Vodafone 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

92

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

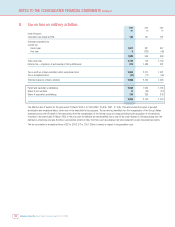

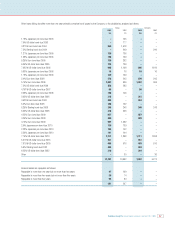

13. Fixed asset investments continued

The Group’s share of its joint ventures and associated undertakings comprises:

Joint ventures Associated undertakings

2003 2002 2003 2002

£m £m £m £m

Share of turnover of joint ventures and associated undertakings 838,769 10,693

Share of assets

Fixed assets –55 8,390 7,487

Current assets –21 2,640 2,816

–76 11,030 10,303

Share of liabilities

Liabilities due within one year –372 5,261 5,136

Liabilities due after more than one year ––2,127 2,782

Minority interests –(27) 433 124

–345 7,821 8,042

Share of net (liabilities)/assets –(269) 3,209 2,261

Loans –321 –18

Attributed goodwill net of amortisation charges ––22,616 24,970

–52 25,825 27,249

Analysed as:

Fixed asset investments –321 25,825 27,249

Provisions for liabilities and charges –(269) ––

–52 25,825 27,249

The Group’s principal associated undertakings and fixed asset investments are detailed in note 36.

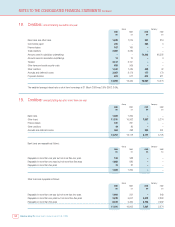

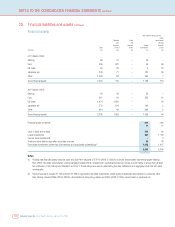

The Group’s share of turnover, profits and losses, assets and liabilities of Verizon Wireless included in the above analysis is as follows:

2003 2002

£m £m

Share of:

Turnover 5,806 5,602

Profit before taxation and goodwill amortisation 1,088 1,058

Goodwill amortisation (1,202) (1,259)

Loss on ordinary activities before taxation (114) (201)

Tax on loss on ordinary activities (71) (66)

Loss on ordinary activities after taxation (185) (267)

Fixed assets 6,140 5,777

Current assets 1,016 1,678

Liabilities due within one year (3,514) (3,782)

Liabilities due after more than one year (1,622) (2,148)

Minority interests (433) (123)

Share of net assets 1,587 1,402

Attributed goodwill net of amortisation charges 16,649 19,748

Share of net assets and attributed goodwill 18,236 21,150