Vodafone 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003

66

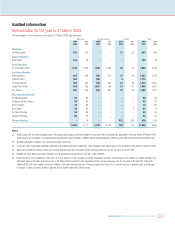

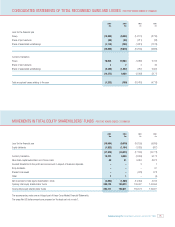

Beneficial interests

The directors’ beneficial interests in the ordinary shares of the Company, which includes interests in the Vodafone Group Profit Sharing Scheme and the Vodafone Share

Incentive Plan, but which excludes interests in the Vodafone Group Share Option Schemes, the Vodafone Group Short Term Incentive or in the Vodafone Group Long

Term Incentives, are shown below: 1 April 2002

or date of

23 May 2003 31 March 2003 appointment

Lord MacLaurin 94,495 94,495 87,170

Sir Christopher Gent 3,340,951 3,340,951 2,199,552

Peter Bamford 258,748 258,336 218,199

Vittorio Colao(1) 643,848 643,848 Nil

Thomas Geitner 12,350 12,350 12,350

Julian Horn-Smith 1,448,841 1,448,427 858,890

Ken Hydon 1,836,232 1,835,818 1,348,483

Paul Hazen(2) 360,900 360,900 422,450

Dr Michael Boskin(3) 212,500 212,500 212,500

Professor Sir Alec Broers 19,099 19,099 19,024

Dr John Buchanan(4) Nil N/a N/a

Penny Hughes 22,500 22,500 22,500

Arun Sarin(5) 4,832,560 4,832,560 4,832,560

Sir David Scholey 50,000 50,000 50,000

Jürgen Schrempp Nil Nil Nil

Notes:

(1) These shares are held in escrow and will be released on 30 June 2003.

(2) Paul Hazen’s interest reduced as previously held family beneficial interests over 61,550 shares are no longer held.

(3) On 14 August 1996, prior to the Company’s merger with AirTouch, Dr Michael Boskin entered into an agreement with AirTouch to provide him with a $100,000

unsecured promissory note facility for the purpose of financing the purchase of AirTouch common stock pursuant to the 1993 Long Term Incentive Plan, bearing

interest at a market rate. On 8 January 2003, Dr Michael Boskin repaid the loan and accumulated interest in full.

(4) John Buchanan was appointed to the Board on 1 April 2003.

(5) Arun Sarin also has a non-beneficial interest as the trustee of two family trusts, each holding 5,720 shares.

In July 2000, Sir Christopher Gent undertook to acquire and maintain a shareholding of two million shares within twelve months and Julian Horn-Smith and Ken Hydon

each undertook to maintain a shareholding of not less than 500,000 shares. The directors have complied with these undertakings.

Changes to the interests of the directors of the Company in the ordinary shares of the Company during the period 1 April 2003 to 23 May 2003 relate to shares acquired

either through Vodafone Group Personal Equity Plans or the Vodafone Share Incentive Plan. As at 31 March 2003 and during the period 1 April 2003 to 23 May 2003, no

director had any interest in the shares of any subsidiary company except for Julian Horn-Smith who owned 18,000 ordinary shares of Vodafone Greece, and Vittorio Colao

and Thomas Geitner who each owned 10 ordinary shares of Vodafone Portugal.

Other than those individuals included in the table above who were Board members as at 31 March 2003, members of the Group’s Executive Committee, other than executive

directors, as at 31 March 2003, had an aggregate beneficial interest in 1,455,118 ordinary shares of the Company and, as at 23 May 2003, had an aggregate beneficial

interest in 1,461,894 ordinary shares of the Company, none of whom had an individual beneficial interest amounting to greater than 1% of the Company’s ordinary shares.

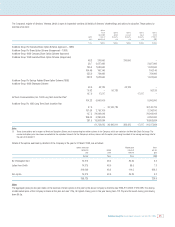

Interests in share options of the Company at 23 May 2003

At 23 May 2003, there had been no change to the directors’ interests in share options from 31 March 2003.

Other than those individuals included in the table above, as at 23 May 2003, members of the Group’s Executive Committee, other than executive directors, as at

31 March 2003, held options for 28,141,475 ordinary shares at prices ranging from 48.3 pence to 291.5 pence per ordinary share, with a weighted average exercise

price of 156.9 pence per ordinary share exercisable at dates ranging from July 1999 to August 2012, and options for 2,011,659 ADSs at prices ranging from $13.65 to

$58.69 per ADS, with a weighted average exercise price of $24.99 per ADS, exercisable at dates ranging from June 1999 to July 2012.

Lord MacLaurin, Paul Hazen, Dr Michael Boskin, Professor Sir Alec Broers, Dr John Buchanan, Penny Hughes, Sir David Scholey and Jürgen Schrempp held no options at

23 May 2003.

The number and option price of the outstanding share options at 23 May 2003 have been converted into the equivalent amounts of the Company’s ordinary shares with

the option price being translated at $1.6376 per £1.00, the Noon Buying Rate in the City of New York for cable transfers in pounds sterling as certified for customs

purposes by the Federal Reserve Bank of New York on 23 May 2003.

BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION Continued