Vodafone 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts and Form 20-F

For the year ended 31 March 2003

Hello

Table of contents

-

Page 1

Vodafone Group Plc Annual Report & Accounts and Form 20-F For the year ended 31 March 2003 Hello -

Page 2

the world's mobile communications leader Enriching customers' lives, helping individuals, businesses and communities be more connected in a mobile world. IFC2 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 3

... Reporting Critical Accounting Policies UK GAAP US GAAP Basis of Consolidation Operating Results 2003 financial year compared to 2002 financial year 2002 financial year compared to 2001 financial year Balance sheet Equity shareholders' funds Dividends Inflation Exchange rate information Accounting... -

Page 4

... Directors' Responsibilities Consolidated Financial Statements Index to the Consolidated Financial Statements 68 69 69 Additional Information for Shareholders Related Party Transactions Share Price History Markets Memorandum and Articles of Association and Applicable English Law Material Contracts... -

Page 5

... House, The Connection, Newbury, Berkshire, RG14 2FN England. Its principal telephone number is +44 (0)1635 33251. The Company's ordinary shares are listed on the London Stock Exchange and the Frankfurt Stock Exchange and the Company's American Depositary Shares ("ADSs") are listed on the New York... -

Page 6

... to a disposal of the Japan Telecom fixed line operations. Acquisition of interests in China Mobile (Hong Kong) Limited ("China Mobile") In an offering that closed on 3 November 2000, the Group acquired newly issued shares representing approximately 2.18% of China Mobile's share capital for a cash... -

Page 7

...service offering, Vodafone live!. Vizzavi has since been renamed Vodafone Content Services and services are provided under the Vodafone brand. Acquisition of additional interest in associated companies During December 2002, the Group completed the purchase of an additional 3.5% indirect equity stake... -

Page 8

...valued Atecs at approximately 19.6 billion, including pension and non-trading financial liabilities to be assumed on closing. On 29 September 2000, a payment of approximately 13.1 billion (£1.9 billion) plus interest was made to Mannesmann in exchange for the transfer of a 50% plus two shares stake... -

Page 9

...) and goodwill amortisation of £14,056 million (2002: £13,470 million, 2001: £11,873 million). See note 3 to the Consolidated Financial Statements, "Segmental analysis" for a further analysis of business segment information. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 7 -

Page 10

... delivering Vodafone branded, easy to use, customer propositions for mobile voice and data. Further details on the Group's strategy for product and service development can be found under "Strategic developments - Global services" below. Where appropriate, and if circumstances allow, the Company may... -

Page 11

... Europe UK Ireland Netherlands(5) Sweden Others TOTAL Central Europe Germany Hungary Others TOTAL Southern Europe Italy(6) Greece Malta Portugal(5) Spain Albania Others TOTAL Americas United States Mexico TOTAL Asia Pacific Japan Australia New Zealand Others(8) TOTAL Middle East and Africa Egypt... -

Page 12

... 2000 and, following a period of network investment and construction, plans to open its 3G network for service later in 2003. During the 2003 financial year, Vodafone UK invested in excess of £100 million in its 3G infrastructure. 10 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 13

... listed on public stock exchanges. However, Vodafone Portugal's shares were de-listed from the Euronext Lisbon exchange on 22 May 2003. Below is a summary of the Group's business activities in its major mobile telecommunications markets in Southern Europe. Italy In November 2002, Vodafone Omnitel... -

Page 14

... which Verizon Wireless controls and manages. Price Communications' partnership interest will be exchangeable into common stock of Verizon Wireless Inc. (if an initial public offering of such stock occurs), subject to specified 12 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 15

... the Group to open its 3G network for service, having commenced nationwide service on 20 December 2002. J-Phone Vodafone's 3G network is compatible with the global W-CDMA standard, providing capability of international W-CDMA and GSM SIM enabled roaming to Japan for the first time. At 31 March 2003... -

Page 16

..., Safaricom in Kenya and Vodacom in South Africa. Egypt Vodafone Egypt is Egypt's second largest mobile operator, with an estimated market share of 48%, and operates under the brand name Vodafone. Since its launch in November 1998, it has increased the number of customers connected to its network to... -

Page 17

... commercially. Furthermore, J-Phone Vodafone customers with an enabled handset, can not only use 3G services within Japan, but can also roam internationally on 2G networks with the convenience of being able to use the same telephone number as they do at home. In Europe, the Group's 3G programme... -

Page 18

... to FCC requirements, are allowed to purchase blocks of mobile telephone numbers and to access mobile services at wholesale rates for resale to the public. In the past twelve months, however, the use of resellers has been reduced. 16 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 19

... Americas United States Verizon Wireless 5 national operators 4 regional operators Mexico Asia Pacific Australia New Zealand Japan China Middle East and Africa Egypt South Africa Vodafone Vodacom 1 2 Mobinil MTN, Cell C Vodafone Vodafone J-Phone Vodafone China Mobile 3 1 3 3 Telstra, Optus, Orange... -

Page 20

... and key regulatory developments in the European Union and selected countries in which the Group has significant interests. mobile network operators in the United Kingdom and Germany, including Group subsidiaries, in July 2001 in connection with its sectoral enquiry into roaming charges. The... -

Page 21

... unannounced inspections of the offices of Vodafone Spain and Telefonica investigating allegations of price squeezing in the corporate market and excessive call termination charges. The investigation is ongoing. The Greek NRA Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 19 -

Page 22

..., including those relating to the Group's 3G networks. Further information on any environmental issues associated with the use of the Group's assets can be found under "Corporate Social Responsibility - Environmental Issues" elsewhere in this Annual Report. Asia Pacific Region Japan In 2001... -

Page 23

... filed in the United States District Court for the Southern District of New York against the Company and Lord MacLaurin, the Chairman of the Company, and Sir Christopher Gent, Julian Horn-Smith and Ken Hydon, executive officers of the Company. The complaints, filed as purported class actions, allege... -

Page 24

... 0.33 US GAAP(3) Group turnover (Loss)/profit for the financial year Basic (loss)/earnings per ordinary share(4) Diluted (loss)/earnings per ordinary share Basic (loss)/earnings per ADS(4) Consolidated Balance Sheet Data UK GAAP(3) Total assets Long term obligations Equity shareholders' funds Non... -

Page 25

... dividend income from associated undertakings and share of profits and losses from associated undertakings. Fixed charges comprise one-third of rental expense, including the portion of rental expense representative of interest and interest expense as reported in the Consolidated Financial Statements... -

Page 26

... associated with the roll-out and scope of 3G technology and services and Vodafone live! and Mobile Office from Vodafone in new markets; • the ability of the Group to offer new services and secure the timely delivery of high-quality, reliable GPRS and 3G handsets, network equipment and other key... -

Page 27

... adversely affected by the non-supply of equipment and support services by a major supplier. Companies within the Group source their mobile network infrastructure and related support services from a limited number of third party suppliers. The departure from the market of one or more of these third... -

Page 28

... services will increase average revenue per customer. The Group's business and its ability to retain customers and attract new customers may be impaired by actual or perceived health risks associated with the transmission of radiowaves from mobile telephones, transmitters and associated equipment... -

Page 29

... Accounting Standards Board's Statement, "Operating and Financial Review", which was issued in January 2003. The information in this regard is provided in this section or elsewhere in this Annual Report. Critical Accounting Policies UK GAAP The Group prepares its Consolidated Financial Statements... -

Page 30

..., including those relating to achievement of the Group's strategy on data products and services; timing and quantum of future capital expenditures; and uncertainty of future technological developments, all of which are discounted at a rate to reflect the risks involved. UK GAAP, in the form of FRS... -

Page 31

...(or its international equivalent, IAS 19, "Employee benefits") and will result in pension scheme assets being accounted for at market values. Liabilities will continue to be subject to discounting. However, any resultant gains or losses will be reported in the profit and loss account or statement of... -

Page 32

...interest in Japan Telecom was accounted for as a fixed asset investment. The results and net assets of Japan Telecom and the J-Phone Group were fully consolidated in the Group's financial statements with effect from 12 October 2001. 30 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 33

... activity in certain key European markets by existing competitors looking to attract market share and generate customer loyalty. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 Northern Europe Central Europe Southern Europe Americas Asia Pacific Middle East and Africa 6,057 4,775... -

Page 34

... the Group's interests in Verizon Wireless and Iusacell, both of which are accounted for using equity accounting. Accordingly, the turnover from these operations are not included in the Group's statutory profit and loss account. 32 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 35

...through games downloads, picture messaging and other content and information services. Further details on these two new service offerings can be found under "Strategic Developments - Global services" elsewhere in this document. The Group's main markets of Germany, Italy, the United Kingdom and Japan... -

Page 36

... payments to landline and mobile operators for delivering calls outside the Group's networks and for providing landline or microwave links, depreciation of network infrastructure, the cost of customer equipment sold and network operating costs. Excluding J-Phone Vodafone, the Group's equipment costs... -

Page 37

...Phone Vodafone, equipment costs and financial incentives amounted to 21.1% of turnover from mobile telecommunications, as costs to connect and retain customers, although reducing, remain higher in Japan than in the Group's other key markets. monitors the carrying value of its fixed assets. A review... -

Page 38

... the consolidation of the Group's former associated undertakings, Japan Telecom and J-Phone Vodafone, from October 2001, and of Vizzavi from 29 August 2002, and reduced levels of indebtedness in SFR. Northern Europe Central Europe Southern Europe Americas Asia Pacific Middle East and Africa 5,432... -

Page 39

...market share, with 2,219,000 net customer additions in the period. One of the key drivers of the recent growth, and the levels of turnover experienced, was the success of "sha-mail", J-Phone Vodafone's photo-messaging service which contributed to increases in data and SMS revenues. As a result, data... -

Page 40

... REVIEW AND PROSPECTS Continued The Group's main markets of Germany, Italy, the United Kingdom and, since October 2001, Japan, all experienced increases in mobile data revenues, with SMS revenues continuing to be the principal component of these revenue streams. In J-Phone Vodafone, Internet data... -

Page 41

...of financial incentives to service providers and dealers, payments to landline and mobile operators for delivering calls outside the Group's networks and for providing landline or microwave links, depreciation of network infrastructure, the cost of customer equipment sold and network operating costs... -

Page 42

... for convenience, into US dollars per ordinary share at the Noon Buying Rate on each of the respective payment dates for such interim and final dividends, in both cases, where relevant, net of the associated advance corporation tax. 40 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 43

... Reinvestment Plan, or have mandated their dividend payment to be paid directly into a bank or building society account in the United Kingdom. In accordance with the Company's Articles of Association, the sterling:euro exchange rate will be determined by the Company shortly before the payment date... -

Page 44

... of the differences between UK GAAP and US GAAP, including a summary of the impact of recently issued US accounting standards, see note 37 to the Consolidated Financial Statements, "US GAAP information". Increase in cash in the year During the year ended 31 March 2003, the Group increased its... -

Page 45

... on market price or suitability for a particular investor, and are subject to revision or withdrawal at any time by the assigning rating organisation. Each rating should be evaluated independently. The Group's credit ratings help it to have access to a wide range of debt finance including commercial... -

Page 46

... working capital requirements. Further details regarding the maturity, currency and interest rates of the Group's gross borrowings at 31 March 2003 are included in note 20 to the Consolidated Financial Statements, "Financial liabilities and assets", included in this Annual Report. 28 May 2003... -

Page 47

... and redeemable preference shares. These internal ratios establish levels of debt which the Group should not exceed other than for relatively short periods of time and are shared with Moody's, Standard and Poor's and Fitch. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 45 -

Page 48

... of material loss to be acceptable because of these control procedures. Additional information is set out in notes 20 and 21 to the Consolidated Financial Statements "Financial liabilities and assets" and "Financial instruments". 46 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 49

... and development programme is shared with all subsidiaries of the Company and Group functions. They are able to influence the programme through the governance mechanism, management processes and working interfaces that are designed to allow delivery of the results of the programme directly into... -

Page 50

... a member of the Board of directors since April 1998. He has responsibility for the Group's Northern Europe, Middle East and Africa businesses. He was Managing Director of Vodafone UK Limited until April 2001. Before joining Vodafone in 1997, Mr Bamford was a director of WH Smith Group Plc. Vittorio... -

Page 51

... of the Board of directors of the New York Stock Exchange and Sasol Ltd. He was a member of the Supervisory Board of Mannesmann AG until May 2000. Senior Management Members of the Group Executive Committee who are not also executive directors are regarded as senior managers of the Company. As at... -

Page 52

...certain network operating licences. More details regarding the activities of the Vodafone Group Foundation and local Vodafone Foundations can be found in the Company's separate report on corporate social responsibility. Share capital A statement of changes in the share capital of the Company is set... -

Page 53

...Values have made a difference to their working lives. At 31 March 2003, "Your Call" had visited Australia, New Zealand, the United States, Germany, Italy, Spain, the UK and Portugal, with further visits planned to other countries. The Board places a high priority on effective employee communications... -

Page 54

... Review and Summary Financial Statement, and on page 67 of this Annual Report. Further details are contained in the Company's separate report on corporate social responsibility. Major shareholders The Bank of New York, as custodian of the Company's American Depositary Receipt ("ADR") programme... -

Page 55

... the separate Report of Sir Robert Smith in relation to audit committees) that are expected to be implemented later in 2003 after consideration by the Financial Reporting Council. The Company's American Depositary Shares are listed on the New York Stock Exchange ("NYSE") and the Company is therefore... -

Page 56

... services, new global products and services, brand development, technology and other cost and revenue synergies within the Group's regions. The Group Policy Committee, which meets eight times each year, is chaired by the Chief Executive. The Financial Director and the Group Chief Operating Officer... -

Page 57

...the UK, US and Ireland. Financial and other information is made available on the Company's web site, www.vodafone.com, which is regularly updated. Review of effectiveness The directors, the Chief Executive and the Financial Director consider that the Group's internal controls and procedures provide... -

Page 58

...payments; performance measures must be balanced between absolute financial measures and sector comparative measures to achieve maximum alignment between executive and shareholder objectives; the majority of performance-related remuneration is to be provided in the form of equity; and share ownership... -

Page 59

...Annual deferred share bonus This short/medium term incentive is aimed at focusing executive directors on the business priorities for the next financial year and is provided through the Vodafone Group Short Term Incentive Plan ("STIP"). Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 60

... year to executive directors. The Vodafone Group Plc 1999 Long Term Stock Incentive Plan is the vehicle for the provision of these incentive awards. The price at which shares can be acquired on option exercise will be no lower than the market value of the shares on the day prior to the date of grant... -

Page 61

...by exercising the related option. The options have been granted at up to a 20% discount to market value. UK based executive Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 6 4 2 0 Growth in value of Company from grant date For example, if the Company's share price increases by over... -

Page 62

... these plans. All awards under the new remuneration policy and global market-related options granted under the previous policy provide for awards to be pro-rated for time and performance. Sir Christopher will not receive a salary increase, performance shares or share option awards in 2003. Service... -

Page 63

... health insurance. (3) In January 2003, Paul Hazen received a deferred compensation payment of $88,851, which related to fees earned prior to the dissolution of the AirTouch board in 1999. (4) Salary and benefits for Vittorio Colao and Thomas Geitner have been translated at the average exchange rate... -

Page 64

... has been translated at the average exchange rate for the year of 11.5570:£1. No other pension benefits are provided. In respect of senior management, the Group has made aggregate contributions of £457,617 into pension schemes. 62 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 65

... awards of ordinary shares made to executive directors under the Vodafone Group Long Term Incentive Plan and Vodafone Group Plc 1999 Long Term Stock Incentive Plan, and dividends on those shares paid under the terms of the Company's scrip dividend scheme and dividend reinvestment plan, are shown... -

Page 66

... market price is the closing middle market price of the Company's ordinary shares at 31 March 2003 of 113p. (2) Arun Sarin's share options are in respect of American Depositary Shares, each representing ten ordinary shares in the Company, which are traded on the New York Stock Exchange. The number... -

Page 67

...,126 - 5,000,000 104.23 30,190,911 Note: (1) These share options are in respect of American Depositary Shares, each representing ten ordinary shares in the Company, which are traded on the New York Stock Exchange. The number and option price have been converted into the equivalent amounts for the... -

Page 68

... Company's ordinary shares with the option price being translated at $1.6376 per £1.00, the Noon Buying Rate in the City of New York for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York on 23 May 2003. 66 Vodafone Group Plc Annual Report... -

Page 69

... and services breach internationally accepted safety standards or guidelines. Further details of these initiatives, and progress against environment-related commitments made last year, are provided in the Company's 2002/03 CSR Report. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 70

...OF DIRECTORS' RESPONSIBILITIES United Kingdom company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the Company and the Group as at the end of the financial year and of the profit or loss of the Group for... -

Page 71

... of Consolidated Financial Statements 2. Accounting policies 3. Segmental analysis 4. Exceptional operating items 5. Operating loss 6. Exceptional non-operating items 7. Net interest payable and similar items 8. Tax on loss on ordinary activities 9. Equity dividends 10. Loss per share 11. Intangible... -

Page 72

... cash flow statements, the consolidated statements of total recognised gains and losses and the movement in total equity shareholders' funds for the three years ended 31 March 2003 and the related notes 1 to 37. These financial statements have been prepared under the accounting policies set out... -

Page 73

... 2003 and the determination of shareholders' equity at 31 March 2003 and 2002 to the extent summarised in note 37 to the financial statements. Deloitte & Touche Chartered Accountants and Registered Auditors London, England 27 May 2003 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 74

... (14,470) (936) (98) (15,504) 9 24 10 (1,822) (17,326) (22.75)¢ The accompanying notes are an integral part of these Consolidated Financial Statements. The unaudited US dollar amounts are prepared on the basis set out in note 1. 72 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 75

... SIR CHRISTOPHER GENT K J HYDON Chief Executive Financial Director The accompanying notes are an integral part of these Consolidated Financial Statements. The unaudited US dollar amounts are prepared on the basis set out in note 1. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 73 -

Page 76

...of acquired businesses held for sale Equity dividends paid Cash (outflow)/inflow before management of liquid resources and financing Management of liquid resources Net cash outflow from financing Issue of ordinary share capital Debt repayment Issue of shares to minorities 30 Increase/(decrease) in... -

Page 77

... equity shareholders' funds The accompanying notes are an integral part of these Consolidated Financial Statements. The unaudited US dollar amounts are prepared on the basis set out in note 1. 14,272 49 - - - 2 (3,003) 206,174 203,171 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 78

... as part of a periodic billing cycle and recognised as turnover over the related access period, with unbilled turnover resulting from services already provided from the billing cycle date to the end of each period accrued and 76 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 79

... payments are taken to the profit and loss account. Pensions Costs relating to defined benefit plans, which are subject to periodic valuations calculated by professionally qualified actuaries, are charged against profits, within staff costs, so that the expected costs of providing pensions... -

Page 80

... disclosed in the profit and loss account. Other investments, held as fixed assets, comprise equity shareholdings and other interests. They are stated at cost less provision for any impairment. Dividend income is recognised upon receipt and interest when receivable. Stocks Stocks are valued at the... -

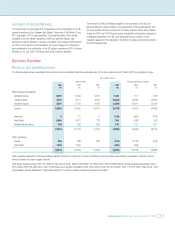

Page 81

... the Group manages its world-wide interests. Turnover is by origin, which is not materially different from turnover by destination. 2003 £m 2002 £m 2001 £m Group turnover Mobile telecommunications: Northern Europe Central Europe Southern Europe Europe Americas Asia Pacific Middle East and Africa... -

Page 82

... Europe Southern Europe Europe Americas Asia Pacific Middle East and Africa Other operations: Europe Asia Pacific (3) 2 (6) (7) (28) (295) 1 (329) 348 (24) (5) - (20) 52 32 - (881) - (849) (11) - (860) (19) - 261 242 (33) (134) 5 80 - - 80 80 Vodafone Group Plc Annual Report & Accounts and Form... -

Page 83

...Americas Asia Pacific Middle East and Africa Other operations: Europe Asia Pacific 1,025 6,643 4,334 12,002 1,235 717 27 13,981 75 - 14,056 900 6,377 4,043 11,320 1,343 617 30 13,310 145 15 13,470 668 6,026 3,525 10,219 1,225 264 29 11,737 136 - 11,873 Vodafone Group Plc Annual Report & Accounts... -

Page 84

... Europe Europe Americas Asia Pacific Middle East and Africa Other operations: Europe Asia Pacific 1,001 893 1,270 3,164 9 1,393 56 4,622 135 186 4,943 925 1,028 1,695 3,648 23 826 152 4,649 214 255 5,118 7,529 6,200 2,552 16,281 67 366 174 16,888 380 - 17,268 82 Vodafone Group Plc Annual Report... -

Page 85

... Japan Telecom, £86m reorganisation costs which relate to the Group's operations in Australia and the UK and £222m for the Group's share of exceptional items of its associated undertakings and joint ventures, which principally comprise £102m of, principally, asset write-downs in J-Phone Vodafone... -

Page 86

... ventures Associated undertakings 2003 £m 2002 £m 2001 £m 8 8,769 8,777 3 10,693 10,696 98 8,891 8,989 Share of operating loss: Joint ventures Associated undertakings (39) (117) (156) (231) (1,226) (1,457) (42) (508) (550) 84 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 87

... charges 476 8 12 2 (24) 311 287 (23) 353 330 342 - 845 (6) 331 325 327 - 1,177 Share of joint ventures and associated undertakings net interest payable Other similar items Net interest payable and similar items 295 (19) 752 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 88

...Law incentive scheme in Italy. The Visco Law has subseque ntly been replaced by a less favourable tax regime. The tax recoverable on exceptional items of £37m (2002: £71m, 2001: £55m) is mainly in respect of reorganisation costs. 86 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 89

... book depreciation Short term timing differences Losses carried forward utilised/current year losses for which no credit taken Prior year adjustments Net under/(over) charge relating to international associated undertakings Non taxable profits/non deductible losses International corporate tax rate... -

Page 90

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued 9. Equity dividends 2003 £m 2003 Pence per ordinary share 2002 £m 2002 Pence per ordinary share 2001 £m 2001 Pence per ordinary share Interim dividend paid Proposed final dividend Additional final dividend payable in respect of the year ... -

Page 91

... Licence and spectrum fees £m Total £m Cost 1 April 2002 Exchange movements Acquisitions (note 26) Additions Reclassifications 31 March 2003 Amortisation 1 April 2002 Exchange movements Charge for the year Reclassifications 31 March 2003 Net book value 31 March 2003 31 March 2002 116,627 13,534... -

Page 92

... £m Equipment, fixtures and fittings £m Total £m Cost Accumulated depreciation Net book value 31 March 2002 Net book value 401 (75) 326 2,038 (653) 1,385 21,643 (7,124) 14,519 24,082 (7,852) 16,230 503 944 13,297 14,744 90 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 93

... 1 April 2002 Exchange movements Loan advances Reclassifications 31 March 2003 321 12 47 (380) - 18 6 2 (26) - Net book value 31 March 2003 31 March 2002 - 52 25,825 27,249 The Group's share of its joint ventures' and associated undertakings' post acquisition accumulated (losses)/profits at 31... -

Page 94

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued 13. Fixed asset investments continued The Group's share of its joint ventures and associated undertakings comprises: Joint ventures 2003 £m 2002 £m Associated undertakings 2003 2002 £m £m Share of turnover of joint ventures and ... -

