Vodafone 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

54

CORPORATE GOVERNANCE Continued

This Committee is responsible for the operational performance and achievement

of targets of the Group’s business, with a focus on the enhancement of voice

services and growth of non-voice services, new global products and services,

brand development, technology and other cost and revenue synergies within the

Group’s regions.

The Group Policy Committee, which meets eight times each year, is chaired by

the Chief Executive. The Financial Director and the Group Chief Operating Officer,

together with certain other Group functional heads, join him on the Committee,

which is responsible for the determination of policy and the monitoring of non-

operational areas of activity which are important to the Group overall, including

strategy, finance, human resources, legal, regulatory and corporate affairs.

Committees of the Board

The standing Board committees are the Audit Committee, the Nominations

Committee and the Remuneration Committee. The Constitution and terms of

reference of these committees are published on the Company’s website at

www.vodafone.com.

The Audit Committee, which met on five occasions in the year, is comprised of

financially literate members having the necessary ability and experience to

understand financial statements. The Committee is chaired by Paul Hazen (5)

and the other members of the Committee are Dr Michael Boskin (5), Dr John

Buchanan and Sir David Scholey (5). Arun Sarin (4) served on the Committee

during the year and resigned on 1 April 2003. Dr Buchanan joined the

Committee on 1 April 2003.

Under its terms of reference the Committee is required, amongst other things, to

oversee the relationship with the external auditors, to review the Company’s

preliminary results, interim information and annual financial statements, to monitor

compliance with statutory and listing requirements for any exchange on which the

Company’s shares are quoted, to review the scope, extent and effectiveness of

the activity of the Group Internal Audit Department and to investigate any activity

within its terms of reference. At least twice a year the Audit Committee meets

separately with the external auditors and the Group Audit Director without

management being present. Further details on the oversight of the relationship

with the external auditors can be found under “Auditors”on page 52.

The Nominations Committee met five times in the year and is chaired by Lord

MacLaurin (5). The other members of the Committee are Sir Alec Broers (5), Sir

Christopher Gent (5), Sir David Scholey (5) and Jürgen Schrempp (3). Paul Hazen

joined the Committee on 1 April 2003. The Committee, which provides a formal

and transparent procedure for the appointment of new directors to the Board,

generally engages external consultants to advise on prospective Board

appointees. This year, the Committee has been faced with the need to appoint a

new Chief Executive and has also recommended the appointment of a further

non-executive director. In both cases, detailed job profiles were agreed by the

Committee before external search consultants were engaged to prepare

shortlists of potentially suitable candidates. Only after a rigorous interview

process were the appointments recommended to the Board.

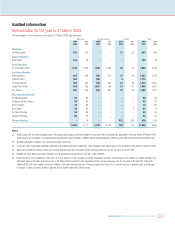

The Remuneration Committee met six times in the year. The Committee is

chaired by Penny Hughes (6). The other members of the Committee are Lord

MacLaurin (6), Sir David Scholey (6), Dr Michael Boskin (4) and Jürgen

Schrempp (5). The Board’s Report to Shareholders on Directors’ Remuneration

on pages 56 to 66 provides further information on this Committee.

Attendance is shown in parenthesis after each respective Committee member.

Internal Control and Disclosure Controls and

Procedures

Introduction

The Board has established procedures that implement in full the Turnbull

Guidance, “Internal Control: Guidance for Directors on the Combined Code”,for

the year under review and to the date of approval of the Annual Report. These

procedures, which are subject to regular review, provide an ongoing process for

identifying, evaluating and managing the significant risks faced by the Group.

Responsibility

The Board has overall responsibility for the system of internal control. A sound

system of internal control is designed to manage rather than eliminate the risk of

failure to achieve business objectives, and can only provide reasonable and not

absolute assurance against material misstatement or loss. The process of

managing the risks associated with social, environmental and ethical impacts is

discussed under “Corporate Social Responsibility”, below.

Control structure

The Board sets the policy on internal control that is implemented by

management. This is achieved through a clearly defined operating structure with

lines of responsibility and delegated authority. The Group Executive Committee,

chaired by the Chief Executive, manages this on a day-to-day basis.

Written policies and procedures have been issued which clearly define the limits

of delegated authority and provide a framework for management to deal with

areas of significant business risk. These policies and procedures are reviewed

and, where necessary, updated at the Group Policy Committee meetings, chaired

by the Chief Executive.

Control environment

The Group’s operating procedures include a comprehensive system for reporting

information to the directors. This system is properly documented and regularly

reviewed.

Budgets are prepared by subsidiary management and subject to review by both

regional management and the directors. Forecasts are revised on a quarterly

basis and compared against budget. When setting budgets and forecasts,

management identifies, evaluates and reports on the potential significant

business risks.

The Group Operational Review Committee and the Board review management

reports on the financial results and key operating statistics.

Emphasis is placed on the quality and abilities of the Group’s employees with

continuing education, training and development actively encouraged through a

wide variety of schemes and programmes. The Group has adopted a set of

values to act as a framework for its people to exercise judgement and make

decisions on a consistent basis.

Directors are appointed to associated undertakings and joint ventures and attend

the board meetings and review the key financial information of those

undertakings. Clear guidance is given to those directors on the preparation that

should take place before these board meetings and their activity at the board

meeting. It is the Group’s policy that its auditors are appointed as auditors of

associated companies and joint ventures, where possible.

The acquisition of any business requires a rigorous analysis of the financial and

operational implications of the acquisition. A sensitivity analysis takes place of