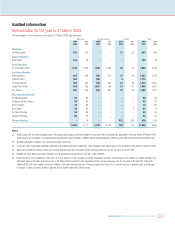

Vodafone 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

56

BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION

Introduction

The Board has delegated to the Remuneration Committee the assessment and

recommendation of policy on remuneration for executive directors.

At the 2002 Annual General Meeting (“AGM”) shareholders approved a new

remuneration policy (“the Policy”) the key principles of which are as follows:

•the expected value of total remuneration must be benchmarked against the

relevant market;

• a high proportion of total remuneration is to be delivered through

performance-related payments;

•performance measures must be balanced between absolute financial

measures and sector comparative measures to achieve maximum

alignment between executive and shareholder objectives;

•the majority of performance-related remuneration is to be provided in the

form of equity; and

•share ownership requirements are to be applied to executive directors.

The Policy was finalised only after extensive consultation with shareholders and

institutional bodies in 2001 and 2002. Earlier this year the Chairman and the

Chairman of the Remuneration Committee again discussed remuneration matters

with the Company’s major shareholders and relevant institutions to keep them

informed of the Company’s position. The Policy provides a strong link between

incentives and the Company’s strategy and sets a framework for remuneration

that is consistent with the Company’s scale and scope. As at 23 May 2003, the

Company was the eleventh largest company in the world by market

capitalisation, with operations in five continents. The business has developed

over fifteen years as a public company and now serves almost 120 million

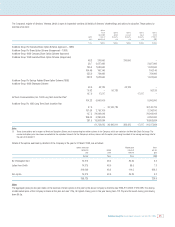

proportionate registered customers in 28 countries. The distribution of statutory

total Group operating profit, before goodwill amortisation and exceptional items,

from mobile telecommunications businesses at 31 March 2003 was as follows:

