US Cellular 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

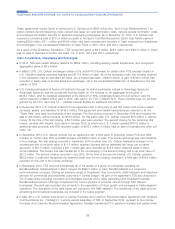

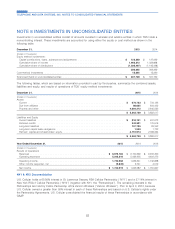

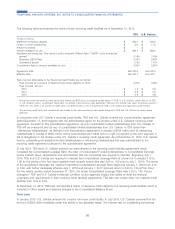

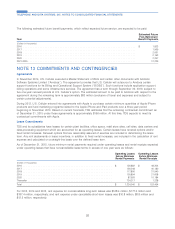

On April 3, 2013, U.S. Cellular entered into an agreement with Verizon Wireless relating to the Partnerships. The

agreement amends the Partnership Agreements in several ways which provide Verizon Wireless with substantive

participating rights that allow Verizon Wireless to make decisions that are in the ordinary course of business of the

Partnerships and which are significant to directing and executing the activities of the business. Accordingly, as required

by GAAP, TDS deconsolidated the Partnerships effective as of April 3, 2013 and thereafter reported them as equity

method investments in its consolidated financial statements (‘‘NY1 & NY2 Deconsolidation’’). After the NY1 &

NY2 Deconsolidation, U.S. Cellular retained the same ownership percentages in the Partnerships and continues to report

the same percentages of income from the Partnerships. Effective April 3, 2013, TDS’ income from the Partnerships is

reported in Equity in earnings of unconsolidated entities in the Consolidated Statement of Operations.

In accordance with GAAP, as a result of the NY1 & NY2 Deconsolidation, U.S. Cellular’s interest in the Partnerships was

reflected in Investments in unconsolidated entities at a fair value of $114.8 million as of April 3, 2013. Recording U.S.

Cellular’s interest in the Partnerships required allocation of the excess of fair value over book value to customer lists,

licenses, a favorable contract and goodwill of the Partnerships. Amortization expense related to customer lists and the

favorable contract will be recognized over their respective useful lives and is included in Equity in earnings of

unconsolidated entities in the Consolidated Statement of Operations. In addition, TDS recognized a non-cash pre-tax

gain of $14.5 million in the second quarter of 2013. The gain was recorded in Gain (loss) on investments in the

Consolidated Statement of Operations.

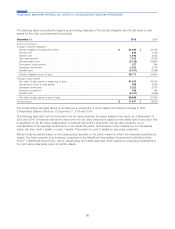

NOTE 9 PROPERTY, PLANT AND EQUIPMENT

TDS’ Property, plant and equipment in service and under construction, and related accumulated depreciation and

amortization, as of December 31, 2015 and 2014 were as follows:

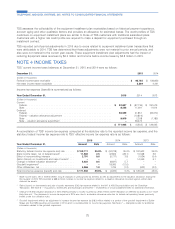

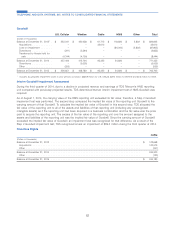

Useful Lives

December 31, (Years) 2015 2014

(Dollars in thousands)

Land ................................................. N/A $ 54,567 $ 52,946

Buildings ............................................... 5-40 506,486 480,028

Leasehold and land improvements ............................... 1-30 1,137,414 1,130,468

Cable and wire ........................................... 15-35 1,688,606 1,628,782

Network and switching equipment ............................... 5-13 2,278,425 2,239,176

Cell site equipment ......................................... 7-25 3,382,743 3,284,993

Office furniture and equipment .................................. 3-10 586,975 634,853

Other operating assets and equipment ............................ 3-12 205,132 204,625

System development ........................................ 1-7 1,459,437 1,319,930

Work in process .......................................... N/A 220,276 218,243

11,520,061 11,194,044

Accumulated depreciation and amortization .......................... (7,755,584) (7,347,919)

$ 3,764,477 $ 3,846,125

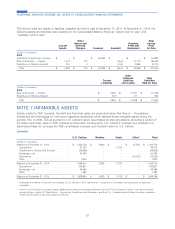

Depreciation and amortization expense totaled $810.5 million, $797.6 million and $984.4 million in 2015, 2014 and 2013,

respectively. In 2015, 2014 and 2013, (Gain) loss on asset disposals, net included charges of $22.2 million, $26.5 million

and $30.8 million, respectively, related to disposals of assets, trade-ins of older assets for replacement assets and other

retirements of assets from service in the normal course of business.

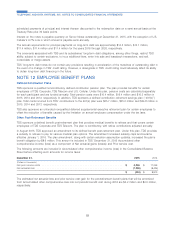

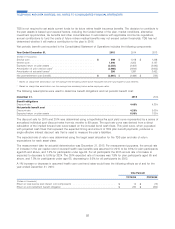

NOTE 10 ASSET RETIREMENT OBLIGATIONS

U.S. Cellular is subject to asset retirement obligations associated with its leased cell sites, switching office sites, retail

store sites and office locations in its operating markets. Asset retirement obligations generally include obligations to

restore leased land and retail store and office premises to their pre-lease conditions.

TDS Telecom owns poles, cable and wire and certain buildings and also leases data center and office space and

property used for housing central office switching equipment and fiber cable. These assets and leases often have

removal or remediation requirements associated with them. For example, TDS Telecom’s poles, cable and wire are often

located on property that is not owned by TDS Telecom and are often subject to the provisions of easements, permits, or

84

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS