US Cellular 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

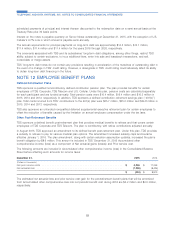

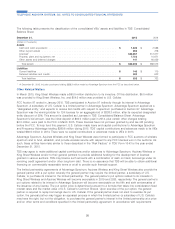

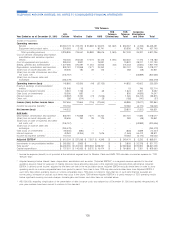

Share repurchases made under these authorizations were as follows:

Number of Average Cost

Year Ended December 31, Shares Per Share Amount

(Shares and dollar amounts in thousands, except per share amounts)

2015

U.S. Cellular Common Shares ........................... 178 $ 34.86 $ 6,188

TDS Common Shares ................................ – – –

2014

U.S. Cellular Common Shares ........................... 496 $ 38.19 $ 18,943

TDS Common Shares ................................ 1,542 25.36 39,096

2013

U.S. Cellular Common Shares ........................... 499 $ 37.19 $ 18,544

TDS Common Shares ................................ 339 28.60 9,692

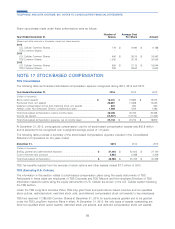

NOTE 17 STOCK-BASED COMPENSATION

TDS Consolidated

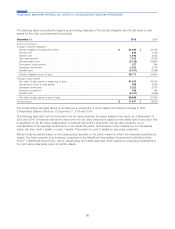

The following table summarizes stock-based compensation expense recognized during 2015, 2014 and 2013:

Year Ended December 31, 2015 2014 2013

(Dollars in thousands)

Stock option awards ................................. $ 18,431 $ 15,802 $ 12,973

Restricted stock unit awards ............................. 20,067 17,968 15,535

Deferred compensation bonus and matching stock unit awards ....... 622 690 550

Awards under Non-Employee Director compensation plan .......... 1,280 1,333 1,280

Total stock-based compensation, before income taxes ............. 40,400 35,793 30,338

Income tax benefit ................................... (15,267) (13,519) (11,459)

Total stock-based compensation expense, net of income taxes ....... $ 25,133 $ 22,274 $ 18,879

At December 31, 2015, unrecognized compensation cost for all stock-based compensation awards was $42.8 million

and is expected to be recognized over a weighted average period of 1.9 years.

The following table provides a summary of the stock-based compensation expense included in the Consolidated

Statement of Operations for the years ended:

December 31, 2015 2014 2013

(Dollars in thousands)

Selling, general and administrative expense .................... $ 37,465 $ 32,505 $ 27,130

Cost of services and products ............................ 2,935 3,288 3,208

Total stock-based compensation ........................... $ 40,400 $ 35,793 $ 30,338

TDS’ tax benefits realized from the exercise of stock options and other awards totaled $7.7 million in 2015.

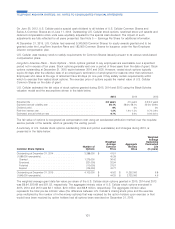

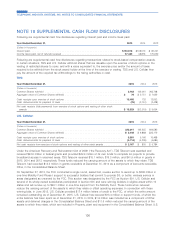

TDS (Excluding U.S. Cellular)

The information in this section relates to stock-based compensation plans using the equity instruments of TDS.

Participants in these plans are employees of TDS Corporate and TDS Telecom and Non-employee Directors of TDS.

Information related to plans using the equity instruments of U.S. Cellular are shown in the U.S. Cellular section following

the TDS section.

Under the TDS Long-Term Incentive Plans, TDS may grant fixed and performance based incentive and non-qualified

stock options, restricted stock, restricted stock units, and deferred compensation stock unit awards to key employees.

TDS had reserved 17,389,000 Common Shares at December 31, 2015 for equity awards granted and to be granted

under the TDS Long-Term Incentive Plans in effect. At December 31, 2015, the only types of awards outstanding are

fixed non-qualified stock option awards, restricted stock unit awards, and deferred compensation stock unit awards.

98

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS