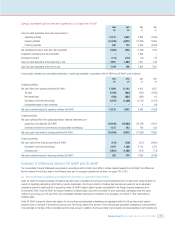

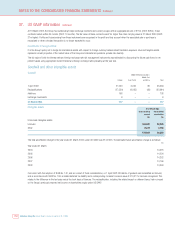

A reconciliation between the consolidated statements of cash flows presented in accordance with UK GAAP and US GAAP is set out below:

2003 2003 2002 2001

$m £m £m £m

Operating activities:

Net cash inflow from operating activities (UK GAAP) 17,593 11,142 8,102 4,587

Tax paid (1,394) (883) (545) (1,585)

Net interest paid (870) (551) (936) (47)

Decrease in short term borrowings (2,157) (1,366) (3,742) (4,765)

Increase/(decrease) in bank overdrafts ––6 (43)

Net cash provided by/(used in) operating activities (US GAAP) 13,172 8,342 2,885 (1,853)

Investing activities:

Net cash (outflow)/inflow from capital expenditure, financial investments and

acquisitions and disposals (UK GAAP) (16,190) (10,253) (12,138) 11,642

Dividends received from joint ventures and associated undertakings 1,172 742 139 353

Net cash (used in)/provided by investing activities (US GAAP) (15,018) (9,511) (11,999) 11,995

Financing activities:

Net cash outflow from financing activities (UK GAAP) (214) (136) (675) (6,691)

Decrease in short term borrowings 2,157 1,366 3,742 4,765

Dividends paid (1,661) (1,052) (978) (773)

Net cash provided by/(used in) financing activities (US GAAP) 282 178 2,089 (2,699)

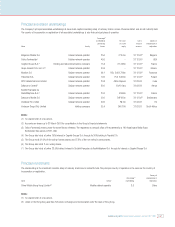

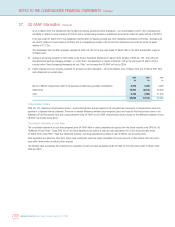

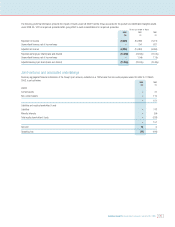

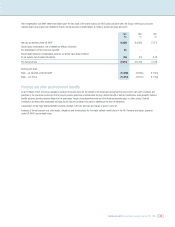

Summary of differences between UK GAAP and US GAAP

The Consolidated Financial Statements are prepared in accordance with UK GAAP, which differ in certain material respects from US GAAP. The differences

that are material to the Group relate to the following items and the necessary adjustments are shown on pages 122 to 125.

(a) Non-consolidated subsidiaries and investments accounted for under the equity method

Under UK GAAP, the results and assets of Vodafone Italy have been consolidated in the Group’s financial statements from 12 April 2000. Under US GAAP, as

a result of significant participating rights held by minority shareholders, the Group’s interest in Vodafone Italy has been accounted for as an associated

undertaking under the equity method of accounting. Under UK GAAP Vodafone Spain has been consolidated in the Group’s financial statements from

29 December 2000. Under US GAAP, the Group’s interests in Vodafone Spain, have been accounted for as an associated undertaking under the equity

method of accounting up to 29 June 2001 and consolidated thereafter, following the completion of the acquisition of a further 17.8% shareholding in

Vodafone Spain.

Under UK GAAP, charges for interest and taxation for joint ventures and associated undertakings are aggregated within the Group interest and taxation

amounts shown on the face of the profit and loss account. The Group’s share of the turnover of joint ventures and associated undertakings is also permitted

to be disclosed on the face of the consolidated profit and loss account. In addition, the Group’s share of gross assets and gross liabilities of joint ventures are