Vodafone 2003 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 129

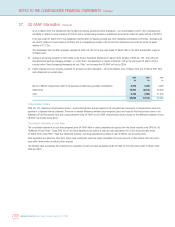

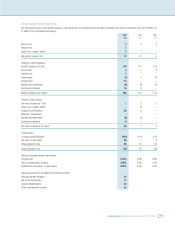

SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”

In May 2003, the FASB issued SFAS No. 150. SFAS No. 150 is effective for financial instruments entered into or modified after 31 May 2003, and otherwise

is effective at the beginning of the first interim period beginning after 15 June 2003. SFAS No. 150 requires that certain financial instruments, previously

accounted for as equity, be classified as liabilities. It is currently anticipated that SFAS No. 150 will result in the Group’s class D & E preferred shares issued

by AirTouch, currently classified as non-equity minority interests, being classified as long term liabilities.

FASB Interpretation No. 45 (“FIN 45”), “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others”

In November 2002, the FASB issued FIN 45. FIN 45 requires certain disclosures to be made by a guarantor in its financial statements about its obligations

under certain guarantees that it has issued. It also requires a guarantor to recognise, at the inception of a guarantee, a liability for the fair value of the

obligation undertaken in issuing the guarantee. The disclosure requirements of FIN 45 are effective for accounting periods ending after 15 December 2002.

The recognition and initial measurement requirements of FIN 45 are effective prospectively for guarantees modified or entered into after 31 December 2002.

Adoption of the recognition and initial measurement requirements has not impacted the Group’s reported financial position and results under US GAAP.

FASB Interpretation No. 46 (“FIN 46”), “Consolidation of Variable Interest Entities”

In January 2003, the FASB issued FIN 46. FIN 46 expands upon existing US GAAP accounting guidance that prescribes when an entity should consolidate

the assets, liabilities and results of another variable interest entity (“VIE”). Under FIN 46 an enterprise shall consolidate a VIE if the enterprise has a variable

interest that will absorb a majority of the VIE’s expected losses or receive the majority of the VIE’s expected residual returns, or both. The consolidation and

disclosure requirements of FIN 46 are effective immediately in respect of VIEs created after 31 January 2003 and in the first period after 15 June 2003 for

existing VIEs. The Group is currently assessing the impact of FIN 46 but it does not expect it to have any impact on the Group’s reported financial position

and results under US GAAP.

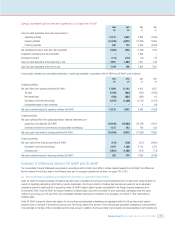

EITF 00-21, “Accounting for Revenue Arrangements with Multiple Element Deliverables”

In November 2002, the Emerging Issues Task Force (“EITF”), of the FASB reached a consensus on EITF 00-21. EITF 00-21 provides guidance on how to

account for arrangements that may involve multiple revenue-generating activities, for example, the delivery of products or performance of services, and/or

rights to use other assets. The requirements of EITF 00-21 will be applicable to agreements entered into for periods beginning after 15 June 2003 and will

therefore first apply to the Group for any arrangements entered into from 1 April 2004. The Group is currently assessing the impact of EITF 00-21 on its

reported financial position and results under US GAAP.

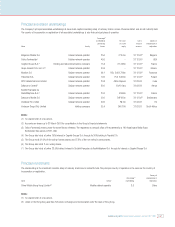

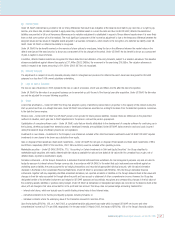

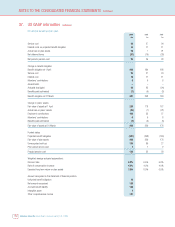

Market risk and financial instruments

Financial instruments: General

The principal financial risks arising from the Group’s activities are funding risk, interest rate risk, currency risk and counterparty risk. The Group manages

these risks by a variety of methods, including the use of a number of financial instruments. All transactions in derivative financial instruments are undertaken

for risk management purposes, by specialist treasury personnel. No instruments are held by the Group for trading purposes. The Group has a central treasury

function which provides a centralised service to the Group for funding, bank relationship management, investment management, foreign exchange, interest

rate management and counterparty risk management, with operations, including transactions in derivative financial instruments, conducted within a policy

framework approved by the Board.

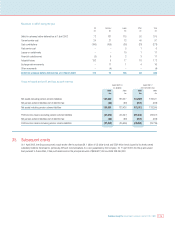

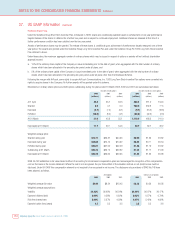

Interest rate risk

The Group’s main interest rate exposures are to euro and yen and, to a lesser extent, dollar and sterling interest rates. Under the Group’s interest rate

management policy, interest rates on monetary assets and liabilities are maintained on a floating rate basis, unless the forecast interest charge for the next

eighteen months is material in relation to forecast results in which case interest rates are fixed. In addition, fixing may be undertaken for longer periods when

interest rates are statistically low. Therefore, the term structure of interest rates is managed within limits approved by the Board, using derivative financial

instruments such as swaps, futures, options and forward rate agreements. At the end of the year, 9% (2002: 38%) of the Group’s gross financial liabilities

were fixed for the twelve month period ending 31 March 2004. At 31 March 2003, the Group had interest rate swaps and futures contracts outstanding with

a notional principle value of £8,887m (2002: £18,580m). The fair value of these agreements was £683m in excess of their carrying value at 31 March 2003

(2002: £64m).

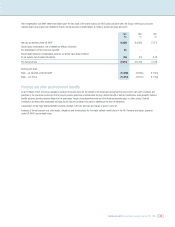

Foreign exchange rate risk

The Group’s geographical spread exposes it to fluctuations in foreign exchange rates. The Group manages its exposure to foreign currency movements by

hedging known future transactions including those resulting from the repatriation of international dividends and loans above a certain de-minimus level using

foreign exchange forward contracts.