Vodafone 2003 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 111

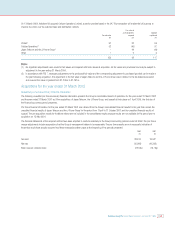

29. Contingent liabilities

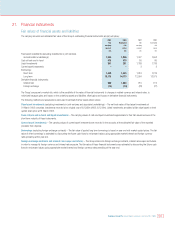

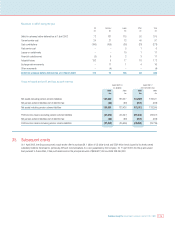

Group Company

2003 2002 2003 2002

£m £m £m £m

Performance bonds 1,921 1,829 1,137 –

Credit guarantees –third party indebtedness 72 412 2,462 1,910

Other guarantees and contingent liabilities 31 20 17 –

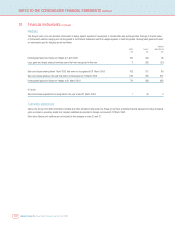

Performance bonds

Performance bonds require the Company, or certain of its subsidiary undertakings, to make payment to third parties in the event that the Company or

subsidiary undertaking does not perform what is expected of it under the terms of any related contracts.

Company and Group performance bonds include £1,085m (2002: Group £978m) in respect of undertakings to roll out third generation networks in Spain

including £130m relating to the Group’s former interest in Xfera Moviles S.A. Group performance bonds include £710m (2002: £973m) in respect of

undertakings to roll out second and third generation networks in Germany. The majority of the Spanish performance bonds expire by December 2007 and for

Germany by December 2005.

On 31 March 2003, the Spanish Ministry for Science and Technology announced new guarantee requirements in respect of the Group’s undertakings to roll

out third generation networks in Spain which are currently anticipated to reduce the level of performance bonds in Spain to approximately £197m in

aggregate.

Credit guarantees –third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities including those in respect of the Group’s joint ventures, associated

undertakings and investments.

At 31 March 2003, the Company had issued guarantees in respect of notes issued by Vodafone Americas Inc. (VAI) amounting to £995m (2002: £1,087m)

and guaranteed debt of J-Phone Co., Ltd. and J-Phone Finance Co. Ltd. (JPFC) amounting to £267m (2002: £530m) and £1,200m (2002: £Nil), respectively.

In April 2003, the Company concluded a transaction to repurchase and cancel part of the outstanding VAI notes as a result of which the outstanding VAI

notes and corresponding Company guarantee, which remains in force until such time as the debt is repaid or until maturity in July 2008, was reduced to

£526m. This J-Phone Co., Ltd. guaranteed debt matures in June 2003 and the JPFC debt matures in January 2007.

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to support disposed entities.

In addition to the amounts disclosed above, the Group has guaranteed financial indebtedness and issued performance bonds for £125m (2002: £335m) in

respect of businesses which have been sold and for which counter indemnities have been received from the purchasers.

The Group also enters into lease arrangements in the normal course of business which are principally in respect of land, buildings and equipment. Further

details on the minimum lease payments due under non-cancellable operating lease arrangements can be found in note 27.

Save as disclosed within “Information on the Company – Business Overview – Legal proceedings”on page 21 of this Annual Report, the Company and its

subsidiaries are not involved in any legal or arbitration proceedings (including any governmental proceedings which are pending or known to be

contemplated) which are expected to have, or have had in the twelve months preceding the date of this document, a significant effect on the financial

position or profitability of the Company and its subsidiaries.