Vodafone 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 57

Vodafone’s policy will be to provide executive directors with remuneration

generally at levels that are competitive with the largest companies in Europe.

A high proportion of the total remuneration will be awarded through

performance-related remuneration, with phased delivery over the short,

medium and long term. For executive directors, approximately 80% of the

total expected remuneration will be performance-related.

Performance measures will be balanced between absolute financial measures

and sector comparative measures to achieve maximum alignment between

executive and shareholder objectives.

All medium and long term incentives are delivered in the form of Vodafone

shares and options. Executive directors are required to comply with share

ownership guidelines.

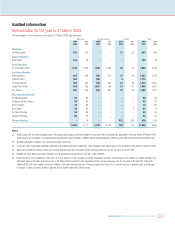

The structure of remuneration for executive directors under the Policy (excluding

pensions) and the performance elements on which they are based is illustrated

below:

Under the Policy, approximately 20% of the potential remuneration of executive

directors (excluding pensions) is comprised of base salary and approximately 80%

of incentive payments, which depend both on the operational performance of the

Group and the Company’s share price, reflecting the Company’s commitment to

ensuring strong linkage between pay and performance. Therefore, the only

guaranteed payment to executive directors is their base salary.

To set the performance conditions, the Committee reviews the Company’s

strategy and selects the performance measures that best align the incentive

awards with achievement of the strategic goals. The measures selected explicitly

incentivise achievement of all the Group’s key financial performance indicators.

The principles of the Policy are cascaded, where appropriate, to employees in all

subsidiary companies. Base salaries and short term incentives (total cash) are

benchmarked against relevant peer companies in each market and are targeted

to deliver total cash that is at between median and top 25% in the relevant

market. Incentive payments conditional on business performance are provided to

employees at levels that are competitive in each local market. As described

further below, substantially all employees of subsidiary companies received

options over shares in the Company in 2002.

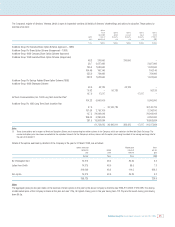

Report on 2002/03 Executive Directors’

Remuneration and Subsequent Periods

Total remuneration levels

Under the Policy, total remuneration levels are benchmarked against other large

European domiciled companies, using externally provided pay data. Total

remuneration for these purposes means the sum of base salary, short, medium

and long term incentives. The European focus was selected because Europe is

currently Vodafone’s major market and the Company is one of the top ten

companies in Europe by market capitalisation.

Award levels for the Chief Executive were set to deliver target total remuneration

that is between the top 25% and the top 10% of the remuneration levels of other

chief executives of large European companies. This range was selected to reflect

Vodafone’s relative size in this region and to recognise that Vodafone also has

significant interests outside of the region. The monetary values of the market

data for this range, based on theoretical expected value calculations, were from

£3.4 million to £9.3 million per annum for chief executives of large European

companies. Awards of short, medium and long term incentives were determined

so that this positioning would only be attained if the Company achieves

exceptionally demanding performance levels.

The total remuneration levels of other executive directors were set at

approximately 65% of the Chief Executive level for the Group Chief Operating

Officer and at approximately 50% of the Chief Executive level for the other

executive directors.

A similar approach is being undertaken to determine total remuneration levels for

the 2004 financial year. The monetary values of the market data based on

theoretical expected value calculations for the same range are now from

£5.6 million to £9.3 million per annum for chief executives of large European

companies. The change from the prior year was not considered material when

setting target remuneration levels for the 2004 financial year.

Components of executive directors’ remuneration

Overview

Executive directors receive salary, short/medium term incentives, medium/long

term incentives and pension benefits. These are explained further below.

The vesting of all short, medium and long term incentives is subject to the

achievement of performance targets which are set by the Remuneration

Committee before the awards are granted.

Salary

Salaries are reviewed annually with effect from 1 July and adjustments may be

made to reflect competitive national pay levels, the prevailing level of salary

reviews within the Group, changes in responsibilities and Group performance.

Only base salary is used to determine pension entitlement.

Incentive awards

Short/medium term incentive

Annual deferred share bonus

This short/medium term incentive is aimed at focusing executive directors on

the business priorities for the next financial year and is provided through the

Vodafone Group Short Term Incentive Plan (“STIP”).

Base Pay Short/medium

term incentive

Deferred

share bonus

1-year measures

of EBITDA, free

cash flow & ARPU+

2-year measures of

EPS relative to UK RPI

3-year relative TSR for

Performance shares

3-5 year EPS over UK

RPI for options

Performance shares+

share options

Performance ContingentFixed

Circa 20% Circa 80%

Medium/long

term incentive