US Cellular 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

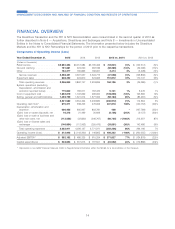

11MAR201618464870

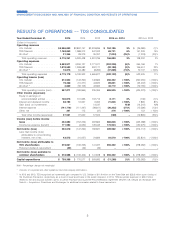

Adjusted EBITDA increased due primarily to increased

revenues and decreased cash expenses in U.S. Cellular’s

operations. U.S. Cellular’s Loss on equipment (Equipment

sales less Cost of equipment sold) decreased

$291.5 million from 2014 to 2015 as a result of the

continued adoption of equipment installment plans, less

devices sold, and a lower average cost per device sold.

Net income (loss) increased from 2014 to 2015 due to the

same reasons as Adjusted EBITDA, and also due to an

increase in Gain on sale of business and other exit costs

in U.S. Cellular, and a Loss on impairment of Goodwill

recognized in the HMS segment in 2014.

Adjusted EBITDA decreased due primarily to decreased

revenues and increased cash expenses in U.S. Cellular’s

operations. U.S. Cellular’s Service revenues declined due

to a decrease in the average retail customer base and a

decrease in Inbound roaming revenue, among other

factors. Net income (loss) decreased from 2013 to 2014

$167

($147)

$263

$870

$781

$1,160

($400)

($200)

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2013 2014 2015

Net Income

(Loss)

Adjusted

EBITDA*

due to the same reasons as Adjusted EBITDA, and also

due to a decrease in both Gain on sale of business and

other exit costs and Gain on license sales and exchanges

in U.S. Cellular. In addition, a Loss on impairment of

Goodwill recognized in the HMS segment in 2014 further

decreased Net income from 2013 to 2014.

* Represents a non-GAAP measure. Refer to Supplemental Information within this MD&A for a reconciliation of this measure.

8

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2015-2014 Commentary

2014-2013 Commentary

Earnings

(Dollars in millions)