Page 95

... Long Term Incentive Plan and Short Term Incentive Plan, and 7,189,316 shares in the Company, held by the Group's Australian and New Zealand businesses, in respect of an employee share option plan. The cost to the Group of these shares was £41m and their market value at 31 March 2003 was £30m. The... -

Page 96

... £m Opening balance at 1 April Exchange adjustments Amounts (credited)/charged to the profit and loss account Acquisitions Assets written off Closing balance at 31 March 126 2 (27) - (12) 89 32 (7) (5) 106 - 126 9 - 23 - - 32 94 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 97

... arose from other timing differences. Debtors are stated after allowances for bad and doubtful debts, an analysis of which is as follows: 2003 £m 2002 £m 2001 £m Opening balance at 1 April Exchange adjustments Amounts charged to the profit and loss account Acquisitions Disposals Assets written... -

Page 98

... TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued 18. Creditors: amounts falling due within one year Group 2003 £m 2002 £m 2003 £m Company 2002 £m Bank loans and other loans Commercial paper Finance leases Trade creditors Amounts owed to subsidiary undertakings Amounts owed to associated... -

Page 99

... in more than two years but not more than five years Repayable in more than five years 47 39 95 181 109 74 84 267 - - - - - - - - Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 97 -

Page 100

... profile of the Group's other financial liabilities at 31 March was as follows: In more than one year but not more than two years In more than two years but not more than five years In more than five years 4 1 14 19 27 - 9 36 98 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 101

... same terms and conditions apply in the case of J-Phone Finance Co., Ltd's ¥225 billion term credit facility, although the change of control provision is applicable to any guarantor of borrowings under the term credit facility. As of 31 March 2003, the Company was the sole guarantor. In addition to... -

Page 102

...333m) represented by listed investments. Listed equity investments denominated in currencies other than sterling include £939m (2002: £848m) denominated in Hong Kong dollars and £86m (2002: £115m) denominated in Japanese yen. 100 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 103

...interest rate exposure. The fair value of these financial instruments was estimated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at the year end. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 101 -

Page 104

... financial exposure to foreign exchange gains or losses on monetary assets and monetary liabilities denominated in foreign currencies at 31 March 2003. Short term debtors and creditors are not included in the analyses in notes 20 and 21. 102 Vodafone Group Plc Annual Report & Accounts and Form... -

Page 105

.... Provisions for liabilities and charges Deferred taxation £m Post employment benefits £m Other provisions £m Total £m 1 April 2002 Exchange movements Acquisitions (note 26) Profit and loss account Utilised in the year - payments Reclassifications from creditors 31 March 2003 2,159 (32) - 905... -

Page 106

.... The dividend rights in respect of these shares have been waived. During the year 5,341,856 shares had been transferred to option holders exercising options under the Savings Related Share Option Scheme or allocated to employees. 104 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 107

... New York Stock Exchange. Following the merger with AirTouch, some rights to acquire AirTouch Communications, Inc. 1993 Long Term Stock Incentive Plan options were converted into rights to acquire shares in the Company. No further awards will be granted under this scheme. American Depositary Shares... -

Page 108

... Non-equity minority interests comprise £1,015m of class D & E preferred shares issued by AirTouch (2002: £1,124m) and £Nil non-cumulative redeemable preference shares issued by Vodafone Australia (2002: £4m). An annual dividend of $51.43 per class D & E preferred share is payable quarterly... -

Page 109

... are in line with the Group's strategy of increasing its shareholding in existing operations where opportunities arise for the creation of enhanced value for the Company's shareholders. In respect of Australia, Germany and Spain, management also believe that by obtaining 100% ownership in these... -

Page 110

... in this transaction form an integral part of the Group's strategy in providing differentiated services to its customers and are of particular importance to Vodafone live!, the Group's recently launched consumer service offering. 108 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 111

On 13 March 2003, Vodafone UK acquired Cellular Operations Limited, a service provider based in the UK. This transaction will enable the UK business to improve its control over its customer base and distribution network. Fair value of assets/(liabilities) acquired £m Goodwill capitalised £m ... -

Page 112

... in Vodafone Greece. The Group is committed to pay, in cash, the excess of Vodafone Greece's share price over 114.29 per share. This compares with a share price at 31 March 2003 of 15.02 per share. The option expires on 29 November 2004. 110 Vodafone Group Plc Annual Report & Accounts and Form 20... -

Page 113

... or known to be contemplated) which are expected to have, or have had in the twelve months preceding the date of this document, a significant effect on the financial position or profitability of the Company and its subsidiaries. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 111 -

Page 114

...: (Decrease)/increase in long term debt Repayment of debt acquired Issue of new bonds 28 1 (97) (1,366) - - (1,700) - 2,998 (136) 3,581 12 (46) (2,486) (1,256) - 6 (991) 505 (675) 65 44 (9) (407) (7,181) 2,823 46 (2,072) - (6,691) 112 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 115

... (2002: £129,328) and by former directors were £Nil (2002: £Nil). Further details of directors' emoluments can be found in "Board's Report to Shareholders on Directors' Remuneration - Remuneration for the year to 31 March 2003". Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 113 -

Page 116

... 6,007 1,771 51,912 15,210 8,300 15,260 38,770 432 3,999 1,485 44,686 9,136 6,130 67,178 8,639 - 53,325 Wages and salaries Social security costs Other pension costs 1,984 199 95 2,278 1,740 192 64 1,996 1,408 113 47 1,568 114 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 117

... defined benefit schemes in Ireland, Sweden, Italy, Greece and the United States. Defined contribution pension schemes are provided in Australia, Egypt, Germany, Greece, Ireland, Italy, Malta, the Netherlands, New Zealand, Portugal, Spain, the United Kingdom and the United States. The Group accounts... -

Page 118

... sum redundancy benefits payable through a redundancy programme associated with the retirement plan. (2) The numbers for 2002 represent the pension costs for the part of the year since the acquisition of the Japanese businesses. 116 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 119

... Charges that would have been made to the profit and loss account and consolidated statement of total recognised gains and losses on full compliance with FRS17 and on the basis of the assumptions stated above UK £m Germany £m Japan £m Other £m Total £m Operating profit: Current service cost... -

Page 120

... of the deferred compensation scheme. The deficit in respect of other schemes at 31 March 2003 primarily relates to internally funded schemes in Italy, Sweden and the United States and the externally funded scheme in Ireland. 118 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 121

... Americas Inc. (previously AirTouch Communications, Inc.) and guaranteed by the Company. On 17 April 2003, the Group announced that, pursuant to these offers, it had purchased bonds in the principal amounts of $569,987,000 and DEM 308,360,000. Vodafone Group Plc Annual Report & Accounts and Form... -

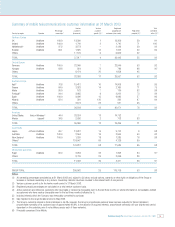

Page 122

... operator Cellular network operator and telecommunications company Cellular network operator Germany Sweden Japan Japan Japan Albania USA Germany Egypt Spain Netherlands Germany Spain Hungary Germany Netherlands Luxembourg Ireland Netherlands England Malta Australia New Zealand Netherlands Greece... -

Page 123

...Activity China Mobile (Hong Kong) Limited(2) Mobile network operator 3.3 China Notes: (1) To nearest tenth of one percent. (2) Listed on the Hong Kong and New York stock exchanges and incorporated under the laws of Hong Kong. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 121 -

Page 124

... Summary of differences between UK GAAP and US GAAP Future developments in US GAAP Market risk and financial instruments Goodwill and other intangible assets Joint ventures and associated undertakings Fixed asset investments Stock based compensation Pensions and other post retirement benefits Page... -

Page 125

... and other intangibles amortisation by £2,431m, decreasing the net credit in relation to income taxes by £1,894m with a corresponding increase in the net loss from investments accounted for under the equity method of £537m. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 123 -

Page 126

...in the net loss from investments accounted for under the equity method of £1,172m. This restatement does not affect previously reported US GAAP net loss for the two years ended 31 March 2002 or US GAAP shareholders' equity at 31 March 2002. (3) Change in accounting principle for 2002 relates to the... -

Page 127

... of joint ventures and associated undertakings is also permitted to be disclosed on the face of the consolidated profit and loss account. In addition, the Group's share of gross assets and gross liabilities of joint ventures are Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 125 -

Page 128

... on borrowings to finance the acquisition of licences are also capitalised until the date that the related network service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets. 126 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 129

... as available-for-sale and are stated at fair value with the unrealised loss or gain, net of deferred taxes, reported in shareholders' equity. Derivative instruments - All the Group's transactions in derivative financial instruments are undertaken for risk management purposes only and are used to... -

Page 130

... reporting in the statement of cash flows is required if a derivative contains a financing component. The effect of SFAS No. 149 on the Group's reported financial position and results under US GAAP is not expected to be material. 128 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 131

... to foreign currency movements by hedging known future transactions including those resulting from the repatriation of international dividends and loans above a certain de-minimus level using foreign exchange forward contracts. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 129 -

Page 132

... difference in the tax basis versus the book basis of licences. The reclassification, including the related impact on deferred taxes, had no impact on the Group's previously reported net income or shareholders equity under US GAAP. 130 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 133

... set out below: 2003 £m 2002 £m Assets Current assets Non-current assets - - - Liabilities and equity shareholders' funds Liabilities Minority interests Total equity shareholders' funds - - - - Turnover Operating loss 16 (77) 743 (54) (538) 151 6 (410) 41 110 151 Vodafone Group Plc Annual Report... -

Page 134

... Summary aggregated financial information of the Group's associated undertakings, extracted on a 100% basis from accounts prepared under UK GAAP to 31 March 2003, is set out below: 2003 2003 2003 Equity-accounted Non-consolidated Equity-accounted entities as subsidiaries as entities as defined... -

