US Cellular 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

other factors that could affect collectability. Accounts receivable balances are reviewed on either an aggregate or

individual basis for collectability depending on the type of receivable. When it is probable that an account balance will

not be collected, the account balance is charged against the allowance for doubtful accounts. TDS does not have any

off-balance sheet credit exposure related to its customers.

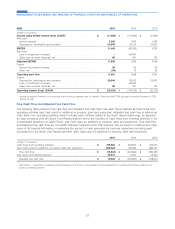

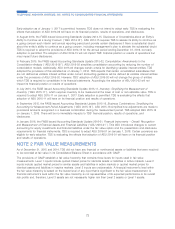

The changes in the allowance for doubtful accounts during 2015, 2014 and 2013 were as follows:

2015 2014 2013

(Dollars in thousands)

Balance at beginning of year ................................... $ 48,637 $ 65,604 $ 33,415

Additions, net of recoveries .................................. 112,292 107,861 105,629

Deductions ............................................ (104,701) (124,828) (73,440)

Balance at end of year1...................................... $ 56,228 $ 48,637 $ 65,604

1In 2015 and 2014, balance includes an allowance of $5.5 million and $6.1 million, respectively, related to the long-term portion of unbilled equipment

installment plan receivables.

Inventory

Inventory consists primarily of wireless devices stated at the lower of cost or market, with cost determined using the

first-in, first-out method and market determined by replacement cost or estimated net realizable value.

Licenses

Licenses consist of direct and incremental costs incurred in acquiring Federal Communications Commission (‘‘FCC’’)

licenses to provide wireless service.

TDS has determined that wireless licenses are indefinite-lived intangible assets and, therefore, not subject to

amortization based on the following factors:

ᔢRadio spectrum is not a depleting asset.

ᔢThe ability to use radio spectrum is not limited to any one technology.

ᔢTDS and its consolidated subsidiaries are licensed to use radio spectrum through the FCC licensing process, which

enables licensees to utilize specified portions of the spectrum for the provision of wireless service.

ᔢTDS and its consolidated subsidiaries are required to renew their FCC licenses every ten years or, in some cases,

every fifteen years. To date, all of TDS’ license renewal applications have been granted by the FCC. Generally, license

renewal applications filed by licensees otherwise in compliance with FCC regulations are routinely granted. If, however,

a license renewal application is challenged either by a competing applicant for the license or by a petition to deny the

renewal application, the license will be renewed if the licensee can demonstrate its entitlement to a ‘‘renewal

expectancy.’’ Licensees are entitled to such an expectancy if they can demonstrate to the FCC that they have

provided ‘‘substantial service’’ during their license term and have ‘‘substantially complied’’ with FCC rules and policies.

TDS believes that it is probable that its future license renewal applications will be granted.

U.S. Cellular performs its annual impairment assessment of Licenses as of November 1 of each year or more frequently

if there are events or circumstances that cause U.S. Cellular to believe the carrying value of Licenses exceeds their fair

value on a more likely than not basis. Prior to the fourth quarter of 2015, U.S. Cellular separated its FCC licenses into

eleven units of accounting based on geographic service areas. The eleven units of accounting consisted of four

geographic units of accounting for developed operating market licenses (‘‘built licenses’’) and seven geographic

non-operating market licenses (‘‘unbuilt licenses’’). As part of the current year annual impairment evaluation, U.S. Cellular

evaluated the aggregation criteria based on how such licenses are deployed and provide value in U.S. Cellular’s

operations, and current industry and market factors. It was determined the built licenses should be aggregated into one

unit of accounting. The unbuilt licenses continued to be separated into seven geographic units of accounting.

As of November 1, 2015, U.S. Cellular performed a qualitative impairment assessment to determine whether it was more

likely than not that the fair value of the built and unbuilt licenses exceed their carrying value. In 2014, U.S. Cellular

estimated the fair value of built licenses for purposes of impairment testing using the build-out method. The build-out

method estimates the fair value of Licenses by discounting to present value the future cash flows calculated based on a

hypothetical cost to build-out U.S. Cellular’s network. For units of accounting which consist of unbuilt licenses, the fair

67

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS