Vodafone 2003 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 123

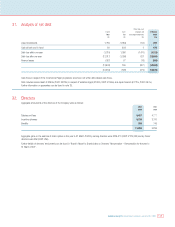

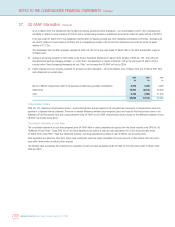

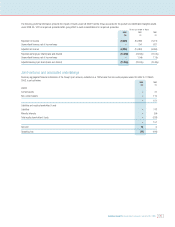

Shareholders’ equity

2003 2003 2002

as restated(2)

Note $m £m £m

Equity shareholders’ funds as reported in accordance with UK GAAP 203,171 128,671 130,573

Items increasing/(decreasing) shareholders’ equity:

Goodwill and other intangibles – net of amortisation(4) (c) 90,600 57,378 39,025

Investments accounted for under the equity method (a) 7,311 4,630 3,821

Exceptional items (d) 639 405 –

Connection income (b) (133) (84) (100)

Capitalised interest (f) 1,694 1,073 752

Income taxes (g) (78,438) (49,676) (28,077)

Minority interests (h) (3,325) (2,106) (5,514)

Proposed dividends (k) 966 612 511

Other (e), (j) (737) (467) (104)

Shareholders’ equity in accordance with US GAAP 221,748 140,436 140,887

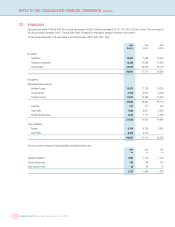

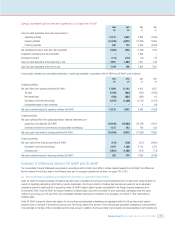

Total assets

2003 2003 2002

as restated(2)

Note $m £m £m

Total assets as reported in accordance with UK GAAP 257,819 163,280 162,900

Items (decreasing)/increasing total assets:

Goodwill and other intangibles – net of amortisation (c) 90,600 57,378 39,025

Investments accounted for under the equity method (a) 2,920 1,849 1,701

Exceptional items (d) 639 405 –

Connection costs (b) 6,599 4,179 2,402

Capitalised interest (f) 1,694 1,073 752

Deferred tax (g) 71 45 13

Other (e), (j) (676) (428) (127)

Total assets in accordance with US GAAP 359,666 227,781 206,666

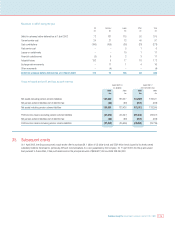

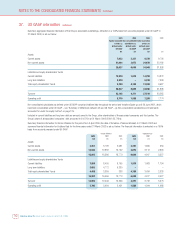

Notes:

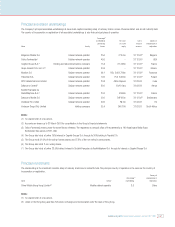

(1) In a number of the Group’s previous business acquisitions, the primary assets acquired were licences to provide mobile telecommunications services. In the

allocation of the purchase price of these acquisitions on a US GAAP basis, amounts classified as goodwill have related to the expected synergies to be derived

from the acquired businesses being part of the Group and the deferred tax consequences resulting from the difference between the tax value and assigned value

of licences. The Group believes that the nature of the acquired licences and the related goodwill is substantially indistinguishable. Concurrent with the adoption of

SFAS No. 142, “Goodwill and Other Intangible Assets”, and as a result of these considerations, on 1 April 2002, £33,664m of goodwill was reclassified as

licences; and in accordance with SFAS No. 109, “Accounting for income taxes”, a related deferred tax liability and a corresponding increase to licence value of

£19,077m has been recognised. This relates to the difference in the tax basis versus the book basis of licences. This reclassification, including the related impact

on deferred taxes, had no impact on the Group’s previously reported net income or shareholders’ equity under US GAAP.

This reclassification differs from that reflected in the Group’s previously filed Form 6-K dated 2 December 2002, where, concurrent with the adoption of SFAS

No. 142 on 1 April 2002, £10,145m representing all synergy goodwill was reclassified as licences and, in accordance with SFAS No. 109, a related deferred tax

liability of £3,696m was recognised. The additional reclassification and the related deferred tax effects had no impact on the Group’s previously reported net loss

or shareholders’equity under US GAAP.

(2) The reconciliations of net loss and shareholders’ equity for the years ended 31 March 2002 and 2001 have been restated to provide comparability with the

presentation for the year ended 31 March 2003. The Group now presents the adjustments for equity investees as a single line item. Previously the US GAAP

adjustments in relation to amortisation expense and income taxes for interests accounted for under the equity basis were presented in the line items described

as “Goodwill and other intangibles” and “Income taxes”, respectively.

In the year ended 31 March 2002, this restatement had the effect of reducing goodwill and other intangibles amortisation by £2,431m, decreasing the net credit in

relation to income taxes by £1,894m with a corresponding increase in the net loss from investments accounted for under the equity method of £537m.