US Cellular 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

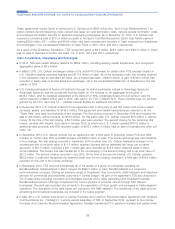

Early adoption as of January 1, 2017 is permitted; however, TDS does not intend to adopt early. TDS is evaluating the

effects that adoption of ASU 2014-09 will have on its financial position, results of operations, and disclosures.

In August 2014, the FASB issued Accounting Standards Update 2014-15, Disclosure of Uncertainties about an Entity’s

Ability to Continue as a Going Concern (‘‘ASU 2014-15’’). ASU 2014-15 requires TDS to assess its ability to continue as

a going concern each interim and annual reporting period and provide certain disclosures if there is substantial doubt

about the entity’s ability to continue as a going concern, including management’s plan to alleviate the substantial doubt.

TDS is required to adopt the provisions of ASU 2014-15 for the annual period ending December 31, 2016, but early

adoption is permitted. The adoption of ASU 2014-15 will not impact TDS’ financial position or results of operations but

may impact future disclosures.

In February 2015, the FASB issued Accounting Standards Update 2015-02, Consolidation: Amendments to the

Consolidation Analysis (‘‘ASU 2015-02’’). ASU 2015-02 simplifies consolidation accounting by reducing the number of

consolidation models. Additionally, ASU 2015-02 changes certain criteria for identifying variable interest entities. TDS

adopted the provisions of this standard as of January 1, 2016. TDS expects that certain consolidated subsidiaries that

are not defined as variable interest entities under current accounting guidance will be defined as variable interest entities

under the provisions of ASU 2015-02. However, TDS’ adoption of ASU 2015-02 will not change the group of entities

which TDS is required to consolidate in its financial statements. Accordingly, the adoption of ASU 2015-02 will not

impact its financial position or results of operations.

In July 2015, the FASB issued Accounting Standards Update 2015-11, Inventory: Simplifying the Measurement of

Inventory (‘‘ASU 2015-11’’), which requires inventory to be measured at the lower of cost or net realizable value. TDS is

required to adopt ASU 2015-11 on January 1, 2017. Early adoption is permitted. TDS is evaluating the effects that

adoption of ASU 2015-11 will have on its financial position and results of operations.

In September 2015, the FASB issued Accounting Standards Update 2015-16, Business Combinations: Simplifying the

Accounting for Measurement-Period Adjustments (‘‘ASU 2015-16’’). ASU 2015-16 simplifies how adjustments are made to

provisional amounts recognized in a business combination during the measurement period. TDS adopted ASU 2015-16

on January 1, 2016. There will be no immediate impacts to TDS’ financial position, results of operations, and

disclosures.

In January 2016, the FASB issued Accounting Standards Update 2016-01, Financial Instruments – Overall: Recognition

and Measurement of Financial Assets and Financial Liabilities (‘‘ASU 2016-01’’). This ASU introduces changes to current

accounting for equity investments and financial liabilities under the fair value option and the presentation and disclosure

requirements for financial instruments. TDS is required to adopt ASU 2016-01 on January 1, 2018. Certain provisions are

eligible for early adoption. TDS is evaluating the effects that adoption of ASU 2016-01 will have on its financial position

and results of operations.

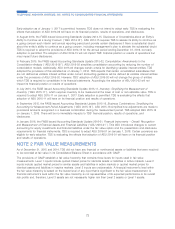

NOTE 2 FAIR VALUE MEASUREMENTS

As of December 31, 2015 and 2014, TDS did not have any financial or nonfinancial assets or liabilities that were required

to be recorded at fair value in its Consolidated Balance Sheet in accordance with GAAP.

The provisions of GAAP establish a fair value hierarchy that contains three levels for inputs used in fair value

measurements. Level 1 inputs include quoted market prices for identical assets or liabilities in active markets. Level 2

inputs include quoted market prices for similar assets and liabilities in active markets or quoted market prices for

identical assets and liabilities in inactive markets. Level 3 inputs are unobservable. A financial instrument’s level within

the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. A

financial instrument’s level within the fair value hierarchy is not representative of its expected performance or its overall

risk profile and, therefore, Level 3 assets are not necessarily higher risk than Level 2 assets or Level 1 assets.

73

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS