US Cellular 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

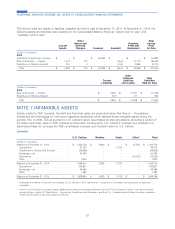

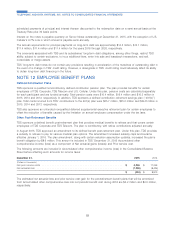

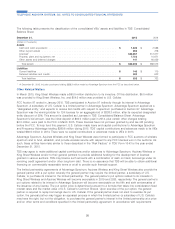

The following table reconciles the beginning and ending balances of the benefit obligation and the fair value of plan

assets for the other post-retirement benefit plan.

December 31, 2015 2014

(Dollars in thousands)

Change in benefit obligation

Benefit obligation at beginning of year .................................. $ 34,645 $ 46,142

Service cost .................................................. 549 1,018

Interest cost .................................................. 1,540 2,255

Plan amendments .............................................. 7,412 (2,057)

Actuarial (gain) loss ............................................. (3,723) (10,897)

Prescription drug subsidy .......................................... 227 264

Employee contribution ............................................ 2,222 2,216

Benefits paid ................................................. (4,101) (4,296)

Benefit obligation at end of year ...................................... 38,771 34,645

Change in plan assets

Fair value of plan assets at beginning of year ............................. 51,324 49,743

Actual return (loss) on plan assets .................................... 395 3,495

Employee contribution ............................................ 2,222 2,216

Employer contribution ............................................ 168 166

Benefits paid ................................................. (4,101) (4,296)

Fair value of plan assets at end of year ................................. 50,008 51,324

Funded status .................................................. $ 11,237 $ 16,679

The funded status identified above is recorded as a component of Other assets and deferred charges in TDS’

Consolidated Balance Sheet as of December 31, 2015 and 2014.

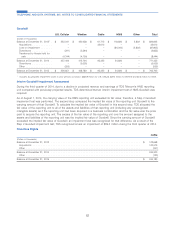

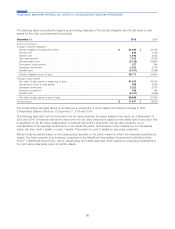

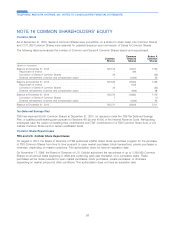

The following table sets forth by level within the fair value hierarchy the plans’ assets at fair value, as of December 31,

2015 and 2014. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that

is significant to the fair value measurement. A financial instrument’s level within the fair value hierarchy is not

representative of its expected performance or its overall risk profile, and therefore Level 3 assets are not necessarily

higher risk than Level 2 assets or Level 1 assets. There were no Level 3 assets for any years presented.

Mutual funds are valued based on the closing price reported on the active market on which the individual securities are

traded. The bank common trust is entirely comprised of the BlackRock Intermediate Government/Credit Bond Index

Fund F (‘‘BlackRock Bond Fund’’) and is valued using the market approach which values the underlying investments in

the fund using observable inputs for similar assets.

90

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS