US Cellular 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advertising Costs

TDS expenses advertising costs as incurred. Advertising costs totaled $267.9 million, $228.5 million and $212.8 million in

2015, 2014 and 2013, respectively.

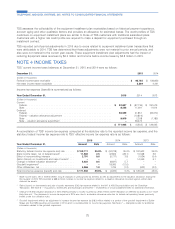

Income Taxes

TDS files a consolidated federal income tax return. Deferred taxes are computed using the liability method, whereby

deferred tax assets are recognized for future deductible temporary differences and operating loss carryforwards, and

deferred tax liabilities are recognized for future taxable temporary differences. Both deferred tax assets and liabilities are

measured using the tax rates anticipated to be in effect when the temporary differences reverse. Temporary differences

are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets and

liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. Deferred tax assets are

reduced by a valuation allowance when it is more likely than not that some portion or all of the deferred tax assets will

not be realized. TDS evaluates income tax uncertainties, assesses the probability of the ultimate settlement with the

applicable taxing authority and records an amount based on that assessment.

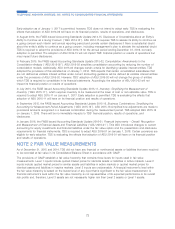

In November 2015, the FASB issued Accounting Standards Update 2015-17, Income Taxes: Balance Sheet Classification

of Deferred Taxes (‘‘ASU 2015-17’’), requiring all deferred tax assets and liabilities, and any related valuation allowance,

to be classified as non-current on the balance sheet. The classification change for all deferred taxes as non-current

simplifies entities’ processes as it eliminates the need to separately identify the net current and net non-current deferred

tax asset or liability in each jurisdiction and allocate valuation allowances. TDS is required to adopt ASU 2015-17 on

January 1, 2017. Early adoption is permitted. TDS early adopted this standard using the prospective method as of

December 31, 2015. No prior period amounts were adjusted.

Stock-Based Compensation and Other Plans

TDS has established long-term incentive plans, dividend reinvestment plans, and a non-employee director compensation

plan. See Note 17 — Stock-Based Compensation for additional information. The dividend reinvestment plan of TDS is

not considered a compensatory plan and, therefore, recognition of compensation costs for grants made under this plan

is not required. All other plans are considered compensatory plans; therefore, recognition of compensation costs for

grants made under these plans is required.

TDS values its share-based payment transactions using a Black-Scholes valuation model. Stock-based compensation

cost recognized during the period is based on the portion of the share-based payment awards that are ultimately

expected to vest. Accordingly, stock-based compensation cost recognized has been reduced for estimated forfeitures.

Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ

from those estimates. Pre-vesting forfeitures and expected life are estimated based on historical experience related to

similar awards, giving consideration to the contractual terms of the stock-based awards, vesting schedules and

expectations of future employee behavior. TDS believes that its historical experience provides the best estimates of

future pre-vesting forfeitures and future expected life. The expected volatility assumption is based on the historical

volatility of TDS’ common stock over a period commensurate with the expected life. The dividend yield assumption is

equal to the dividends declared in the most recent year as a percentage of the share price on the date of grant. The

risk-free interest rate assumption is determined using the U.S. Treasury Yield Curve Rate with a term length that

approximates the expected life of the stock options.

TDS stock option awards cliff vest in three years. Therefore, compensation cost for TDS stock option awards is

recognized on a straight-line basis over the requisite service period, which is generally the vesting period. U.S. Cellular

stock option awards vest on an annual basis in three separate tranches. Compensation cost for U.S. Cellular stock

option awards is recognized using a graded attribution method over the requisite service period, which is generally the

vesting period. TDS and U.S. Cellular restricted stock units cliff vest in three years. Therefore, compensation cost for

TDS and U.S. Cellular restricted stock units is recognized on a straight-line basis over the requisite service period, which

is generally the vesting period.

Recently Issued Accounting Pronouncements

In May 2014, the FASB issued Accounting Standards Update 2014-09, Revenue from Contracts with Customers

(‘‘ASU 2014-09’’). ASU 2014-09 outlines a single comprehensive model to use in accounting for revenue arising from

contracts with customers. In August 2015, the FASB issued Accounting Standards Update 2015-14, Revenue from

Contracts with Customers: Deferral of the Effective Date, requiring the adoption of ASU 2014-09 on January 1, 2018.

72

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS