US Cellular 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Leverage Ratio decreases beginning January 1, 2016 from 3.75 to 3.50, with further decreases effective July 1, 2016 and

January 1, 2017 (and will return to 3.00 to 1.00 at that time). TDS and U.S. Cellular believe they were in compliance at

December 31, 2015 with all such covenants. However, depending on TDS and U.S. Cellular’s future financial

performance, there is a risk that TDS and/or U.S. Cellular could fail to satisfy the financial covenants in the future. If TDS

or U.S. Cellular breach a financial or other covenant of any of these agreements, it would result in a default under that

agreement, and could involve a cross-default under other debt instruments. This could in turn cause the affected lenders

to accelerate the repayment of principal and accrued interest on any outstanding debt under such agreements and, if

they choose, terminate the facility. If appropriate, TDS and U.S. Cellular may request the applicable lender for an

amendment of financial covenants in the TDS and U.S. Cellular revolving credit facility and the U.S. Cellular term loan

facility, in order to provide additional financial flexibility to TDS and U.S. Cellular, and may also seek other changes to

such facilities. There is no assurance that the lenders will agree to any amendments. If the lenders agree to

amendments, this may result in additional payments or higher interest rates payable to the lenders and/or additional

restrictions. Restrictions in such debt instruments may limit TDS’ operating and financial flexibility.

Other Long-Term Financing

TDS and U.S. Cellular each have an effective shelf registration statement on Form S-3 to issue senior or subordinated

debt securities. The proceeds from any such issuances may be used for general corporate purposes including: the

possible reduction of other short-term or long-term debt, spectrum purchases, and capital expenditures; in connection

with acquisition, construction and development programs; for working capital; to provide additional investments in

subsidiaries; or the repurchase of shares. The TDS shelf registration permits TDS to issue at any time and from time to

time senior or subordinated debt securities in one or more offerings in an indeterminate amount. The U.S. Cellular shelf

registration statement permits U.S. Cellular to issue at any time and from time to time senior or subordinated debt

securities in one or more offerings, up to the amount registered. The ability of TDS or U.S. Cellular to complete an

offering pursuant to such shelf registration statements is subject to market conditions and other factors at the time.

In November 2015, U.S. Cellular issued $300 million of 7.25% Senior Notes due in 2064 for general corporate purposes

including spectrum purchases, reducing the available amount on U.S. Cellular’s shelf registration statement from

$500 million to $200 million. U.S. Cellular has the authority to replenish this shelf registration statement back to

$500 million.

TDS believes that it and its subsidiaries were in compliance as of December 31, 2015 with all covenants and other

requirements set forth in its long-term debt indentures. TDS and U.S. Cellular have not failed to make nor do they expect

to fail to make any scheduled payment of principal or interest under such indentures.

The long-term debt principal payments due for the next five years represent less than 3% of the total gross long-term

debt obligation at December 31, 2015. Refer to Market Risk — Long-Term Debt for additional information regarding

required principal payments and the weighted average interest rates related to TDS’ Long-term debt.

TDS and U.S. Cellular, at their discretion, may from time to time seek to retire or purchase their outstanding debt through

cash purchases and/or exchanges for other securities, in open market purchases, privately negotiated transactions,

tender offers, exchange offers or otherwise. Such repurchases or exchanges, if any, will depend on prevailing market

conditions, liquidity requirements, contractual restrictions and other factors. The amounts involved may be material.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information on long-term

financing.

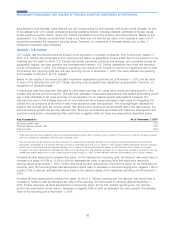

Credit Ratings

In certain circumstances, TDS’ and U.S. Cellular’s interest cost on their various facilities may be subject to increase if

their current credit ratings from nationally recognized credit rating agencies are lowered, and may be subject to

decrease if the ratings are raised. The facilities do not cease to be available nor do the maturity dates accelerate solely

as a result of a downgrade in TDS’ or U.S. Cellular’s credit rating. However, downgrades in TDS’ or U.S. Cellular’s credit

rating could adversely affect their ability to renew the facilities or obtain access to other credit facilities in the future.

34

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS