Vodafone 2003 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

126

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

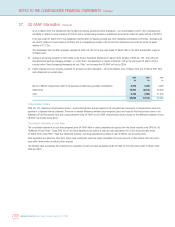

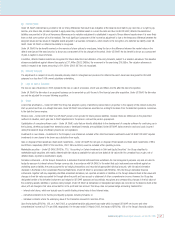

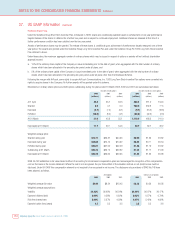

shown on the face of the consolidated balance sheet. US GAAP does not permit the Group’s share of turnover of joint ventures and associated undertakings

to be disclosed on the face of the consolidated income statement, nor does it permit the Group’s share of gross assets and gross liabilities to be shown on

the face of the consolidated balance sheet.

Equity accounting for Vodafone Italy and Vodafone Spain results in the operating loss, Group net interest payable, Group taxation payable and equity minority

interests being less than/(more than) the equivalent UK GAAP amount by £1,955m, £(45)m, £478m and £264m (2002: £2,060m, £(9)m, £402m and

£249m; 2001: £2,231m, £15m, £265m and £209m), respectively. Equity accounting for Vodafone Italy and Vodafone Spain results in the Group’s share of

the operating loss, interest payable and taxation payable of associated undertakings being greater/(lower) under US GAAP than UK GAAP by £1,501m,

£(34)m and £367m (2002: £1,577m, £(7)m and £307m; 2001: £2,508m, £11m and £201m), respectively. The Group’s investment in subsidiaries

consolidated under UK GAAP but equity accounted under US GAAP at 31 March 2003 would be £21,512m (2002: £21,394m) greater under US GAAP than

UK GAAP.

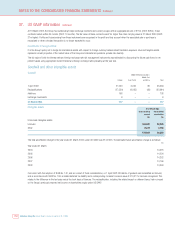

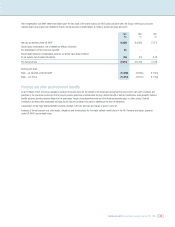

(b) Connection revenues and income

Under the Group’s UK GAAP accounting policy, connection revenues are recognised upon connection of the customer to the cellular network, and revenues from

the sale of a mobile handset and related costs are recognised upon delivery to the customer. Under US GAAP, connection revenues are recognised over the

period that a customer is expected to remain connected to a network. Connection costs directly attributable to the income deferred are recognised over the same

period. Where connection costs exceed connection revenues, the excess costs are charged in the profit and loss account immediately upon connection.

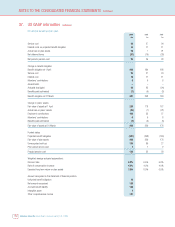

(c) Goodwill and other intangibles

Under UK GAAP, the policy followed prior to the introduction of FRS 10, “Goodwill and Intangible Assets”, which is effective for accounting periods ended on

or after 23 December 1998 and was adopted on a prospective basis, was to write off goodwill against shareholders’ equity in the year of acquisition. FRS 10

requires goodwill to be capitalised and amortised over its estimated useful economic life. Under US GAAP, following the introduction of SFAS No. 142, which

is effective for accounting periods starting after 15 December 2001 and, transitionally, for acquisitions completed after 30 June 2001, goodwill and

intangible assets with indefinite lives are capitalised and not amortised, but tested for impairment, at least annually, in accordance with SFAS No. 142.

Intangible assets with finite lives continue to be capitalised and amortised over their useful economic lives.

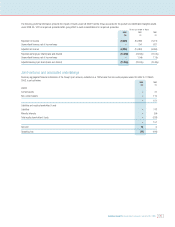

Under UK GAAP and US GAAP the purchase price of a transaction accounted for as an acquisition is based on the fair value of the consideration. In the case

of share consideration, under UK GAAP the fair value of such consideration is based on the share price at completion of the acquisition or the date when the

transaction becomes unconditional. Under US GAAP the fair value of the share consideration is based on the average share price over a reasonable period of

time before and after the proposed acquisition is agreed to and announced. This has resulted in a difference in the fair value of the consideration for certain

acquisitions and consequently in the amount of the purchase price capitalised under UK and US GAAP.

Under UK GAAP, costs incurred in reorganising acquired businesses are charged to the profit and loss account as post-acquisition expenses. Under US GAAP,

certain of such costs are considered in the allocation of purchase consideration and thereby the determination of goodwill arising on acquisition.

(d) Exceptional items

As described in note 4, the Group recorded an impairment charge under UK GAAP of £405m in relation to the fixed assets of Japan Telecom. Under US

GAAP, the Group evaluated the recoverability of these fixed assets in accordance with the requirements of SFAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets”, and determined that the carrying amount of these assets was recoverable. As a result, the UK GAAP impairment charge of

£405m has not been recognised under US GAAP.

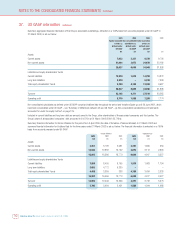

(e) Stock based compensation

Under UK GAAP, options granted over the Company’s ordinary shares are accounted for using the intrinsic value method, with the difference between the fair

value of shares at grant date and the exercise price charged to the profit and loss over the period until the shares first vest. Grants under the Company’s

SAYE schemes are exempt from this accounting methodology.

Under US GAAP, the Group accounts for option plans in accordance with the requirements of APB 25, “Accounting for stock issued to employees” and applies

the disclosure provisions of SFAS No. 148, “Accounting for stock-based compensation – transition and disclosure”. Under APB 25, such plans are accounted

for as variable and the cost is calculated by reference to the market price of the shares at grant date and amortised over the period until the shares first

vest. Where the measurement period has not yet been completed, the cost is calculated by reference to the market price of the relevant shares at the end of

each accounting period.

(f) Capitalised interest

Under UK GAAP, the Group’s policy is not to capitalise interest costs on borrowings in respect of the acquisition of tangible and intangible fixed assets. Under

US GAAP, the interest cost on borrowings used to finance the construction of network assets is capitalised during the period of construction until the date

that the asset is placed in service. Interest costs on borrowings to finance the acquisition of licences are also capitalised until the date that the related

network service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets.

37. US GAAP information continued