US Cellular 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

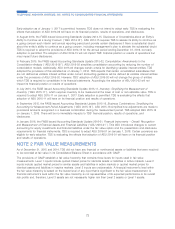

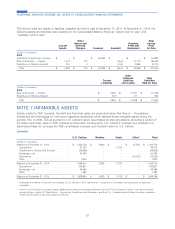

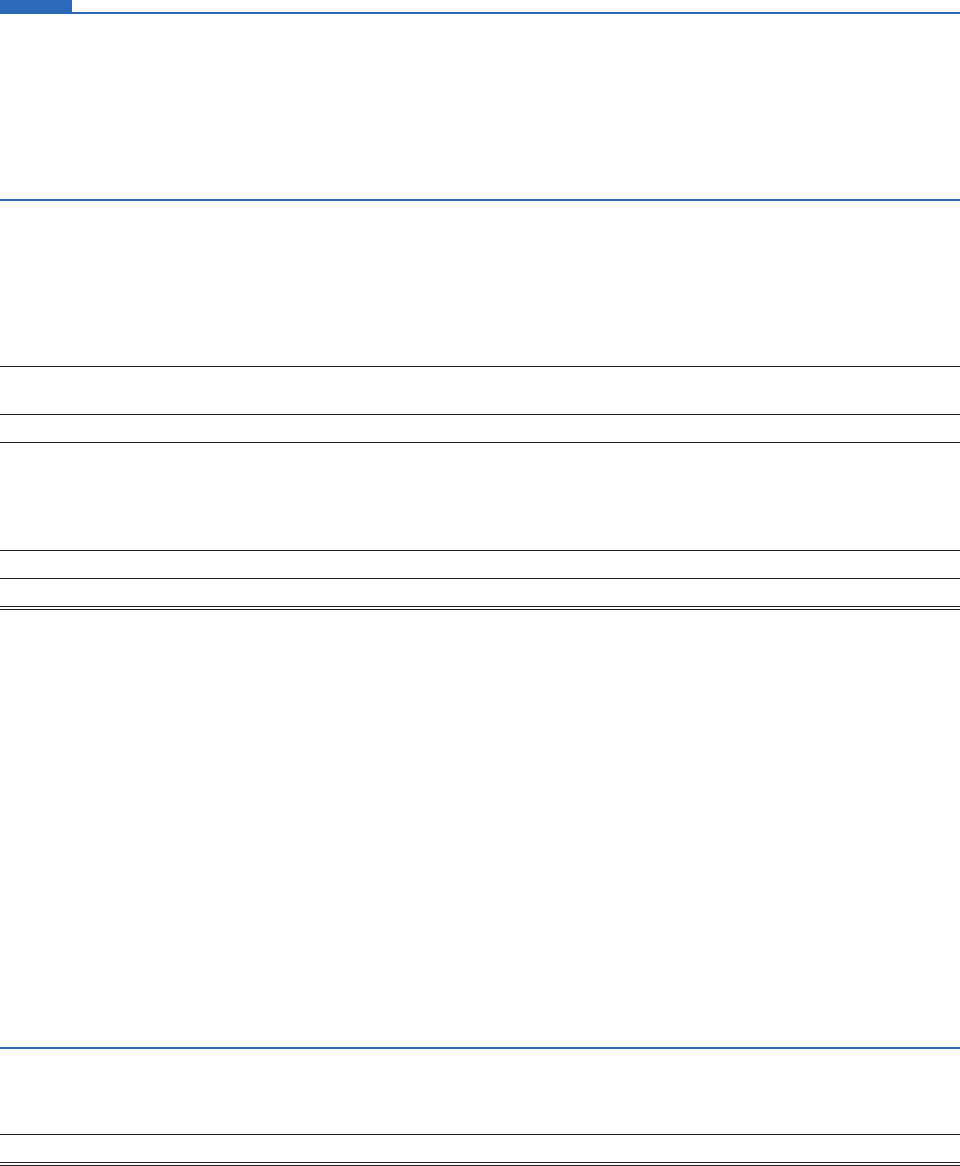

Significant components of TDS’ deferred income tax assets and liabilities at December 31, 2015 and 2014 were as

follows:

December 31, 2015 2014

(Dollars in thousands)

Deferred tax assets

Current deferred tax assets ............................................. $–$ 113,402

Net operating loss (‘‘NOL’’) carryforwards .................................... 137,574 135,676

Stock-based compensation ............................................. 61,680 54,789

Compensation and benefits – other ........................................ 37,744 11,014

Deferred rent ...................................................... 19,896 19,604

Other ........................................................... 92,787 35,523

Total deferred tax assets ................................................ 349,681 370,008

Less valuation allowance ............................................... (112,357) (113,553)

Net deferred tax assets ................................................. 237,324 256,455

Deferred tax liabilities

Property, plant and equipment ........................................... 672,473 667,540

Licenses/intangibles .................................................. 300,669 259,865

Partnership investments ............................................... 163,287 151,123

Other ........................................................... –9,724

Total deferred tax liabilities .............................................. 1,136,429 1,088,252

Net deferred income tax liability ............................................ $ 899,105 $ 831,797

TDS early adopted ASU 2015-17 as of December 31, 2015 using the prospective method. The change required by the

guidance, whereby all deferred taxes are classified as non-current, simplifies processes by eliminating the need to

separately identify the net current and net non-current deferred tax asset or liability in each jurisdiction and allocate

valuation allowances. The prior year Consolidated Balance Sheet and the deferred tax disclosure above were not

revised. At December 31, 2015, $900.1 million of net deferred income tax liability is included in Net deferred income tax

liability and $1.0 million is included in Other assets and deferred charges in the Consolidated Balance Sheet. At

December 31, 2014, $107.7 million of net current deferred income tax asset is included in Net deferred income tax asset

and $941.5 million of net noncurrent deferred income tax liability is included in Net deferred income tax liability and

$2.0 million is included in Other assets and deferred charges in the Consolidated Balance Sheet.

At December 31, 2015, TDS and certain subsidiaries had $2.4 billion of state NOL carryforwards (generating a

$114.2 million deferred tax asset) available to offset future taxable income. The state NOL carryforwards expire between

2016 and 2035. Certain subsidiaries had federal NOL carryforwards (generating a $23.4 million deferred tax asset)

available to offset their future taxable income. The federal NOL carryforwards expire between 2018 and 2035. A valuation

allowance was established for certain state NOL carryforwards and federal NOL carryforwards since it is more likely than

not that a portion of such carryforwards will expire before they can be utilized.

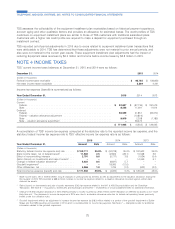

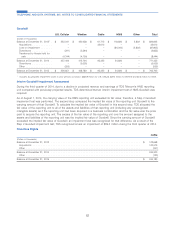

A summary of TDS’ deferred tax asset valuation allowance is as follows:

2015 2014 2013

(Dollars in thousands)

Balance at beginning of year ....................................... $ 113,553 $ 79,064 $ 70,502

Charged (credited) to income tax expense ............................. (1,196) 34,489 1,954

Charged to other accounts ....................................... –– 6,608

Balance at end of year ........................................... $ 112,357 $ 113,553 $ 79,064

76

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS