Vodafone 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 99

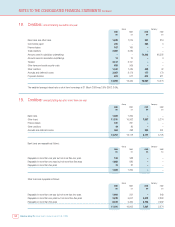

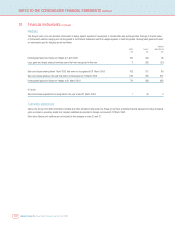

Borrowing facilities

At 31 March 2003, the Group’s most significant committed borrowing facilities comprised a $11.025 billion (£6,975m, 2002: $13.7 billion, (£9,621m)) bank

facility, which expires in one year or less unless a one year term out option is exercised prior to maturity on 27 June 2003, and a ¥225 billion (£1,200m,

2002: £1,192m) term credit facility, which expires in more than two years but not more than five years. The bank facility remained undrawn throughout the

period and the term credit facility was drawn down in full on 15 October 2002.

Under the terms and conditions of the $11.025 billion bank facility, lenders would have the right, but not the obligation, to cancel their commitment 30 days

from the date of notification of a change of control of the Company and have outstanding advances repaid on the last day of the current interest period. The

bank facility agreement provides for certain structural changes that do not affect the obligations of the Company to be specifically excluded from the

definition of a change of control. This is in addition to the rights of lenders to cancel their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of J-Phone Finance Co., Ltd’s ¥225 billion term credit facility, although the change of control

provision is applicable to any guarantor of borrowings under the term credit facility. As of 31 March 2003, the Company was the sole guarantor.

In addition to the above, certain of the Group’s subsidiaries had committed facilities at 31 March 2003 of £1,086m (2002: £1,973m) in aggregate, of which

£91m (2002: £134m) was undrawn. Of the total committed facilities, £415m expires in less than one year, £598m expires between two and five years, and

£73m expires in more than five years.

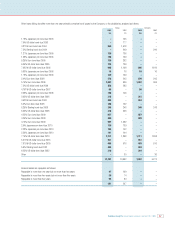

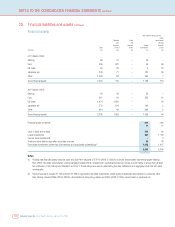

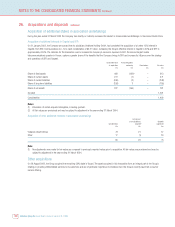

Interest rate and currency of financial liabilities

After taking into account the various interest rate and currency swaps entered into by the Group, the currency and interest rate exposure of the financial

liabilities of the Group was:

Fixed rate financial liabilities Non-interest

bearing

Weighted financial

average liabilities –

Floating Fixed Non-interest Weighted time weighted

rate rate bearing average for which average

financial financial financial interest rate is period until

Total liabilities liabilities liabilities rate fixed maturity

Currency £m £m £m £m % Years Years

At 31 March 2003:

Sterling 699 249 450 – 5.9 29.7 –

Euro 7,351 7,351 –––––

US dollar 1,163 997 166 – 4.3 1.6 –

Japanese yen 5,065 4,368 678 19 2.5 1.1 4.9

Other 346 346 –––––

Gross financial liabilities 14,624 13,311 1,294 19 3.9 11.1 4.9

At 31 March 2002:

Sterling 675 675 –––––

Euro 7,249 4,159 3,090 – 3.9 1.0 –

US dollar 1,118 – 1,118 – 3.8 0.9 –

Japanese yen 3,791 2,649 1,106 36 2.6 1.2 2.6

Other 1,106 1,106 –––––

Gross financial liabilities 13,939 8,589 5,314 36 3.6 1.0 2.6

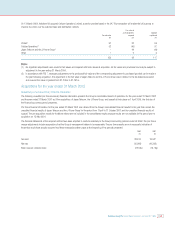

Interest on floating rate borrowings is based on national LIBOR equivalents or government bond rates in the relevant currencies.

The figures shown in the tables above take into account interest rate swaps and futures used to manage the interest rate profile of financial liabilities.

Further protection from interest rate movements is provided by forward-starting interest rate swaps on up to £1,014m at rates between 0.33% and 0.39%,

commencing between June 2005 and March 2006 and maturing in March 2007 and forward-starting interest rate futures on up to £1,734m at rates

between 0.11% and 0.27% and maturing between December 2003 and March 2005.