Vodafone 2003 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 101

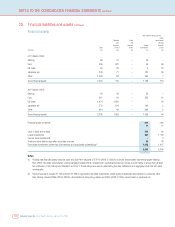

21. Financial instruments

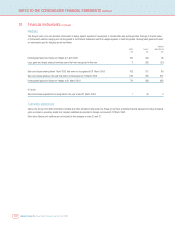

Fair values of financial assets and liabilities

The carrying amounts and estimated fair value of the Group’s outstanding financial instruments are set out below:

2003 2003 2002 2002

Net Estimated Net Estimated

carrying fair carrying fair

amount value amount value

£m £m £m £m

Fixed asset investments (excluding investments in joint ventures

and associated undertakings) 1,205 1,056 1,407 1,653

Cash at bank and in hand 475 475 80 80

Liquid investments 291 291 1,789 1,789

Current asset investments ––33

Borrowings:

Short term 1,430 1,445 1,319 1,319

Long term 13,175 14,173 12,584 13,075

Derivative financial instruments:

Interest rate 360 1,043 210 274

Foreign exchange (73) (74) (28) (27)

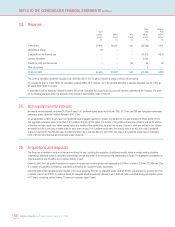

The Group’s exposure to market risk, which is the sensitivity of the value of financial instruments to changes in related currency and interest rates, is

minimised because gains and losses on the underlying assets and liabilities offset gains and losses on derivative financial instruments.

The following methods and assumptions were used to estimate the fair values shown above.

Fixed asset investments (excluding investments in joint ventures and associated undertakings) – The net book value of fixed asset investments at

31 March 2003 comprises investments recorded at an original cost of £2,568m (2002: £2,513m). Listed investments are stated at fair value based on their

quoted share price at 31 March 2003.

Cash at bank and in hand and liquid investments – The carrying values of cash and liquid investments approximate to their fair values because of the

short term maturity of these instruments.

Current asset investments – The carrying values of current asset investments are recorded in the accounts at the estimated fair value of the expected

proceeds from disposal.

Borrowings (excluding foreign exchange contracts) – The fair value of quoted long term borrowings is based on year end mid-market quoted prices. The fair

value of other borrowings is estimated by discounting the future cash flows to net present values using appropriate market interest and foreign currency

rates prevailing at the year end.

Foreign exchange contracts and interest rate swaps and futures – The Group enters into foreign exchange contracts, interest rate swaps and futures

in order to manage its foreign currency and interest rate exposure. The fair value of these financial instruments was estimated by discounting the future cash

flows to net present values using appropriate market interest and foreign currency rates prevailing at the year end.