US Cellular 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

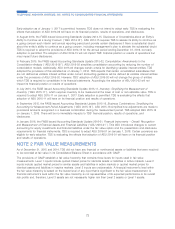

Debt Issuance Costs

Debt issuance costs include underwriters’ and legal fees and other charges related to issuing various borrowing

instruments and other long-term agreements, and are amortized over the respective term of each instrument. TDS early

adopted ASU 2015-03 using the retrospective method as of December 31, 2015. ASU 2015-03 requires certain debt

issuance costs to be presented in the balance sheet as an offset to the related debt obligation. Debt issuance costs

related to TDS and U.S. Cellular’s revolving credit facilities are excluded from the scope of ASU 2015-03 and are

recorded in Other assets and deferred charges in the Consolidated Balance Sheet. As a result of the retrospective

adoption, TDS reclassified unamortized debt issuance costs of $52.5 million as of December 31, 2014 from Other assets

and deferred charges to Long-term debt, net in the Consolidated Balance Sheet. Other than this reclassification, the

adoption of ASU 2015-03 did not have an impact on TDS’ consolidated financial statements.

Asset Retirement Obligations

TDS accounts for asset retirement obligations by recording the fair value of a liability for legal obligations associated with

an asset retirement in the period in which the obligations are incurred. At the time the liability is incurred, TDS records a

liability equal to the net present value of the estimated cost of the asset retirement obligation and increases the carrying

amount of the related long-lived asset by an equal amount. Until the obligation is fulfilled, TDS updates its estimates

relating to cash flows required and timing of settlement. TDS records the present value of the changes in the future

value as an increase or decrease to the liability and the related carrying amount of the long-lived asset. The liability is

accreted to future value over a period ending with the estimated settlement date of the respective asset retirement

obligation. The carrying amount of the long-lived asset is depreciated over the useful life of the related asset. Upon

settlement of the obligation, any difference between the cost to retire the asset and the recorded liability is recognized in

the Consolidated Statement of Operations.

Treasury Shares

Common Shares repurchased by TDS are recorded at cost as treasury shares and result in a reduction of equity. When

treasury shares are reissued, TDS determines the cost using the first-in, first-out cost method. The difference between

the cost of the treasury shares and reissuance price is included in Capital in excess of par value or Retained earnings.

Revenue Recognition

Revenues related to services are recognized as services are rendered. Revenues billed in advance or in arrears of the

services being provided are estimated and deferred or accrued, as appropriate.

Revenues from sales of equipment, products and accessories are recognized when TDS no longer has any

requirements to perform, when title has passed and when the products are accepted by the customer.

Multiple Deliverable Arrangements

U.S. Cellular and TDS Telecom sell multiple element service and equipment offerings. In these instances, revenues are

allocated using the relative selling price method. Under this method, arrangement consideration is allocated to each

element on the basis of its relative selling price. Revenue recognized for the delivered items is limited to the amount due

from the customer that is not contingent upon the delivery of additional products or services.

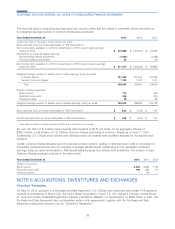

Loyalty Reward Program

In March 2015, U.S. Cellular announced that it would discontinue its loyalty reward program effective September 1, 2015.

All unredeemed reward points expired at that time and the deferred revenue balance of $58.2 million related to such

expired points was recognized as service revenues. At December 31, 2014, U.S. Cellular had deferred revenue related to

loyalty reward points outstanding of $94.6 million.

U.S. Cellular followed the deferred revenue method of accounting for its loyalty reward program. Under this method,

revenue allocated to loyalty reward points was deferred. The amount allocated to the loyalty points was based on the

estimated retail price of the products and services for which points may be redeemed divided by the number of loyalty

points required to receive such products and services. This was calculated on a weighted average basis and required

U.S. Cellular to estimate the percentage of loyalty points that would be redeemed for each product or service.

Revenue was recognized at the time of customer redemption or when such points were depleted via an account

maintenance charge. U.S. Cellular employed the proportional model to recognize revenues associated with breakage.

70

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS