Vodafone 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 27

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Introduction

The following discussion is based on the Consolidated Financial Statements

included elsewhere in this Annual Report. Such Consolidated Financial

Statements are prepared in accordance with Generally Accepted Accounting

Principles in the United Kingdom, or UK GAAP, which differ in certain significant

respects from US GAAP. Reconciliations of the material differences in such

Consolidated Financial Statements to US GAAP are set forth in note 37 to the

Consolidated Financial Statements, “US GAAP information”.

The directors have endeavoured to follow the principles set out in the Accounting

Standards Board’s Statement, “Operating and Financial Review”, which was

issued in January 2003. The information in this regard is provided in this section

or elsewhere in this Annual Report.

Foreign Currency Translation

The Company publishes its Consolidated Financial Statements in pounds

sterling. However, many of the Company’s subsidiary and associated

undertakings report their turnover, costs, assets and liabilities in currencies

other than pounds sterling and the Company translates the turnover, costs,

assets and liabilities of those subsidiary and associated undertakings into

pounds sterling when preparing its consolidated financial statements.

Consequently, fluctuations in the value of the pound sterling versus other

currencies could materially affect the amount of these items in the Company’s

Consolidated Financial Statements, even if their value has not changed in their

original currency.

In this Annual Report, references to “US dollars”, “$”, “cents”or “¢” are to

United States currency and references to “pounds sterling”, “£”, “pence”or “p”

are to UK currency. References to “euros”or “1”are to the currency of the

European Union, which, prior to 1 January 2002, was used only in “paperless”

transactions. Euro banknotes and coins were issued on 1 January 2002.

References to “yen”or “¥” are to the currency of Japan. Merely for

convenience, this Annual Report contains translations of certain pounds

sterling, euro and yen amounts into US dollars at specified rates. These

translations should not be construed as representations that the pounds

sterling, euro or yen amounts actually represent such US dollar amounts or

could be converted into US dollars at the rate indicated or at any other rate.

Unless otherwise indicated, the translations of pounds sterling and euro

amounts into US dollars have been made at $1.5790 per £1.00, $1.0900 per

11.00 and ¥118.07 per $1.00, the Noon Buying Rate in the City of New York

for cable transfers in pounds sterling, euro and yen amounts as certified for

customs purposes by the Federal Reserve Bank of New York (the “Noon Buying

Rate”) on 31 March 2003. The Noon Buying Rates on 23 May 2003 were

$1.6376 per £1.00, $1.1786 per 11.00 and ¥116.89 per $1.00. See

“Exchange rate information”below for information regarding the Noon Buying

Rates for the financial years ended 31 March 1999 through 31 March 2003,

and for the period from 1 November 2002 to 23 May 2003.

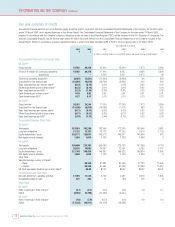

Basis of Segmental Reporting

As described under “Business Overview – Business activities – Mobile

telecommunications – Geographic operations”, the Group adopts the following

segments for the presentation of its geographical analysis of results: Europe

(further sub-analysed between Northern Europe, Central Europe and Southern

Europe); Americas; Asia Pacific; and Middle East and Africa. See note 3 to the

Consolidated Financial Statements, “Segmental analysis”, for further details.

Critical Accounting Policies

UK GAAP

The Group prepares its Consolidated Financial Statements in accordance with UK

GAAP, the application of which often requires judgements to be made by

management when formulating the Group’s financial position and results. Under

UK GAAP, the directors are required to adopt those accounting policies most

appropriate to the Group’s circumstances for the purposes of giving a true and

fair view and to review them regularly. In determining and applying these

policies, judgement is often required in respect of items where the choice of

specific policy to be followed can materially affect the reported results or net

asset position of the Group.

The Company considers the Group’s accounting policies in respect of goodwill

and other intangible assets, tangible fixed assets, taxation, revenue recognition

and presentation and retirement benefits to be its critical accounting policies

and, accordingly, provides an explanation of each below. The discussion below

should also be read in conjunction with the Group’s disclosure of material

accounting policies, which is provided in note 2 to the Consolidated Financial

Statements, “Accounting policies”elsewhere in this Annual Report.

Senior management has discussed the selection of its critical accounting policies

and associated disclosures with the Group’s Audit Committee.

Fixed assets

Goodwill and intangible assets

Goodwill

Goodwill is calculated as the surplus of cost over fair value attributed to the net

assets (excluding goodwill) of acquired subsidiary undertakings, joint ventures

and associated undertakings.

For acquisitions made before the adoption of FRS 10, “Goodwill and Intangible

Assets”, on 1 April 1998, goodwill was written off directly to reserves. For

acquisitions made after the financial year ended 31 March 1998, goodwill is

capitalised and held as a foreign currency denominated asset, where applicable,

and is thus subject to exchange rate fluctuations.

In the event of impairment, see “Impairment”below, a charge is made to the

profit and loss account in the period in which the impairment occurs, with a

corresponding write down in the carrying value of goodwill. Goodwill written off

directly to reserves is also reinstated in the profit and loss account when the

related business is sold.

At 31 March 2003, goodwill, including that attributable to the acquisition of

interests in associated undertakings, amounted to £115,449 million (2002:

£116,665 million), and represented 75% (2002: 76%) of the Group’s total fixed

assets. In addition, a further £1,190 million of goodwill is carried in reserves

(2002: £1,190 million).

Once capitalised, in accordance with UK GAAP, goodwill is amortised on a

straight line basis over its estimated useful economic life. However, the size of

the Group’s goodwill assets makes the choice of amortisation period critical to

the Group’s results. The majority of goodwill relates to the purchase of cellular

network businesses and is therefore amortised over the shorter of the unexpired

period of the associated licences under which the network operator provides

telecommunications services or twenty-five years. In respect of other

acquisitions, the amortisation period for goodwill is typically between five and ten

years and is determined by management. Applying these lives to the Group’s

goodwill asset has resulted in the amortisation charge as stated below.