Page 135

... Plan enables UK staff to acquire shares in the Company through monthly purchases of up to £125 per month or 5% of salary, whichever is lower. For each share purchased by the employee, the Company provides a free matching share. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003... -

Page 136

... the Vodafone Group Plc 1999 Long Term Stock Incentive Plan referred to above. Under these plans, the maximum aggregate number of ordinary shares which may be issued in respect of options or awards will not (without shareholder approval) exceed: a. 10% of the ordinary share capital of the Company in... -

Page 137

... UK, Germany and Japan is given in note 34. Analyses of the net pension cost, plan assets, obligations and funded status for the major defined benefit plans in the UK, Germany and Japan, prepared under US GAAP, are provided below. Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 135 -

Page 138

...TO THE CONSOLIDATED FINANCIAL STATEMENTS Continued 37. US GAAP information UK defined benefit pension plan continued 2003 £m 2002 £m 2001 £m Service cost Interest costs on projected benefit obligation Actual loss on plan assets Net deferred items Net periodic pension cost Change in benefit... -

Page 139

... year-end exchange rate of 11.4486:£1, at 31 March 2003 comprised the following: 2003 £m 2002 £m 2001 £m Service cost Interest cost Actual loss on plans' assets Net periodic pension cost Change in benefit obligation Benefit obligation at 1 April Service cost Interest cost Amendments Actuarial... -

Page 140

... 2003 (2002: 12 October 2001) Employer's contributions Benefits paid Fair value of assets at 31 March Funded status Projected benefit obligation Fair value of plan assets Unrecognised net loss Prior period service cost Accrued pension cost Weighted-average actuarial assumptions: Discount rate Rate... -

Page 141

... fixed rate shares of £1.00 each. Markets Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange, the Frankfurt Stock Exchange and, in the form of American Depositary Shares ("ADSs"), on the New York Stock Exchange. Five year data on an annual basis London Stock Exchange... -

Page 142

...with any connected person) is a shareholder or an officer or is otherwise interested, provided that the director (together with any connected person) is not interested in 1% or more of any class of the company's equity share capital or the voting rights available to its shareholders, (e) relating to... -

Page 143

... than in connection with a rights issue up to an amount specified by the shareholders and free of the restriction in Section 89. In accordance with institutional investor guidelines, the amount of relevant securities to be fixed by Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 141 -

Page 144

... the United States and the United Kingdom for which instruments of ratification were exchanged in March 2003 (the "New Treaty"). These laws are subject to change, possibly on a retroactive basis. (i) Variation of rights If, at any time, the Company's share capital is divided into different classes... -

Page 145

...shares, or the Depositary, in the case of ADSs, actually or constructively receives the dividend. A US holder, eligible for the benefits of the Old Treaty, may include in the gross amount of income the UK tax withheld from the dividend payment pursuant to Vodafone Group Plc Annual Report & Accounts... -

Page 146

...plan for depositary receipts, with a dividend reinvestment facility. For additional information, please write to: The Bank of New York Shareholder Relations Department Global BuyDIRECT P.O. Box 1958 Newark New Jersey 07101-1958 USA 144 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 147

..., London E1 8DF (telephone: +44 (0) 870 241 1713), or visit its website at www.uar.co.uk Shareholder enquiries and information The Annual Report and the Annual Review & Summary Financial Statement 2003 are available to view at and/or download from the Company's web site at www.vodafone.com/investor... -

Page 148

...telephone number. ADS holders can also, subject to passing an identity check, view their account balances and transaction history, sell shares and request certificates from their Global BuyDIRECT Plan at www.stockbny.com Continued 146 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 149

... periods presented in this annual report; The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have: a) b) c) designed such disclosure controls... -

Page 150

... internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. Date: 11 June 2003 /s/ K J Hydon Kenneth J Hydon Financial Director 148 Vodafone Group Plc Annual Report & Accounts and Form... -

Page 151

... 7A Major Shareholders 7B Related Party Transactions Financial Information 8A Consolidated Statements and Other Financial Information 8A7 Litigation 8A8 Dividend Policy 8B Significant Changes The Offer and Listing 9A Share Price History 9C Markets Directors' Report - Major Shareholders Additional... -

Page 152

... Code of Ethics Principal Accountant Fees and Services - - - - 17 Financial Statements PART III 18 19 Financial Statements Exhibits Index to the Consolidated Financial Statements Filed with the SEC 69 - 150 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 Vodafone Group Plc... -

Page 153

NOTES Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 151 -

Page 154

NOTES 152 Vodafone Group Plc Annual Report & Accounts and Form 20-F 2003 -

Page 155

Vodafone Group Plc Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No. 1833679 Telephone: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 www.vodafone.com Printed in the United Kingdom