Vodafone 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

108

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued

Acquisition of additional stakes in associated undertakings

During the year ended 31 March 2003 the Company has directly or indirectly increased its interest in its associated undertakings in France and South Africa.

Acquisition of additional interests in Cegetel and SFR

On 21 January 2003, the Company announced that its subsidiary, Vodafone Holding GmbH, had completed the acquisition of a further 15% interest in

Cegetel, from SBC Communications Inc., for a cash consideration of $2.27 billion, increasing the Group’s effective interest in Cegetel to 30% and SFR to

approximately 43.9%. The rationale for the transaction was to increase the Company’s economic exposure to SFR, the second largest mobile

telecommunications operator in France, capture a greater share of the benefits that the Company brings to SFR and increase its influence over the strategy

and operations of SFR and Cegetel.

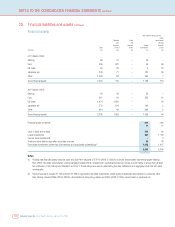

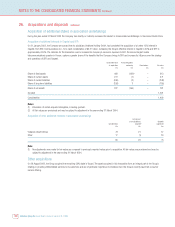

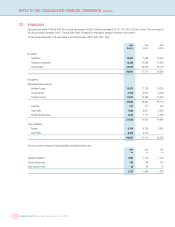

Local book value Accounting policy

at acquisition conformity Revaluations Fair value

£m £m £m £m

Share of fixed assets 469 (156)(1) – 313

Share of current assets 272 (1) – 271

Share of current liabilities (246) (2) – (248)

Share of long term liabilities (158) 3 – (155)

Share of net assets 337 (156) – 181

Goodwill 1,221

Consideration 1,402

Notes:

(1) Elimination of certain acquired intangibles, including goodwill.

(2) All fair values are provisional and may be subject to adjustment in the year ending 31 March 2004.

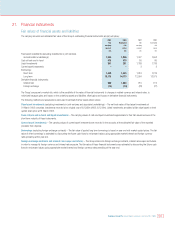

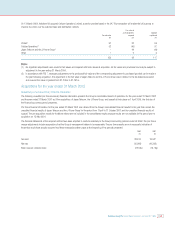

Acquisition of other additional interests in associated undertakings

Fair value of

assets/(liabilities) Goodwill

Consideration acquired(1) capitalised

£m £m £m

Vodacom (South Africa) 78 21 57

Other 17 (1) 18

95 20 75

Note:

(1) No adjustments were made for fair values as compared to previously reported values prior to acquisition. All fair values are provisional and may be

subject to adjustment in the year ending 31 March 2004.

Other acquisitions

On 29 August 2002, the Group acquired the remaining 50% stake in Vizzavi. The assets acquired in this transaction form an integral part of the Group’s

strategy in providing differentiated services to its customers and are of particular importance to Vodafone live!, the Group’s recently launched consumer

service offering.

26. Acquisitions and disposals continued