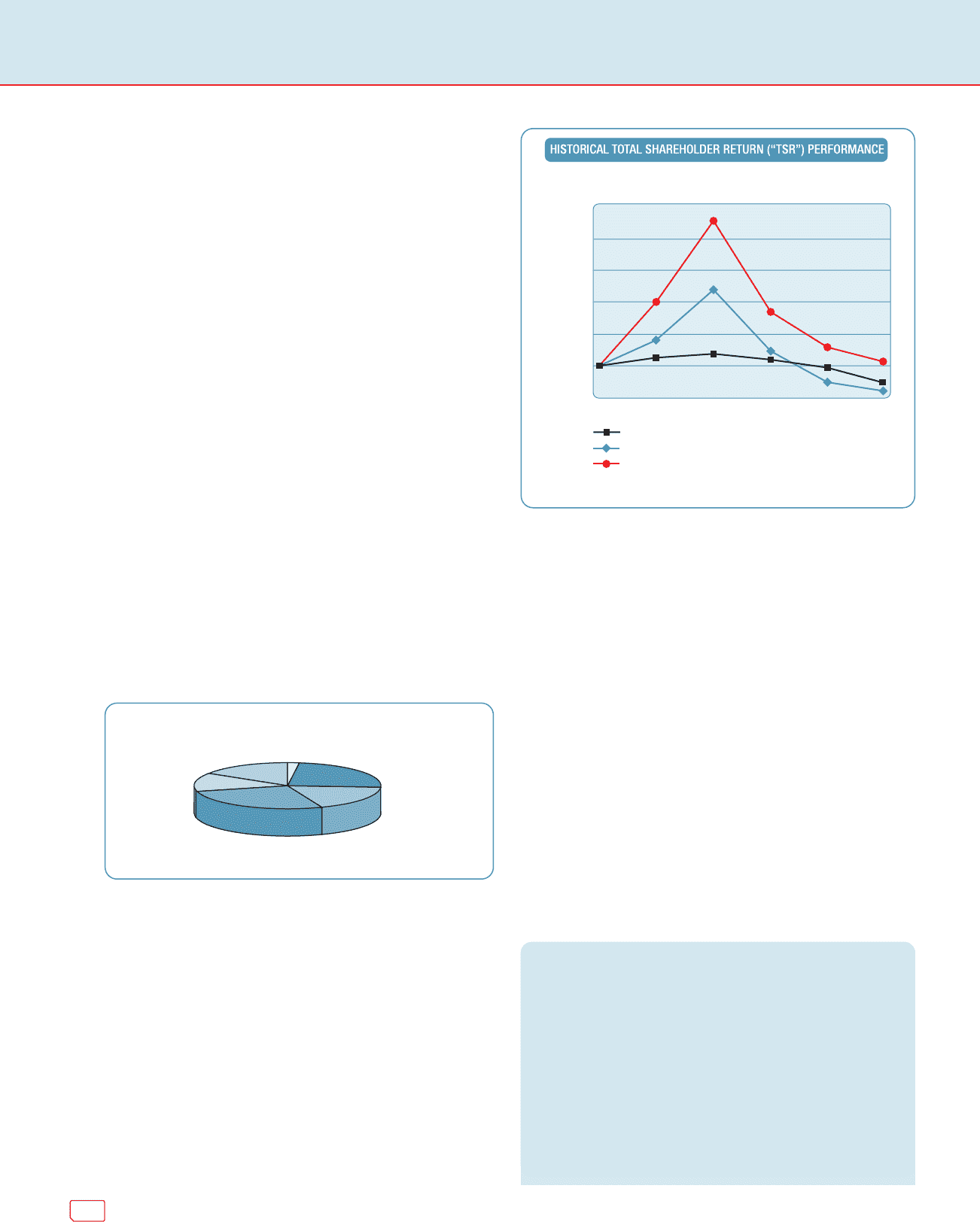

At the 2003 AGM, shareholders will be invited to vote on the Board’s report to

shareholders on directors’remuneration. The chart that follows shows the

performance of the Company relative to the FTSE 100 index and the FTSE Global

Telecommunications index, which are the most relevant indices for the Company.

It should be noted that the performance of the Company shown by the graph is

not indicative of vesting levels under the Company’s various incentive plans.

The performance of the Company during the 2003 financial year has been

strong, with excellent growth announced on all measures, as described

elsewhere in this Annual Report. For example, Group turnover, statutory total

Group operating profit, before goodwill amortisation and exceptional items, and

profit before taxation, goodwill amortisation and exceptional items, all increased

by 30% or more over the prior year.

Remuneration Committee

The Remuneration Committee consists of independent non-executive directors.

Penny Hughes (Chairman), Dr Michael Boskin, Lord MacLaurin, Sir David Scholey

and Jürgen Schrempp all continue as members.

The Chief Executive attends meetings of the Remuneration Committee, except

when his own remuneration is being discussed. The Remuneration Committee

met on six occasions during the year.

The review of remuneration for 2003/04 has included an extended consultation

with a larger number of shareholders and institutional bodies. The Remuneration

Committee appointed and received advice from Towers Perrin (market data and

advice on market practice and governance) and Kepler Associates (performance

analysis and advice on performance measures and market practice) and received

advice from the Group Human Resources Director and the Group Compensation

and Benefits Director. As a result of this review, the Remuneration Committee has

concluded that the existing policy will remain in place for the year ending

31 March 2004. It will be subject to regular review in subsequent years and

shareholders will be consulted on, and informed of, any policy developments, as

appropriate.

Remuneration Policy

The Policy was approved by shareholders in 2002. The Policy is set out below:

The overriding objective of the Policy on incentives is to ensure that Vodafone

is able to attract, retain and motivate executives of the highest calibre

essential to the successful leadership and effective management of a global

company at the leading edge of the telecommunications industry.

To achieve this objective, Vodafone, from the context of its UK domicile, takes

into account both the UK regulatory framework, including best practice in

corporate governance, shareholder views, political opinion and the

appropriate geographic and nationality basis for determining competitive

remuneration, recognising that this may be subject to change over time as

the business evolves.

The total remuneration will be benchmarked against the relevant market.

Vodafone is one of the largest companies in Europe and is a global business;

Middle East

and Africa

2%

Northern

Europe

24% (UK 12%)

Central

Europe

18%

Southern

Europe

27%

Americas

13%

Asia Pacific

16%

Date

FTSE 100

Value of hypothetical £100 holding

£350

£300

£250

£200

£150

£100

£0 Mar-98 Mar-99 Mar-00 Mar-01 Mar-02 Mar-03

FTSE GLOBAL TELECOMMUNICATIONS

Vodafone Group

Growth in the value of a hypothetical £100 holding up to March 2003

FTSE Global Telecommunications and FTSE 100 comparison based on 30 trading day average values

Graph supplied by Towers Perrin and calculated according to a methodology that is compliant with the

requirements of the regulations. Data sources: FTSE and Datastream.