Vodafone 2003 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

134

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

Restricted Share Plans

Under the Vodafone Group Short Term Incentive Plan, introduced in 1998, shares are conditionally awarded based on achievement of one-year performance

targets. Release of the shares is deferred for a further two years and is subject to continued employment. Additional shares are released at this time if a

further performance condition has been satisfied over the two year period.

Awards of performance shares may be granted. The release of these shares is conditional upon achievement of performance targets measured over a three

year period. The awards are granted under the Vodafone Group Long Term Incentive Plan and under the Vodafone Group Plc 1999 Long Term Stock Incentive

Plan referred to above.

Under these plans, the maximum aggregate number of ordinary shares which may be issued in respect of options or awards will not (without shareholder

approval) exceed:

a. 10% of the ordinary share capital of the Company in issue immediately prior to the date of grant, when aggregated with the total number of ordinary

shares which have been allocated in the preceding ten period under all plans; and

b. 5% of the ordinary share capital of the Company in issue immediately prior to the date of grant, when aggregated with the total number of ordinary

shares which have been allocated in the preceding ten year period under all plans other than the Sharesave Scheme.

Following the merger with AirTouch, some rights to acquire AirTouch Communications, Inc. 1993 Long Term Stock Incentive Plan options were converted into

rights to acquire shares in the Company. No further awards will be granted under this scheme.

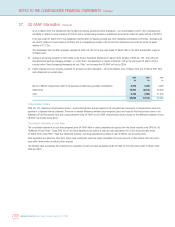

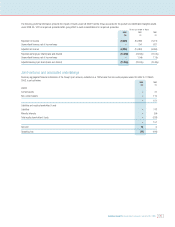

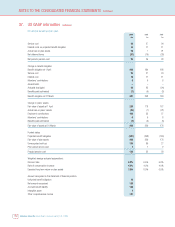

Movements in ordinary share options and ADS options outstanding during the years ended 31 March 2003, 2002 and 2001 are summarised as follows:

Number of ADS options Number of ordinary share options

2003 2002 2001 2003 2002 2001

(millions) (millions) (millions) (millions) (millions) (millions)

At 1 April 43.8 55.1 63.3 488.3 211.0 154.6

Granted 6.5 4.1 2.0 700.9 332.8 77.5

Exercised (2.7) (7.4) (6.1) (9.7) (13.2) (18.8)

Forfeited (26.6) (8.0) (4.1) (68.6) (42.3) (2.3)

At 31 March 21.0 43.8 55.1 1,110.9 488.3 211.0

Exercisable at 31 March 11.7 39.7 54.6 90.7 82.1 32.2

Weighted average price:

Granted during year $13.71 $29.31 $44.66 £0.99 £1.56 £2.82

Exercised during year $10.00 $14.14 $14.92 £0.82 £0.77 £0.54

Forfeited during year $33.61 $41.00 $42.09 £1.46 £1.79 £2.62

Outstanding at 31 March $22.32 $29.74 $29.82 £1.23 £1.71 £1.90

Exercisable at 31 March $25.20 $29.64 $29.65 £1.45 £1.33 £0.68

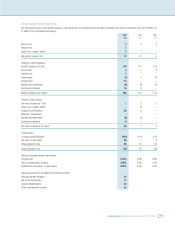

SFAS No.148 establishes a fair value based method of accounting for stock based compensation plans and encourages the recognition of the compensation

cost on this basis in the income statement. Where the cost is not recognised, the pro forma effect of the valuation method on net (loss)/income must be

disclosed. Under UK GAAP the compensation element is not required to be recognised in net income. The disclosure only provisions of SFAS No.148 have

been adopted, as follows.

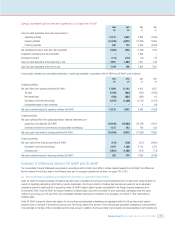

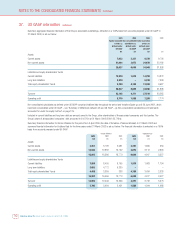

ADS options Ordinary share options

2003 2002 2001 2003 2002 2001

Weighted average fair value $4.49 $8.24 $13.45 £0.28 £0.56 £0.95

Weighted average assumptions:

Volatility 34.83% 36.02% 36.34% 34.82% 36.07% 36.17%

Expected dividend yield 0.62% 0.58% 0.82% 0.63% 0.57% 0.79%

Risk-free interest rate 5.02% 5.37% 4.58% 4.97% 5.45% 4.92%

Expected option lives (years) 3.5 3.5 3.5 3.5 3.5 3.6

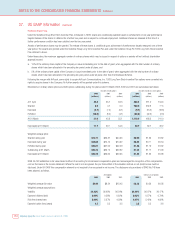

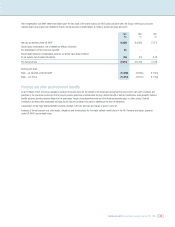

37. US GAAP information continued