US Cellular 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

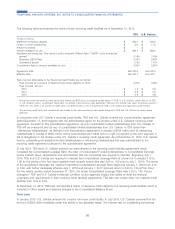

scheduled payments of principal and interest thereon discounted to the redemption date on a semi-annual basis at the

Treasury Rate plus 30 basis points.

Interest on the notes is payable quarterly on Senior Notes outstanding at December 31, 2015, with the exception of U.S.

Cellular’s 6.7% note in which interest is payable semi-annually.

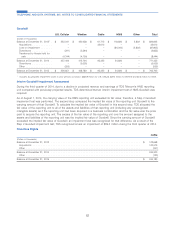

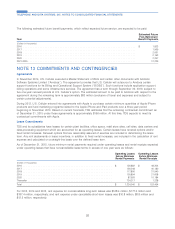

The annual requirements for principal payments on long-term debt are approximately $14.3 million, $12.1 million,

$11.4 million, $11.4 million and $11.4 million for the years 2016 through 2020, respectively.

The covenants associated with TDS and its subsidiaries’ long-term debt obligations, among other things, restrict TDS’

ability, subject to certain exclusions, to incur additional liens, enter into sale and leaseback transactions, and sell,

consolidate or merge assets.

TDS’ long-term debt notes do not contain any provisions resulting in acceleration of the maturities of outstanding debt in

the event of a change in TDS’ credit rating. However, a downgrade in TDS’ credit rating could adversely affect its ability

to obtain long-term debt financing in the future.

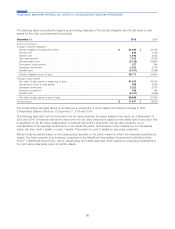

NOTE 12 EMPLOYEE BENEFIT PLANS

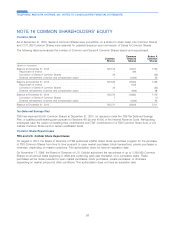

Defined Contribution Plans

TDS sponsors a qualified noncontributory defined contribution pension plan. The plan provides benefits for certain

employees of TDS Corporate, TDS Telecom and U.S. Cellular. Under this plan, pension costs are calculated separately

for each participant and are funded annually. Total pension costs were $16.4 million, $16.4 million and $16.2 million in

2015, 2014 and 2013, respectively. In addition, TDS sponsors a defined contribution retirement savings plan (‘‘401(k)’’)

plan. Total costs incurred from TDS’ contributions to the 401(k) plan were $25.7 million, $25.3 million and $24.8 million in

2015, 2014 and 2013, respectively.

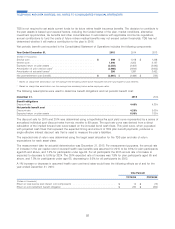

TDS also sponsors an unfunded nonqualified deferred supplemental executive retirement plan for certain employees to

offset the reduction of benefits caused by the limitation on annual employee compensation under the tax laws.

Other Post-Retirement Benefits

TDS sponsors a defined benefit post-retirement plan that provides medical benefits to retirees and that covers certain

employees of TDS Corporate and TDS Telecom. The plan is contributory, with retiree contributions adjusted annually.

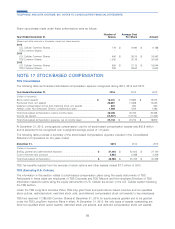

In August 2015, TDS approved an amendment to its defined benefit post-retirement plan. Under this plan, TDS provides

a subsidy to retirees to pay for various medical plan options. The amendment increased subsidy caps and became

effective January 1, 2016. The plan amendment, along with certain valuation assumption updates, increased the plan’s

benefit obligation by $8.6 million. This amount is included in TDS’ December 31, 2015 Accumulated other

comprehensive income (loss) as a component of Net actuarial gains (losses) and Prior service cost.

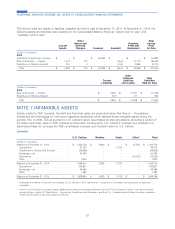

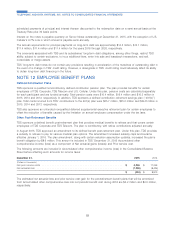

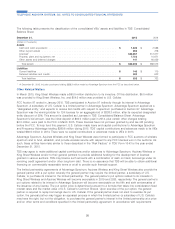

The following amounts are included in Accumulated other comprehensive income (loss) in the Consolidated Balance

Sheet before affecting such amounts for income taxes:

December 31, 2015 2014

(Dollars in thousands)

Net prior service costs ................................................. $ 6,846 $ 17,246

Net actuarial loss .................................................... (7,280) (8,436)

$ (434) $ 8,810

The estimated net actuarial loss and prior service cost gain for the postretirement benefit plans that will be amortized

from Accumulated other comprehensive loss into net periodic benefit cost during 2016 are $0.2 million and $2.0 million,

respectively.

89

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS