Vodafone 2003 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

144

ADDITIONAL INFORMATION FOR SHAREHOLDERS Continued

time during the six years immediately preceding the relevant disposal of shares

or ADSs may be subject to tax with respect to capital gains arising from the

dispositions of the shares or ADSs not only in the country of which the holder is

resident at the time of the disposition, but also in that other country.

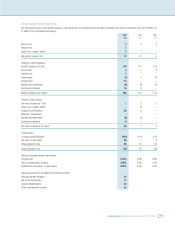

US federal income taxation

A US holder that sells or otherwise disposes of the Company’s shares or ADSs

will recognise a capital gain or loss for US federal income tax purposes equal to

the difference between the US dollar value of the amount realised and its tax

basis, determined in US dollars, in the shares or ADSs. Generally, capital gains of

a non-corporate US holder that are recognised after 6 May 2003 and before

1 January 2009 are taxed at a maximum rate of 15% where the property is held

for more than one year. The gain or loss will generally be income or loss from

sources within the United States for foreign tax credit limitation purposes. The

deductibility of losses is subject to limitations.

Additional tax considerations

UK inheritance tax

An individual who is domiciled in the United States (for the purposes of the

Estate and Gift Tax Convention) and is not a UK national will not be subject to UK

inheritance tax in respect of the Company’s shares or ADSs on the individual’s

death or on a transfer of the shares or ADSs during their lifetime, provided that

any applicable US federal gift or estate tax is paid, unless the shares or ADSs are

part of the business property of a UK permanent establishment or pertain to a UK

fixed base used for the performance of independent personal services. Where

the shares or ADSs have been placed in trust by a settlor, they may be subject to

UK inheritance tax unless, when the trust was created, the settlor was domiciled

in the United States and not a UK national. Where the shares or ADSs are subject

to both UK inheritance tax and to US federal gift or estate tax, the Estate and Gift

Tax Convention generally provides a credit against US federal tax liabilities for UK

inheritance tax paid.

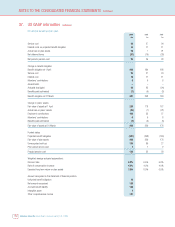

UK stamp duty and stamp duty reserve tax

Stamp duty will, subject to certain exceptions, be payable on any instrument

transferring shares in the Company to the Custodian of the Depositary at the rate

of 11⁄2per cent on the amount or value of the consideration if on sale or on the

value of such shares if not on sale. Stamp duty reserve tax (“SDRT”), at the rate

of 11⁄2per cent of the price or value of the shares could also be payable in these

circumstances, and on issue to such a person, but no SDRT will be payable if

stamp duty equal to such SDRT liability is paid. In accordance with the terms of

the Deposit Agreement, any tax or duty payable on deposits of shares by the

Depositary or the Custodian of the Depositary will be charged to the party to

whom ADSs are delivered against such deposits.

No stamp duty will be payable on any transfer of ADSs of the Company, provided

that the ADSs and any separate instrument of transfer are executed and retained

at all times outside the United Kingdom.

A transfer of shares in the Company in registered form will attract ad valorem

stamp duty generally at the rate of 1⁄2per cent of the purchase price of the shares.

There is no charge to ad valorem stamp duty on gifts. On a transfer from nominee

to beneficial owner (the nominee having at all times held the shares on behalf of

the transferee) under which no beneficial interest passes and which is neither a

sale nor in contemplation of a sale, a fixed £5.00 stamp duty will be payable.

SDRT is generally payable on an unconditional agreement to transfer shares in

the Company in registered form at 1⁄2per cent of the amount or value of the

consideration for the transfer, but is repayable if, within six years of the date of

the agreement, an instrument transferring the shares is executed, or, if the SDRT

has not been paid, the liability to pay the tax (but not necessarily interest and

penalties) would be cancelled. However, an agreement to transfer the ADSs of

the Company will not give rise to SDRT.

Documents on Display

The Company is subject to the information requirements of the US Securities and

Exchange Act of 1934 applicable to foreign private issuers. In accordance with

these requirements, the Company files its Annual Report on Form 20-F and other

related documents with the SEC. These documents may be inspected at the

SEC’s public reference rooms located at 450 Fifth Street, NW Washington, DC

20549. Information on the operation of the public reference room can be

obtained in the US by calling the SEC on 1-800-SEC-0330. In addition, some of

the Company’s SEC filings, including all those filed on or after 4 November 2002,

are available on the SEC’s website at www.sec.gov. Shareholders can also obtain

copies of the Company’s Memorandum and Articles of Association from the

Company’s registered office.

Other Shareholder Information

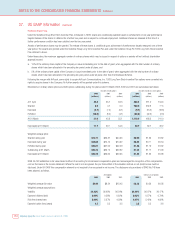

Financial calendar 2003/04

Annual General Meeting (see below) 30 July 2003

Interim Results announcement 18 November 2003

Full year results announcement May 2004

Dividends

Full details on the dividend amount per share or ADS and the Group’s dividend

policy can be found on pages 40 and 41. Information relevant to the final

dividend for the financial year ended 31 March 2003 is:

Final

Ex-dividend date 4 June 2003

Record date 6 June 2003

DRIP election date 18 July 2003

Dividend payment date 8 August 2003*

* Payment date for both ordinary shares and ADSs.

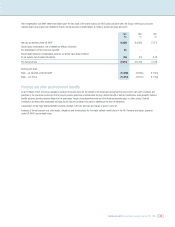

Dividend reinvestment

The Company offers a Dividend Reinvestment Plan which allows holders of

ordinary shares who choose to participate to use their cash dividends to acquire

additional shares in the Company that are purchased on their behalf by the Plan

Administrator through a low cost dealing arrangement. Further details can be

obtained from the Plan Administrator on +44 (0) 870 702 0198.

For ADS holders, The Bank of New York maintains a Global BuyDIRECT Plan for

the Company, which is a direct purchase and sale plan for depositary receipts,

with a dividend reinvestment facility. For additional information, please write to:

The Bank of New York

Shareholder Relations Department

Global BuyDIRECT

P.O. Box 1958

Newark

New Jersey 07101-1958

USA