Vodafone 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 53

CORPORATE GOVERNANCE

Introduction

The Combined Code on corporate governance appended to and forming part of

the UK Listing Authority’s Listing Rules requires companies listed on the London

Stock Exchange to make a disclosure statement on the application of the

principles of and compliance with the provisions of good governance set out in

the Code.

The Company has been in compliance with the Combined Code provisions

throughout the year ended 31 March 2003.

On 20 January 2003, the Higgs Review, (“the Review”) on the role and

effectiveness of non-executive directors was published. The Review has

continued the “comply or explain” philosophy of earlier UK corporate governance

reports. The Review has published suggested revisions to the Combined Code

(which also incorporate the recommendations of the separate Report of Sir

Robert Smith in relation to audit committees) that are expected to be

implemented later in 2003 after consideration by the Financial Reporting Council.

The Company’s American Depositary Shares are listed on the New York Stock

Exchange (“NYSE”) and the Company is therefore subject to the rules of the

NYSE as well as US securities laws and the rules of the US Securities and

Exchange Commission (“SEC”). In July 2002, the US Congress passed the

Sarbanes-Oxley Act of 2002 which, together with consequent adoption of new

rules by the SEC, has introduced a number of changes to the corporate

governance requirements on both US domestic companies and non-US

registered issuers such as the Company. Some of the changes are already in

force. During the year, the Company established a Disclosure Committee with

responsibility for reviewing and approving controls and procedures over the

public disclosure of financial and related information, and other procedures

necessary to enable the Chief Executive and Financial Director to provide their

certifications of the Annual Report. The Company has also adopted a corporate

code of ethics for senior financial officers.

The Board has reviewed all of the changes and proposed changes to compliance

requirements and has concluded that the Company is in compliance with all

those provisions which are currently in force. The Board is continuing to monitor

closely developments in corporate governance.

Directors and Organisation

The Company’s Board of directors presently consists of fifteen directors, fourteen

of whom served throughout the year ended 31 March 2003. As at 31 March

2003, in addition to the Chairman, Lord MacLaurin, there were six executive

directors and seven non-executive directors. Paul Hazen is the nominated senior

independent director.

Vittorio Colao joined the Board as an executive director on 1 April 2002. Dr John

Buchanan joined the Board as a non-executive director on 1 April 2003. The

Company considers all its present non-executive directors to be fully

independent. The executive directors are Sir Christopher Gent (Chief Executive),

Arun Sarin (Chief Executive Designate), Julian Horn-Smith, Peter Bamford, Vittorio

Colao, Thomas Geitner and Ken Hydon. Sir Christopher will retire as Chief

Executive after the Annual General Meeting on 30 July 2003. He will be

succeeded as Chief Executive by Arun Sarin, who joined the Executive Committee

on 1 April 2003.

The Company’s Articles of Association provide that every director who was

elected or last re-elected at or before the Annual General Meeting held in the

third calendar year before the current year shall automatically retire. Accordingly,

Lord MacLaurin, Ken Hydon, Thomas Geitner, Sir Alec Broers and Jürgen

Schrempp will be retiring and, being eligible, will offer themselves for re-election

at the Company’s Annual General Meeting to be held on 30 July 2003. Sir

Christopher Gent will be retiring but is not offering himself for re-election. The

Company’s Articles of Association also provide that every director appointed to

the Board since the last Annual General Meeting shall retire. Therefore, Dr John

Buchanan will retire and, being eligible, will offer himself for re-election.

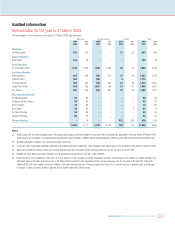

The Board met on eight occasions in the financial year to 31 March 2003.

Individual directors’ attendance was: Lord MacLaurin (8), Paul Hazen (7), Sir

Christopher Gent (8), Julian Horn-Smith (8), Peter Bamford (8), Vittorio Colao (7),

Thomas Geitner (8), Ken Hydon (8), Dr Michael Boskin (5), Sir Alec Broers (8),

Penny Hughes (8), Arun Sarin (8), Sir David Scholey (8) and Jürgen Schrempp

(5). In addition to the regular Board meetings, there were a number of other

meetings to deal with specific matters.

The Board provides the effective leadership and control required for a listed

company. Actual financial results are presented to each meeting, together with

reports from the executive directors in respect of their areas of responsibility. The

Chief Executive presents his report to each meeting which deals, amongst other

things, with investor relations, giving Board members an opportunity to develop

an understanding of the views of major investors. From time to time, the Board

receives detailed presentations from non-Board members on matters of

significance or on new opportunities for the Group. Financial plans, including

budgets and forecasts, are regularly discussed at Board meetings. The non-

executive directors periodically visit different parts of the Group and are provided

with briefings and information to assist them in performing their duties. The non-

executive directors (including the Chairman) regularly meet without executives

present.

The Board is confident that all its members have the knowledge, talent and

experience to perform the functions required of a director of a listed company.

On appointment, all directors are provided with appropriate training and guidance

as to their duties, responsibilities and liabilities as a director of a public and listed

company and also have the opportunity to discuss organisational, operational and

administrative matters with the Chairman, the Chief Executive and the Company

Secretary. When considered necessary, more formal training is provided.

The Board has a formal schedule of matters specifically referred to it for

decision, including the approval of Group commercial strategy, major capital

projects, the adoption of any significant change in accounting policies or

practices and material contracts not in the ordinary course of business. The

directors have access to the advice and services of the Company Secretary and

have resolved to ensure the provision, to any director who believes it may be

required in the furtherance of his or her duties, of independent professional

advice at the cost of the Company.

Performance evaluation of the Board, its committees and individual directors

takes place on an annual basis.

The executive directors, together with certain other Group functional heads and

regional Chief Executive Officers, meet on ten occasions each year as the Group

Executive Committee under the chairmanship of the Chief Executive. This

Committee is responsible for the day-to-day management of the Group’s

businesses, the overall financial performance of the Group in fulfilment of

strategy, plans and budgets and Group capital structure and funding. It also

reviews major acquisitions and disposals.

Two management committees, the Group Operational Review Committee and the

Group Policy Committee, oversee, together with the Group Executive Committee,

the execution of the Board’s strategy and policy.

The Group Operational Review Committee, which meets ten times a year under

the chairmanship of the Group Chief Operating Officer, comprises other executive

directors, certain Group functional heads and regional Chief Executive Officers.